Markets Report: are the markets today just like 2015?

There are similarities between the markets in 2025 and 2015. This has significant implications for global equities, bonds, and currencies.

I continue to believe that financial markets in 2025 will be similar to 2015 in several aspects.

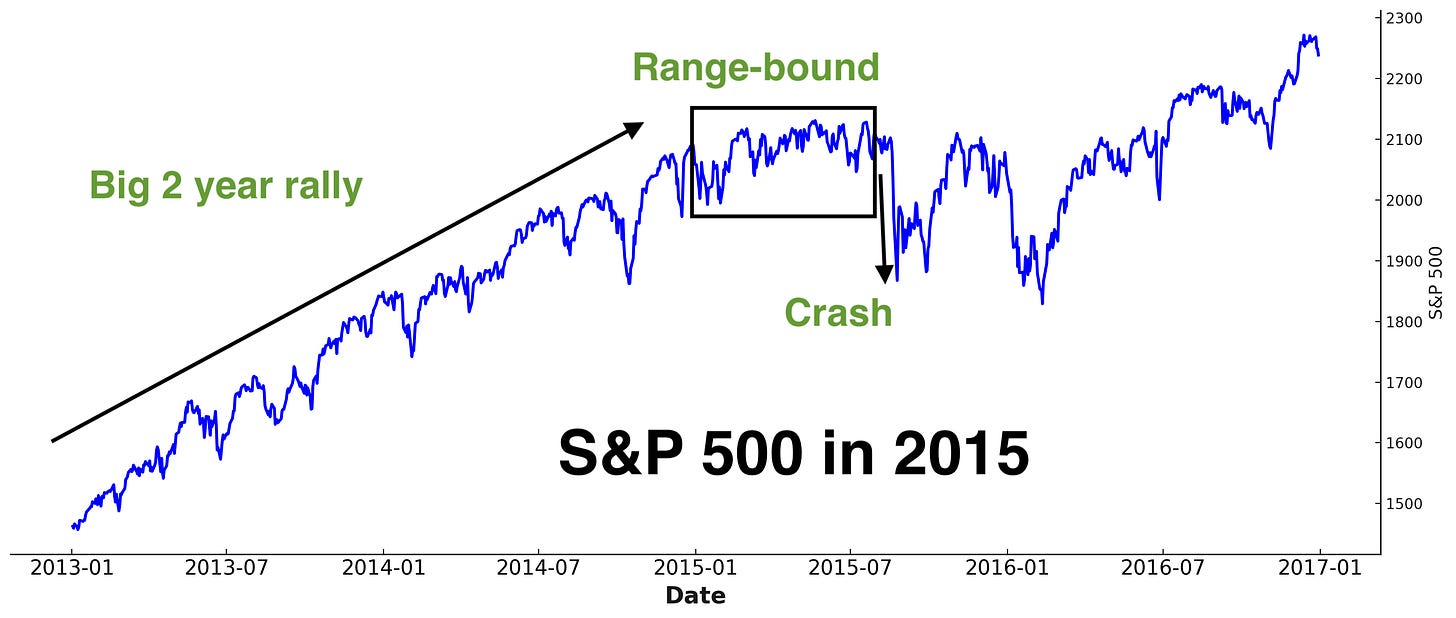

2015 came after a big 2 year rally for U.S. equities (2013-2014). Similarly, 2025 arrives hot on the heels of a strong two-year rally (2023-2024).

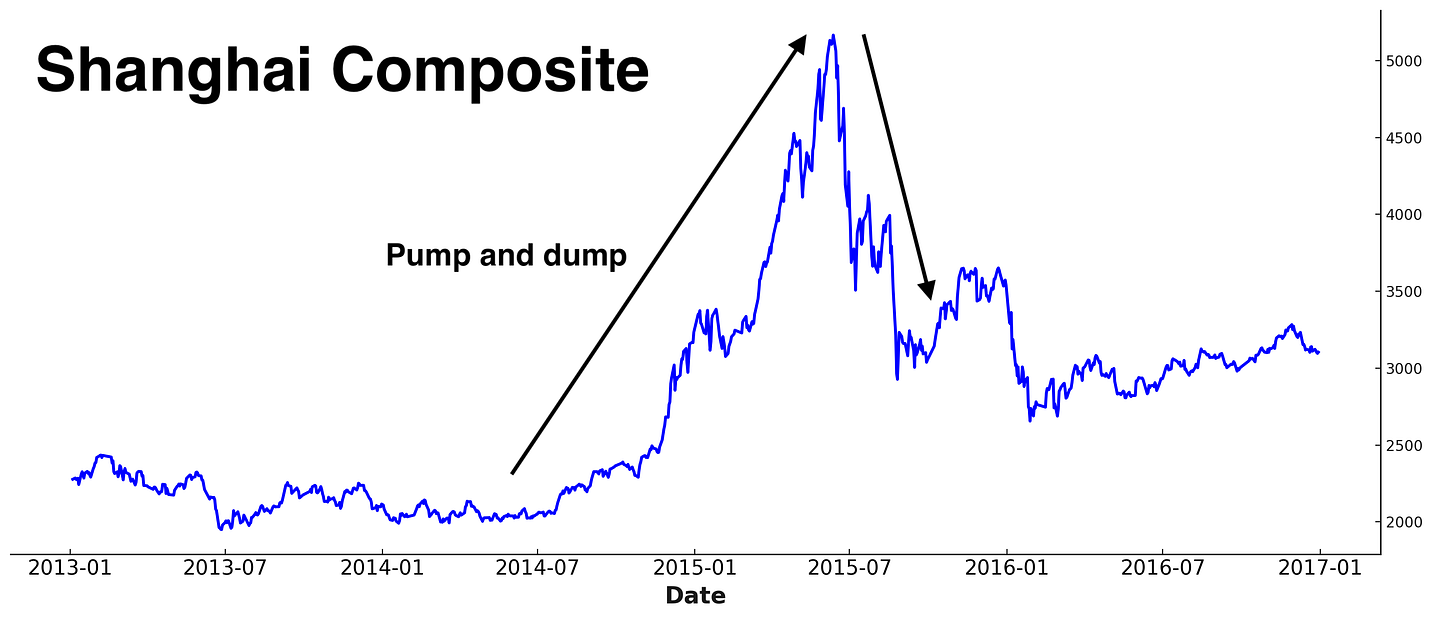

The U.S. stock market mostly swung sideways throughout the first half of 2015. While U.S. equities were range-bound, other markets saw strong trends. E.g. Chinese equities and emerging markets first pumped, then dumped.

My base case for 2025 is that U.S. equities will swing sideways here for the next few months, perhaps even making marginal new all-time highs. There is neither a sufficiently bullish narrative that can propel stocks massively higher, nor a sufficiently bearish narrative that can drive stocks massively lower right now.

In the meantime, the U.S. stock market’s general lack of direction will provide ample opportunities for other markets to make their own moves. Ex-U.S. equities, bonds, and commodities can rally while the U.S. Dollar falls. Then later in the year, I expect U.S. and ex-U.S. equities to fall in unison.

Today’s Markets Report:

U.S. stock market: room to move higher, although long term concerns for 2025 remain.

Big opportunities in Chinese and Indian equities.

U.S. Dollar’s bearish reversal.

Bonds’ bullish reversal.

U.S. Equities

Short term (can move higher)

Options Flow

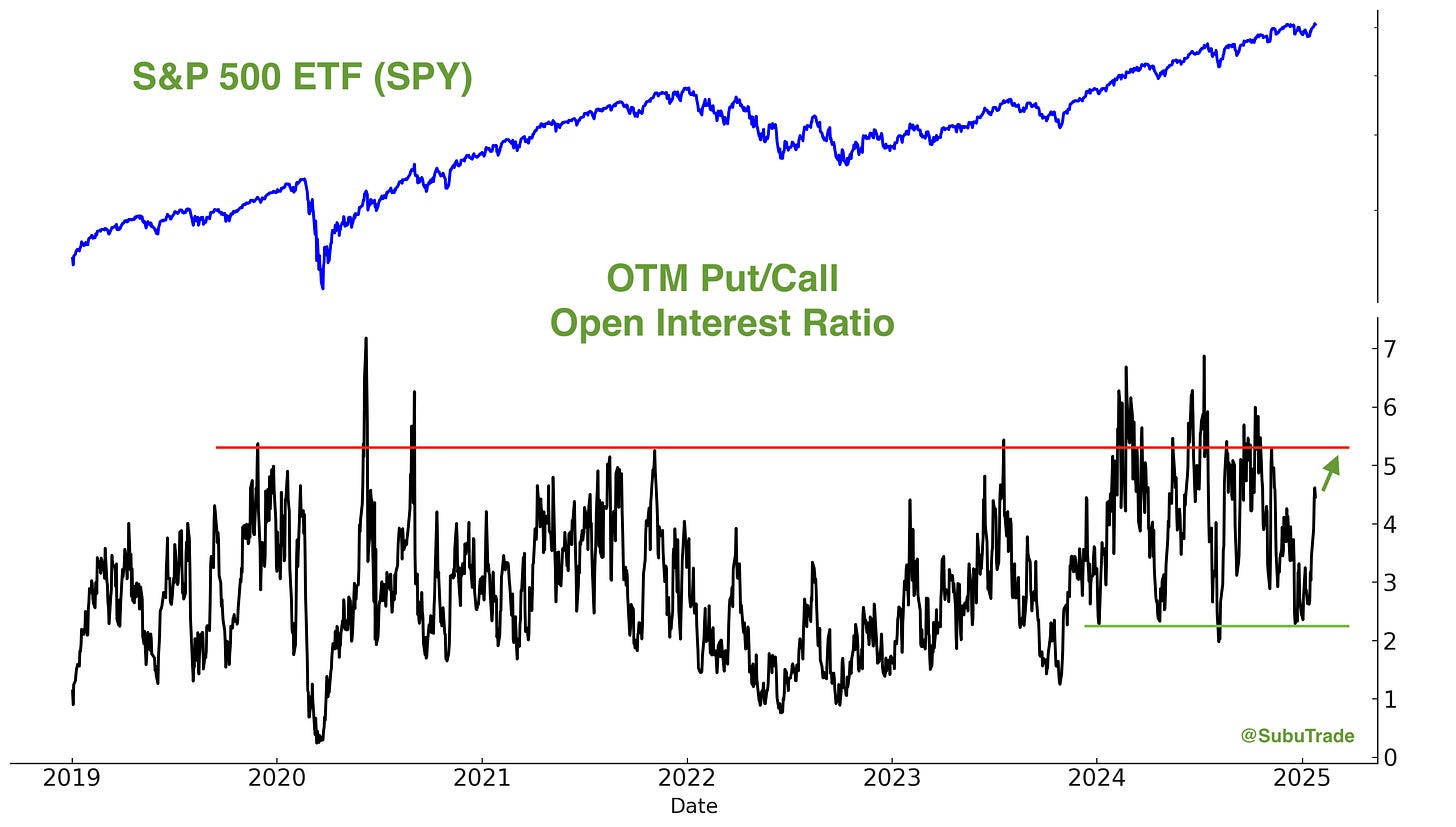

SPY OTM Put/Call Open Interest ratio: has room to push higher like in previous rallies.

*OTM (Out of the Money) Put/Call Open Interest Ratio tracks who is losing money right now: put buyers or call buyers. This Ratio goes up when the market goes up, and goes down when the market goes down.

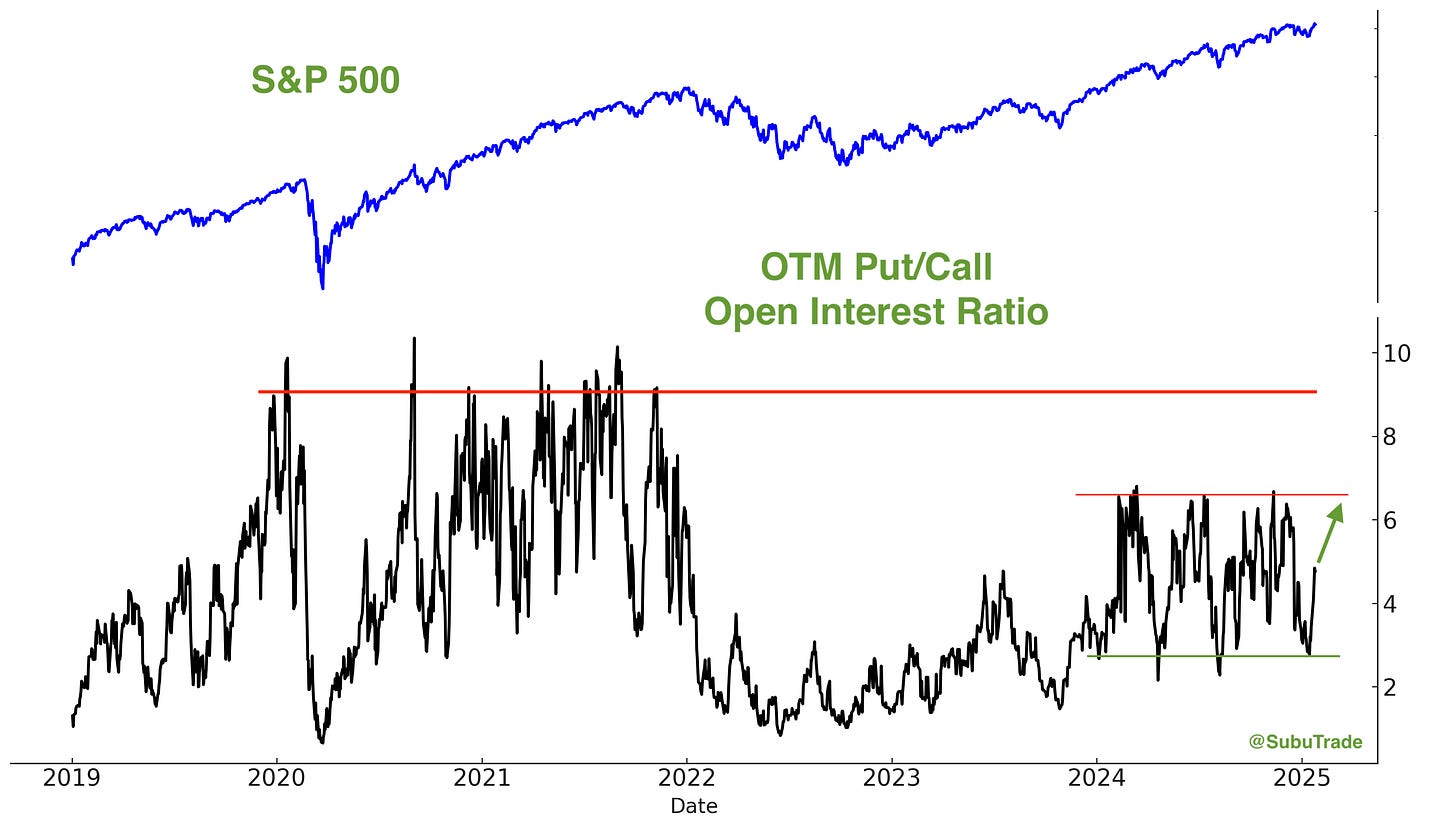

S&P 500 OTM Put/Call Open Interest ratio: has room to push higher like in previous rallies.

Sentiment

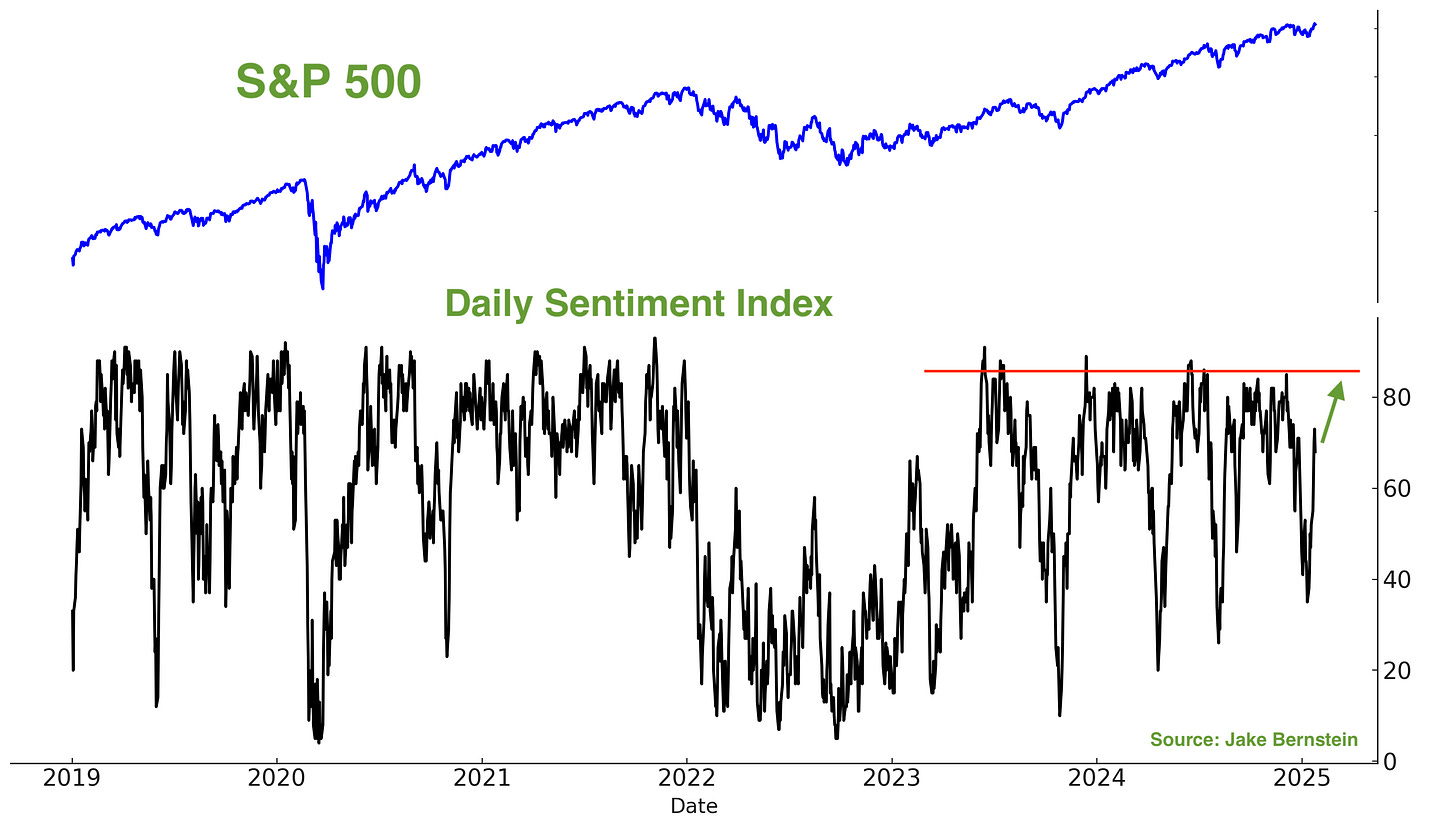

S&P 500’s Daily Sentiment Index: has room to push higher like in previous rallies.

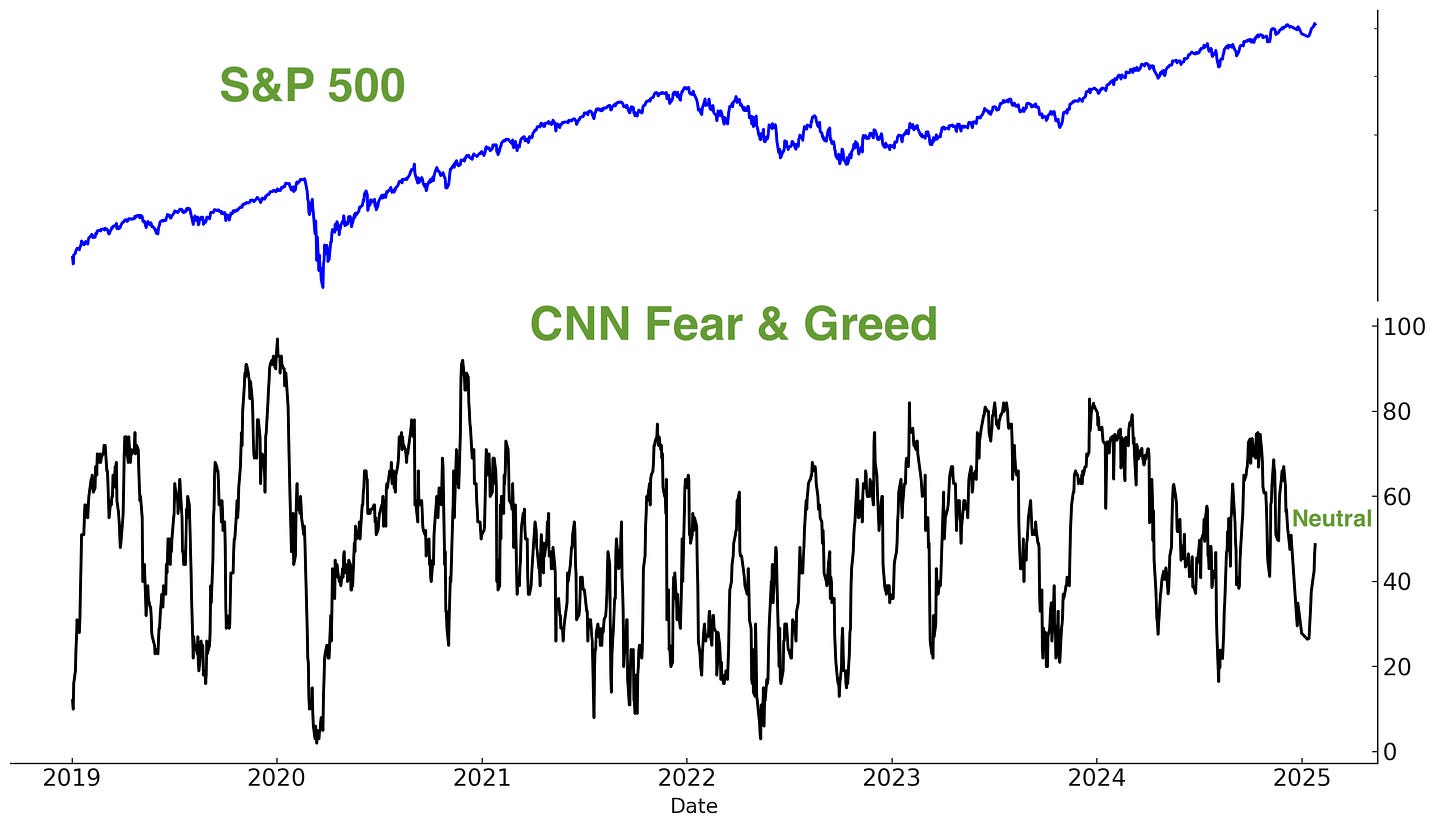

CNN Fear & Greed: back to neutral territory. Again, this has room to move higher:

Corporate Insiders

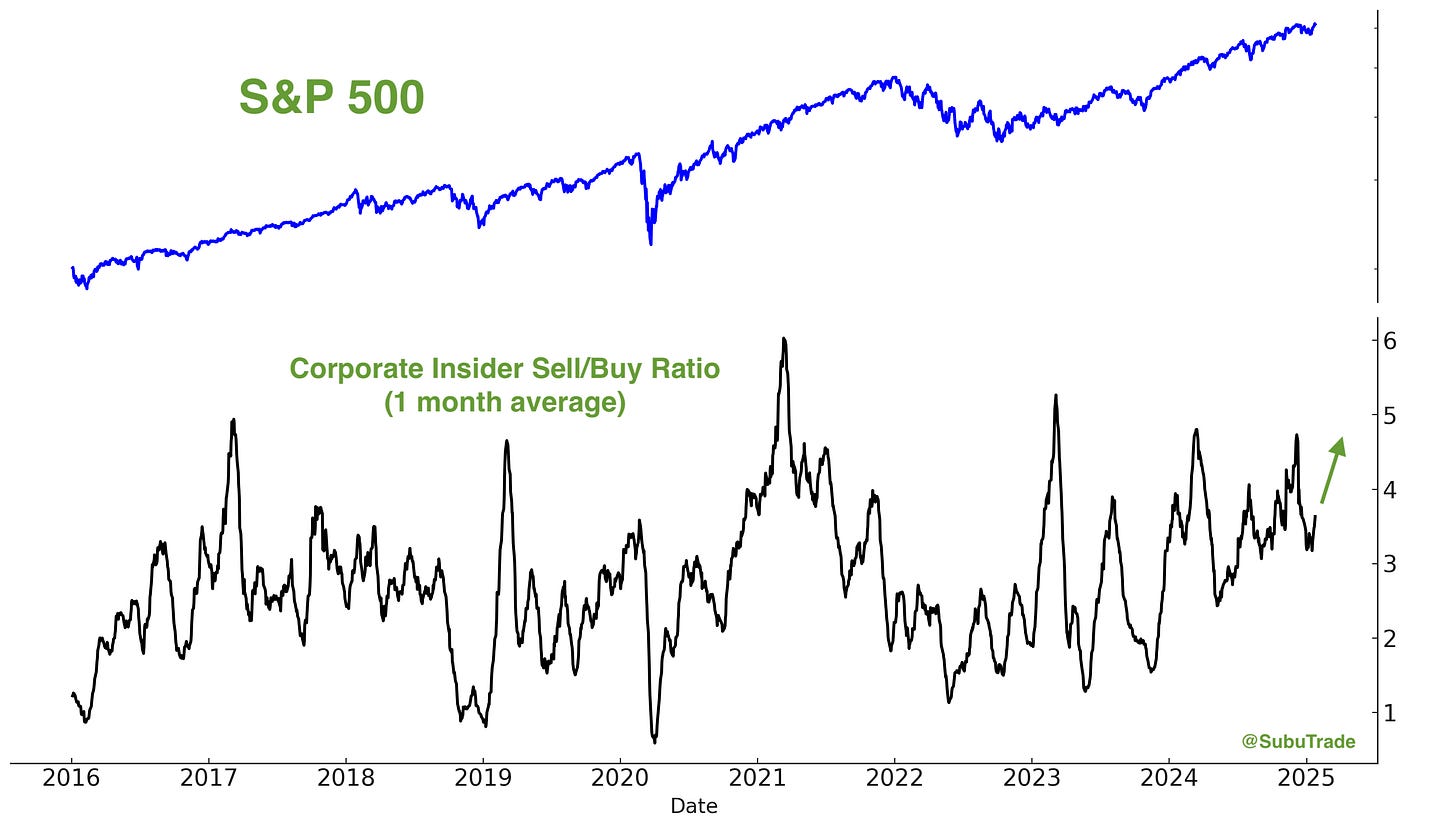

Corporate Insider Sell/Buy ratio: has room to move higher before this becomes a concern.

Trend

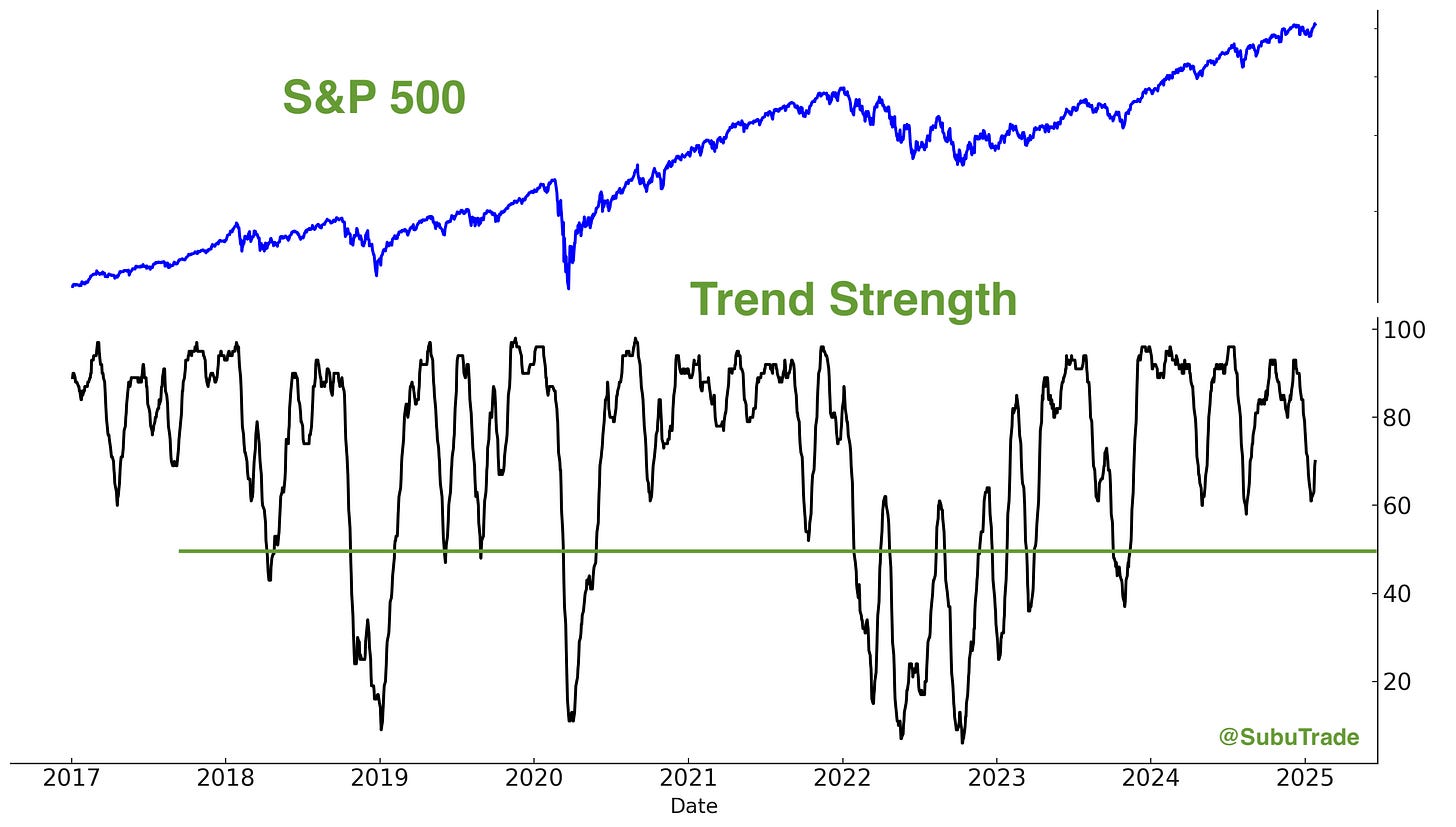

The S&P 500 remains in an up-trend. Remember: the trend is your friend, until it ends.

Breadth

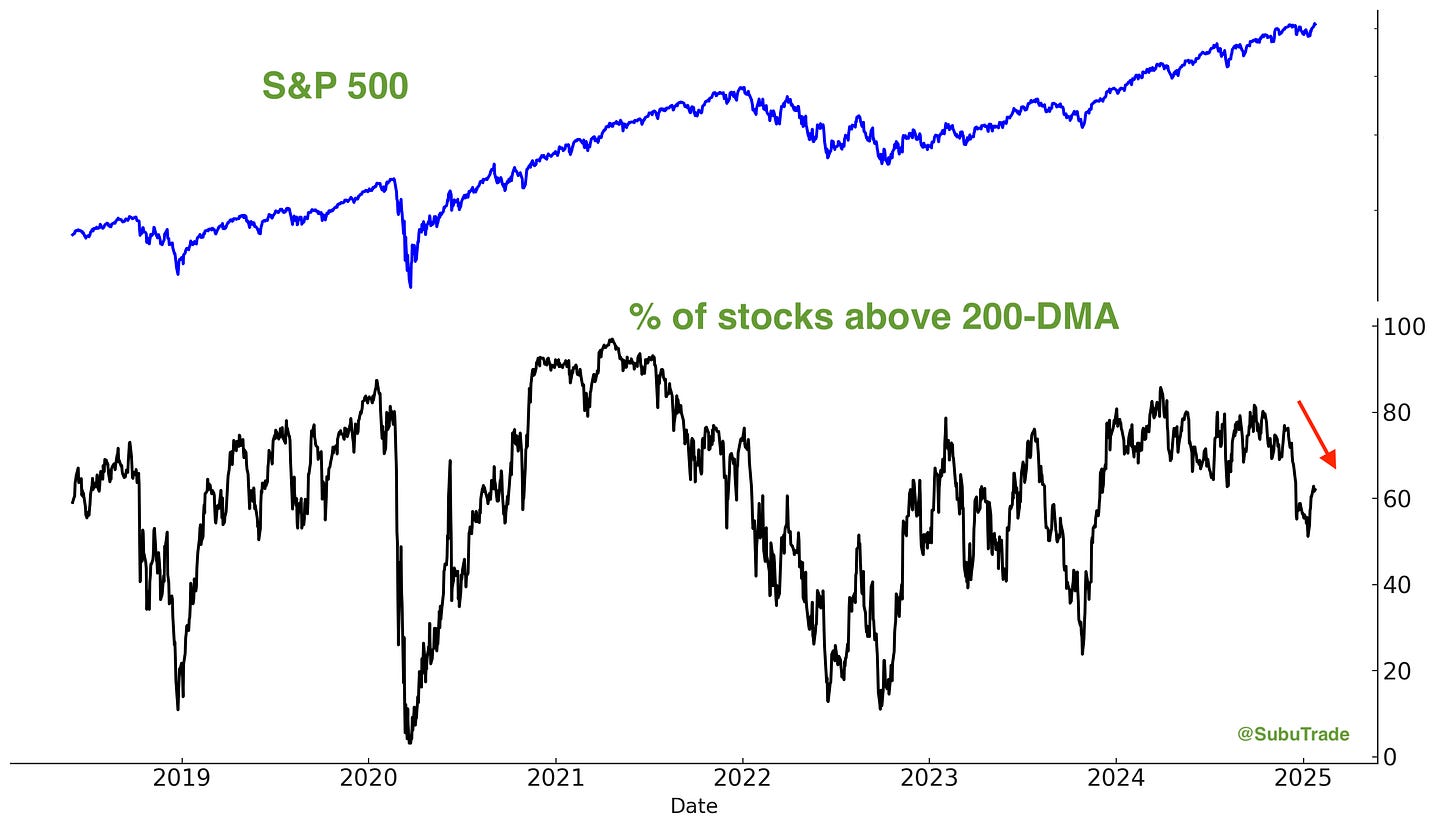

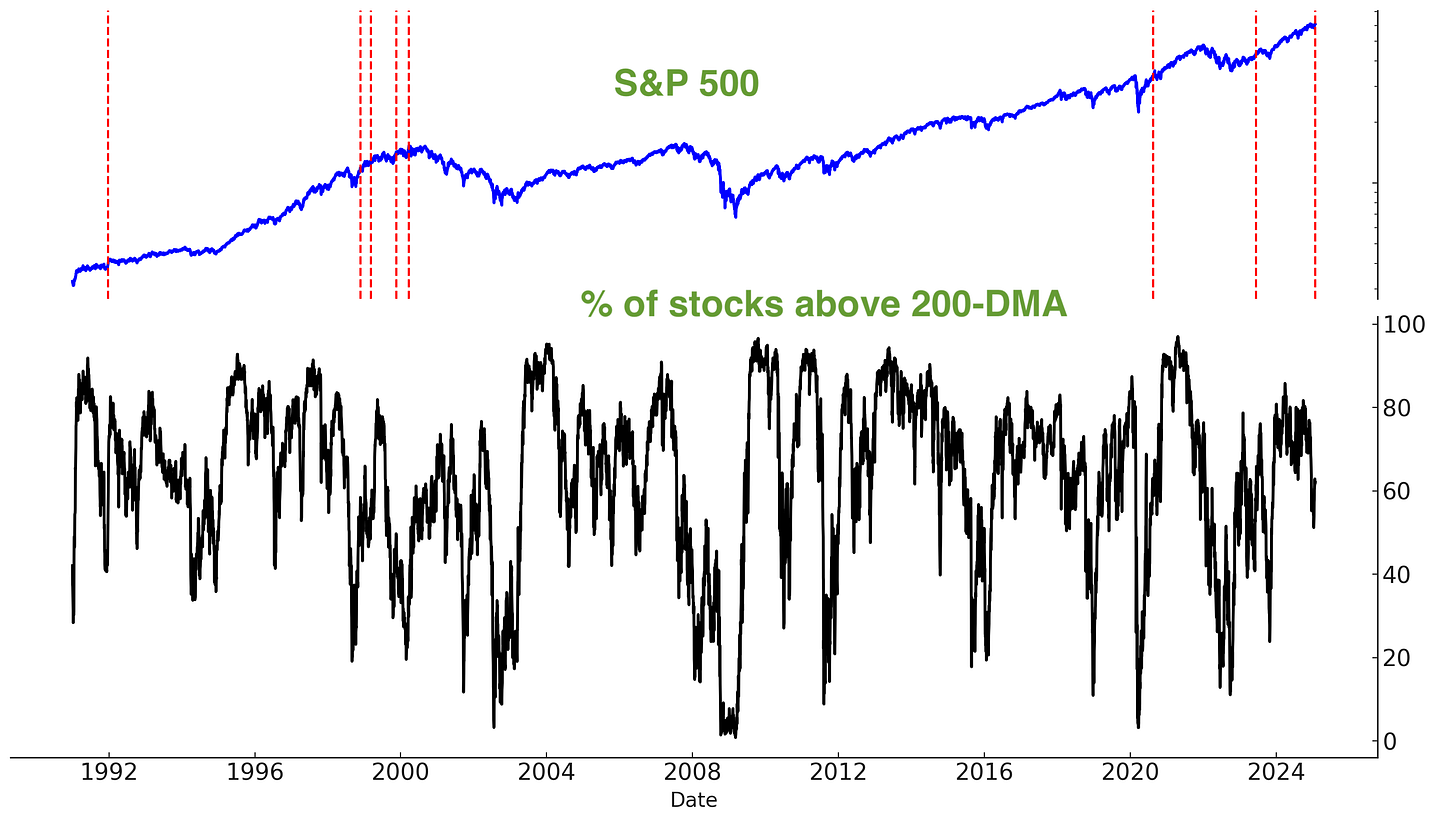

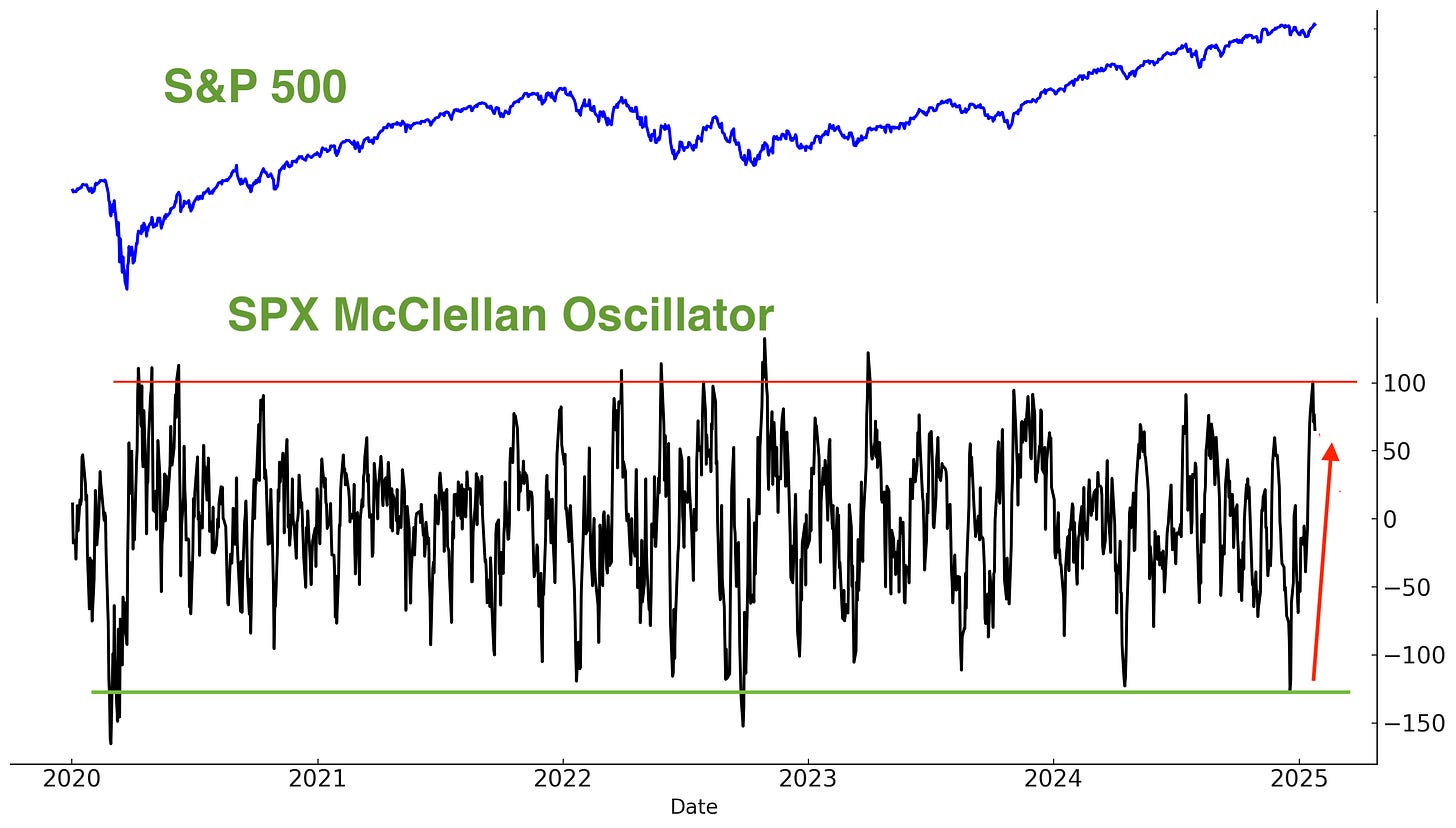

Some market watchers are concerned about breadth. Although the S&P 500 made a new all-time high, fewer stocks are above their 200-DMA than during the last rally.

This “breadth problem” is a hallmark of historic rallies like the dot-com bubble. All massive rallies come to an end, but this says nothing about WHEN the rally will end:

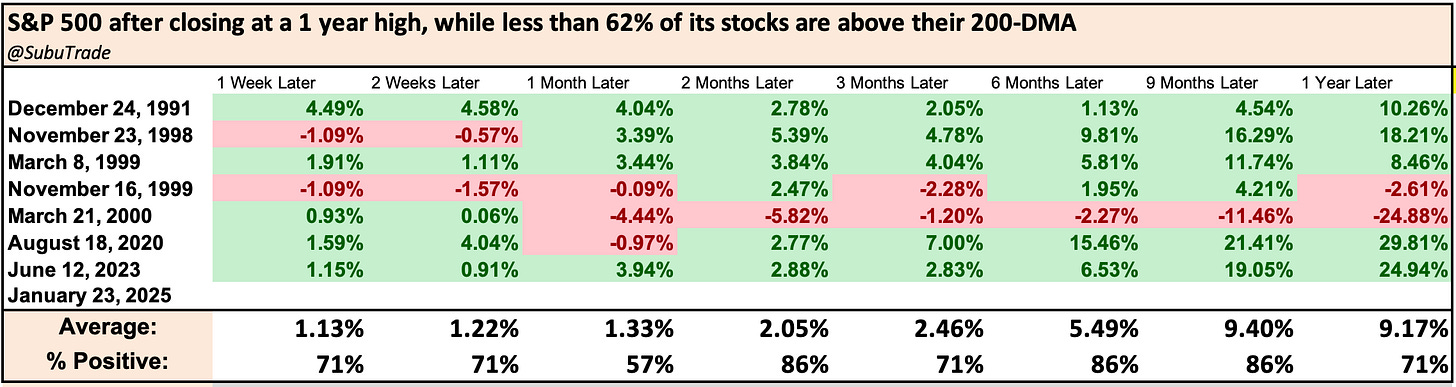

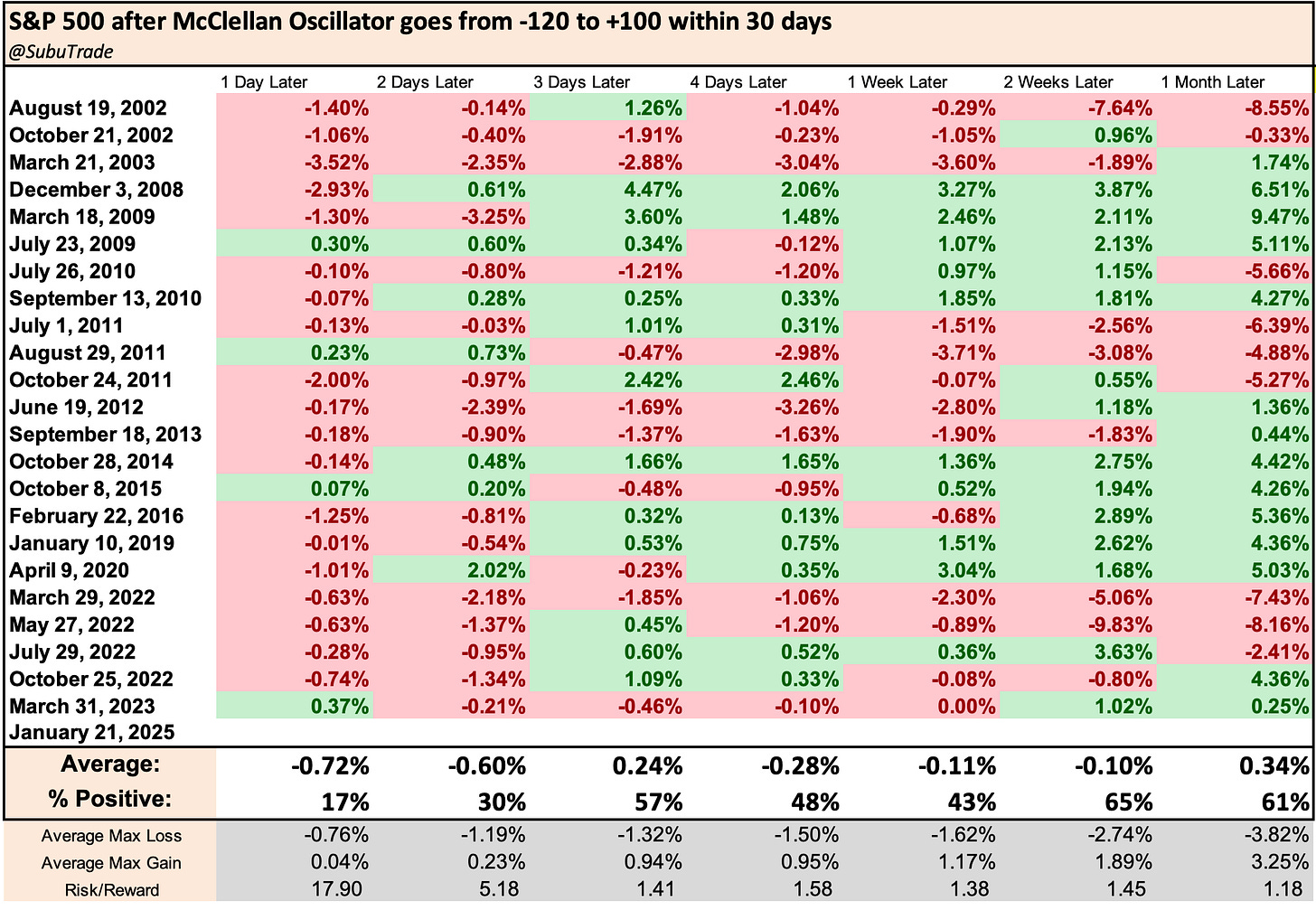

The stock market’s rally may pause here for a few days. As I shared on Twitter/X on Tuesday, the S&P 500’s McClellan Oscillator surged from extreme oversold to extreme overbought:

This was a short term bearish factor for the S&P 500:

Overall, the setup is neither great for bulls nor bears, although it’s better to be bullish than bearish.

Medium term problems

Now that we’ve looked at the U.S. stock market’s room to move higher, I want to re-emphasize the longer term bearish concerns for 2025.

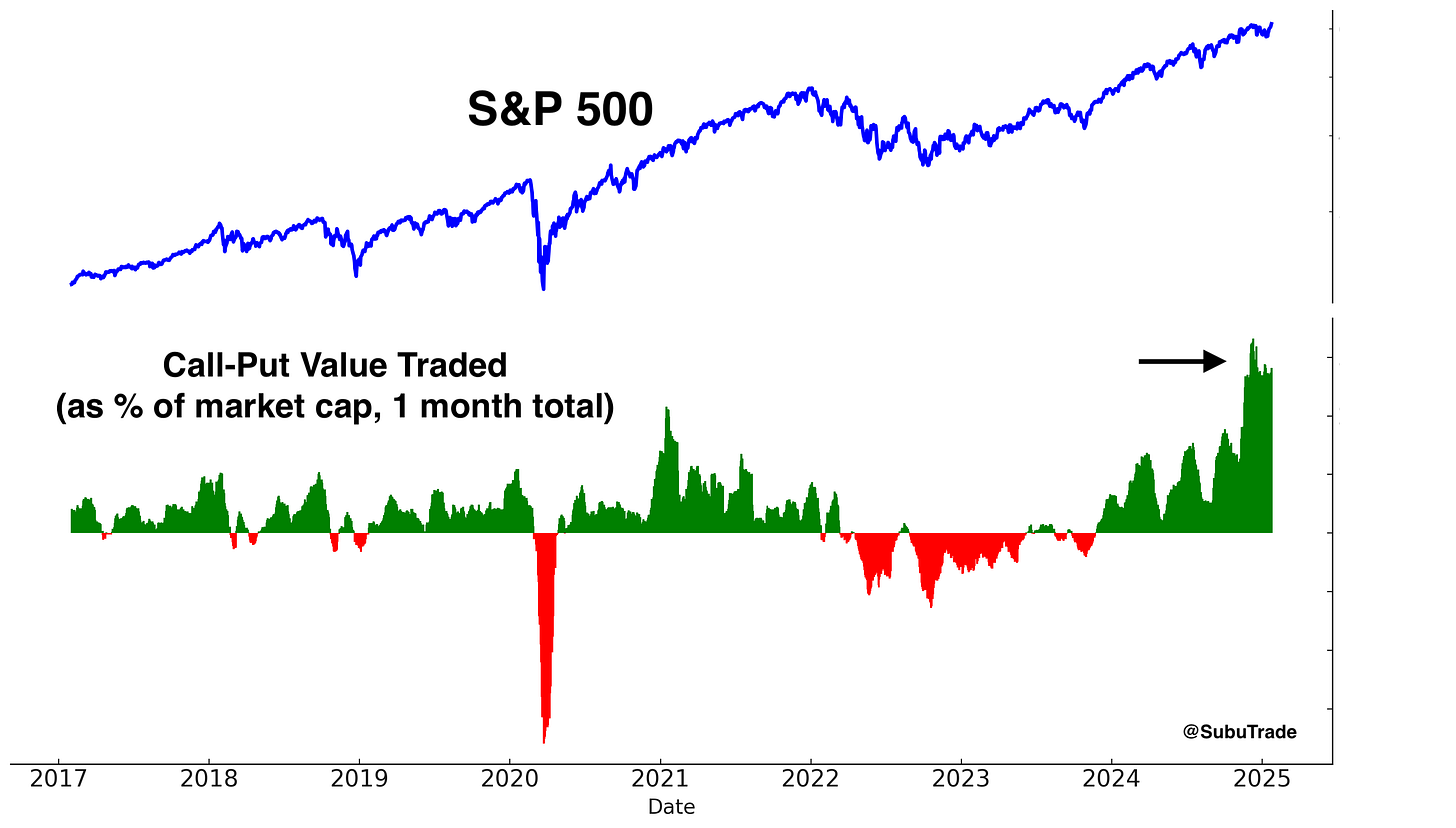

Here’s the S&P 500’s Call-Put Value Traded: a massive spike. Traders are going all-in on call options, which is the exact opposite of what happened at the market’s bottom in March 2020:

Similarly, the SKEW Index, which essentially measures the probability of a stock market crash, is at an all-time high:

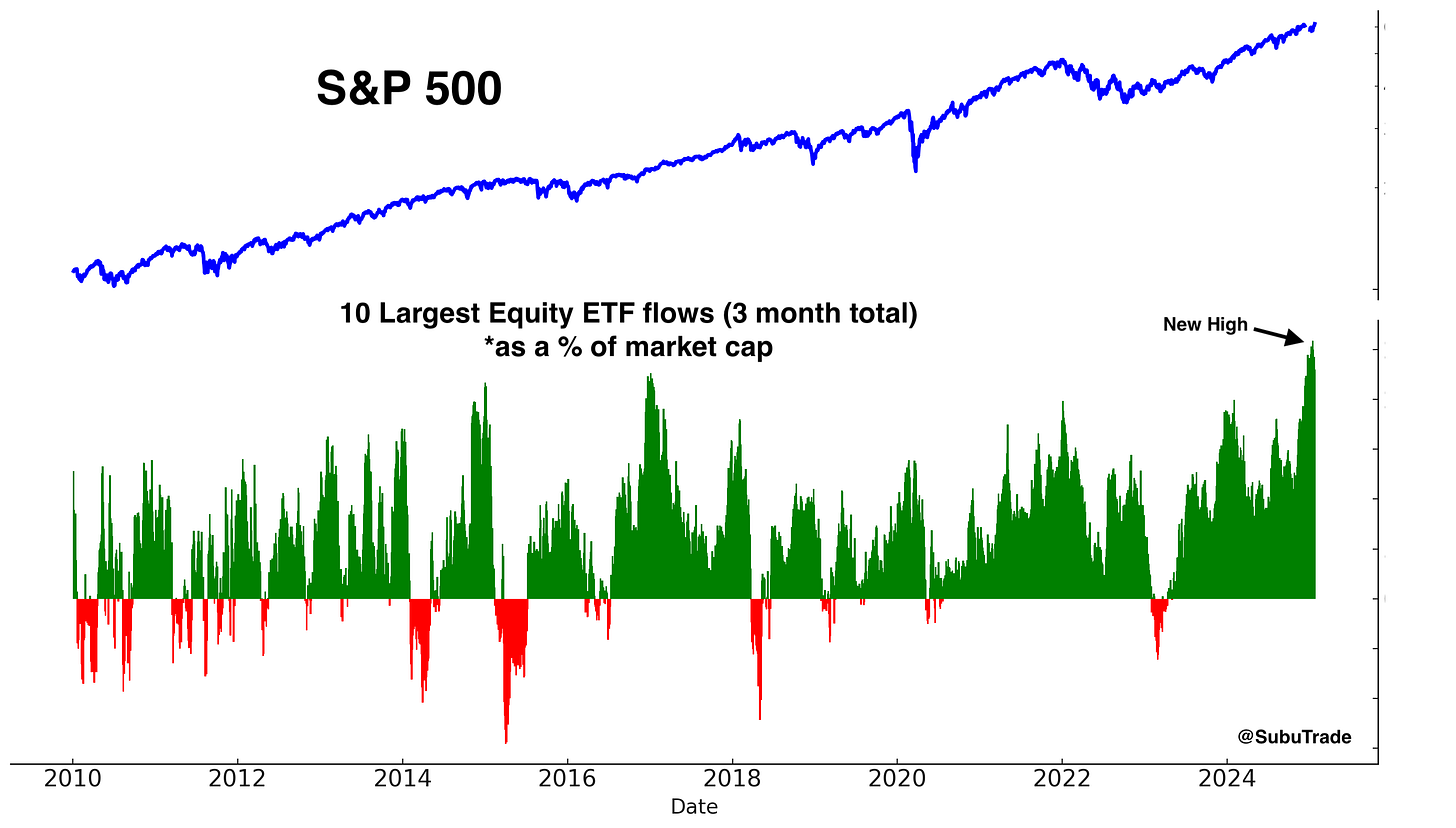

The past 3 months have seen record inflows into U.S. equity ETFs:

Asset Managers are still incredibly long stocks (according to the COT Report):

As you can see, the setup in U.S. equities is not great. The trend remains Up, for now. There are better opportunities elsewhere.

Ex-U.S. Equities

China

The past few months have been brutal for Chinese equities. Chinese equities quietly slid lower after a big spike in September/October 2024. This kind of price action wears out investors’ patience, and it is only when investors’ patience has been ground to dust, can a new rally begin.

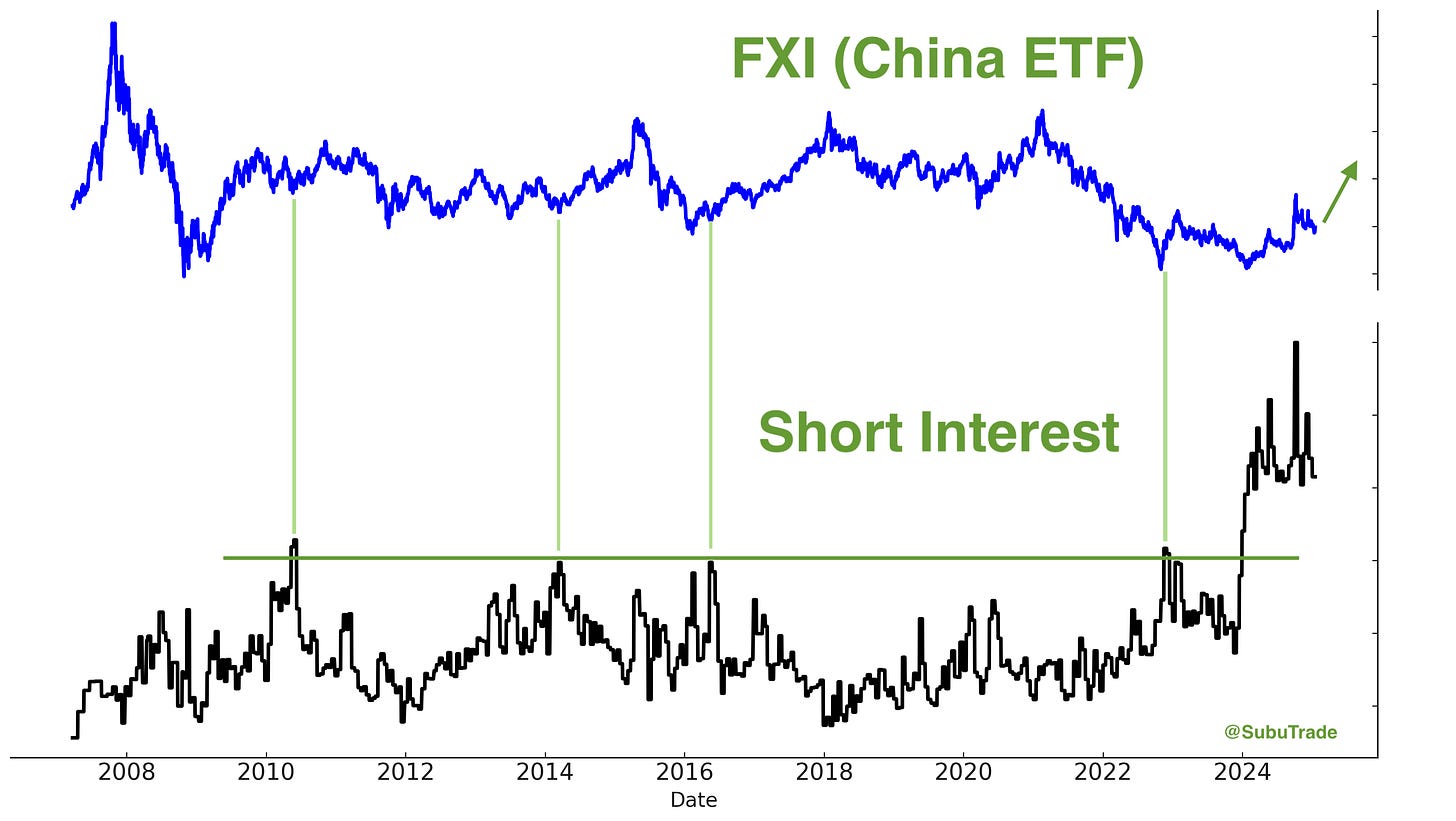

As I noted on Twitter/X, the past 3 months saw record outflows from Chinese equity ETFs:

Meanwhile, short interest in China is still near an all-time high, despite Chinese stocks bottoming a year ago:

Again, I want to emphasize that I am not long term bullish on China. China will lose the U.S.+India vs. China economic war. But for the time being, sentiment towards Chinese equities is so depressed that there is room for a multi-month rally.

Herein lies another interesting parallel to 2015. Will we see another China pump-and-dump in 2025, like in 2015?

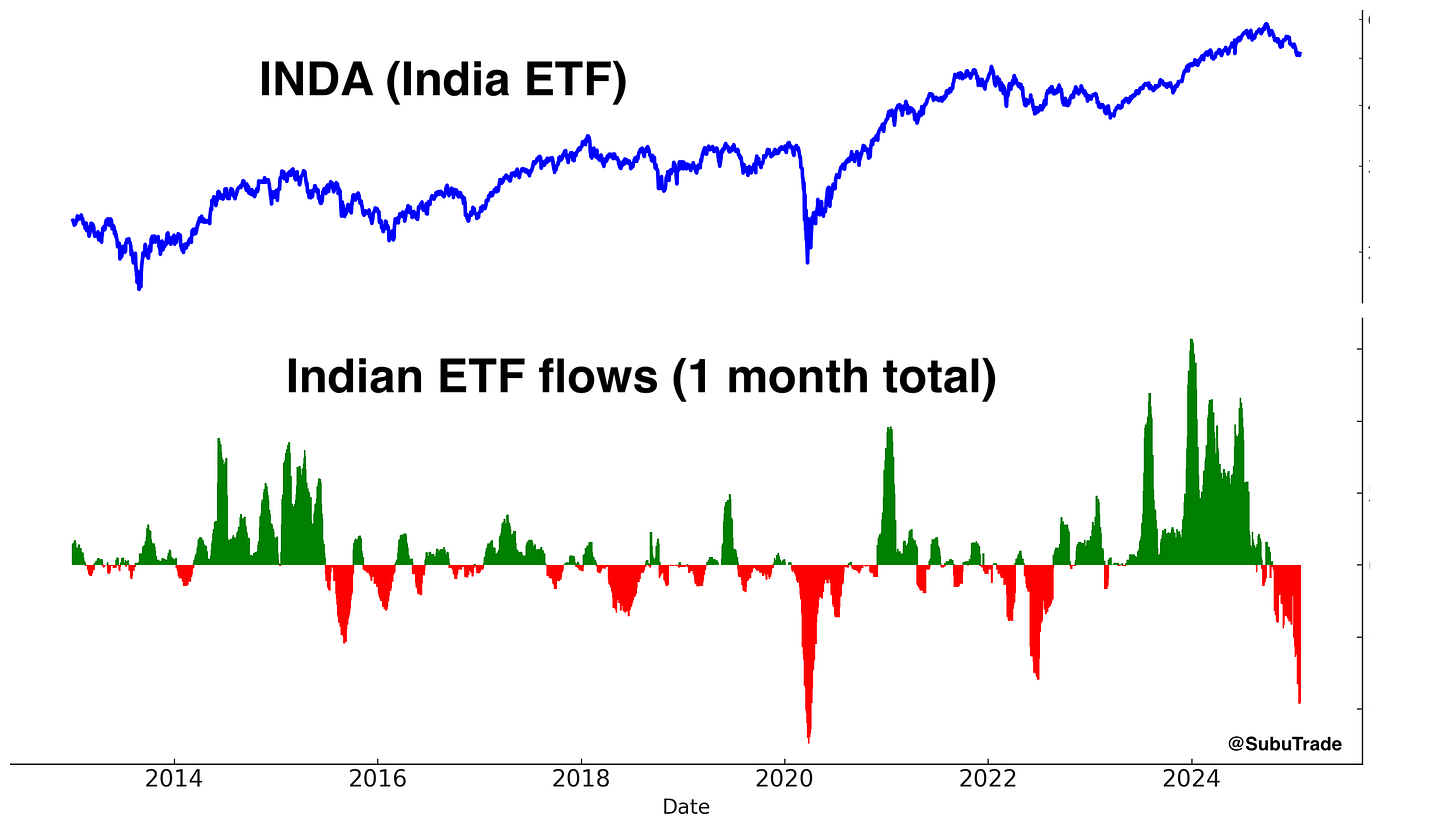

Meanwhile in India, the real winner of the U.S.-China economic war:

Bullish.

Bonds and Currencies

Like Chinese equities, investors have run out of patience with U.S. bonds after years of losses. Check out this week’s Barron’s cover:

“Market volatility will get worse. Stocks could climb anyway.”

“Bond prices could fall further. Why that’s bad for borrowers.”

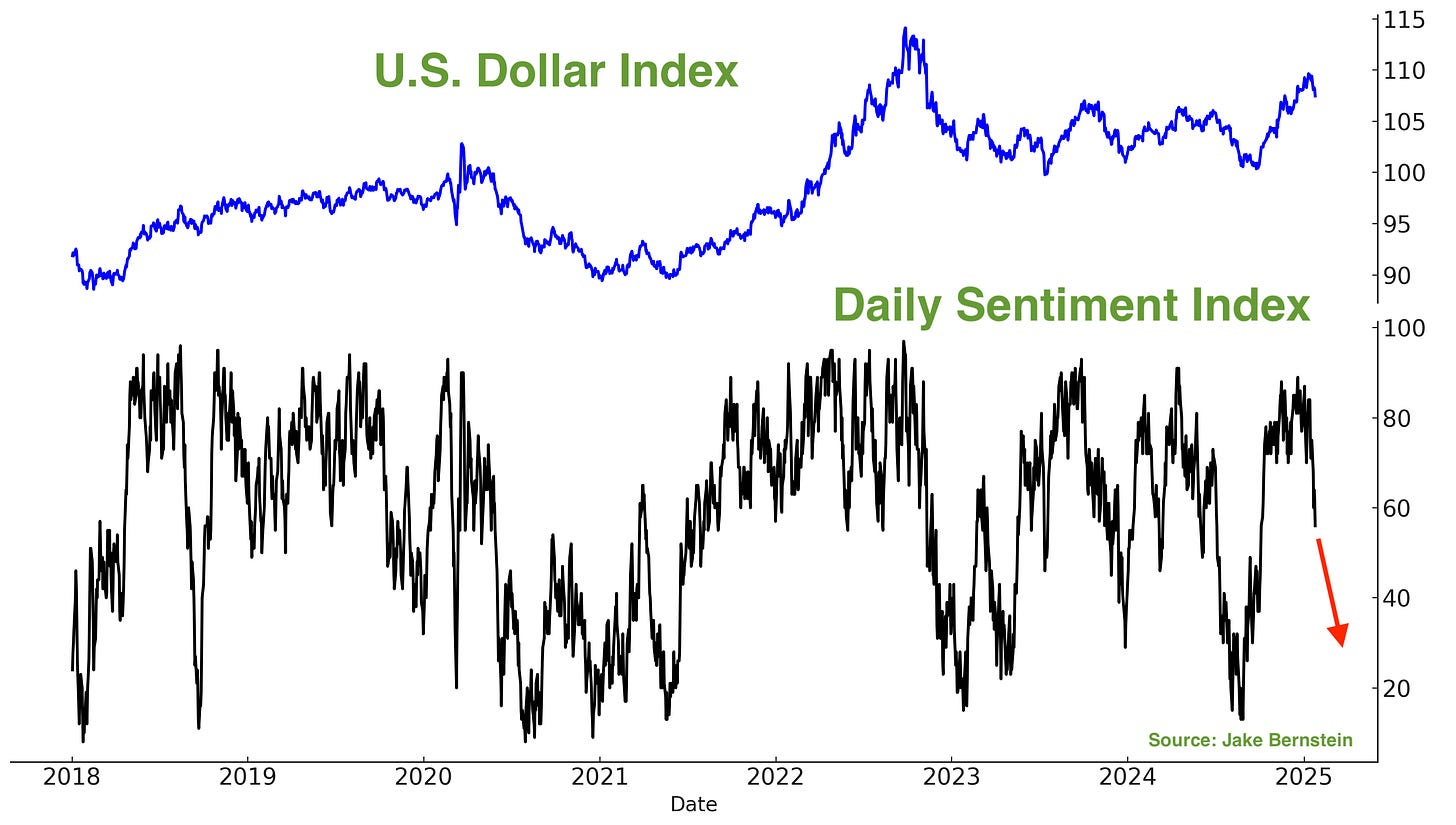

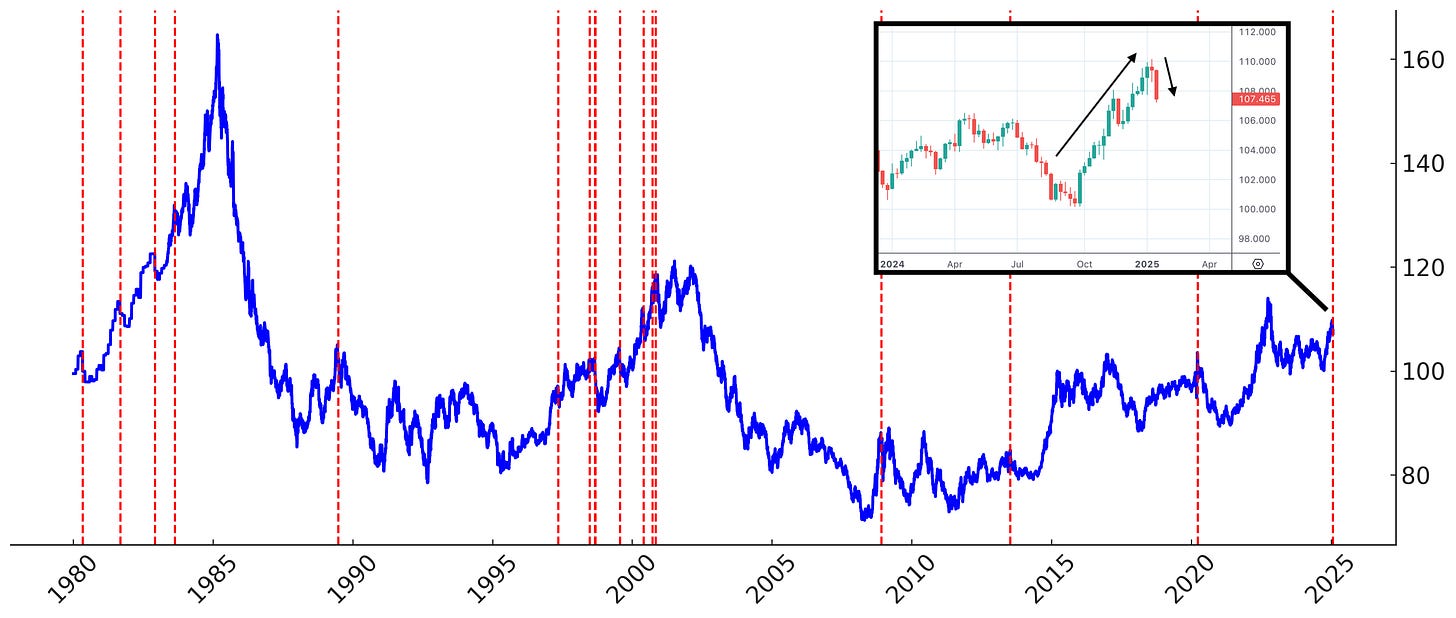

U.S. bonds fell over the past few months, which drove up the U.S. Dollar (increasing interest rate differentials). But the Dollar’s top could be in, and bonds’ bottom could be in.

Here’s the U.S. Dollar’s Daily Sentiment Index: peaked, and coming down.

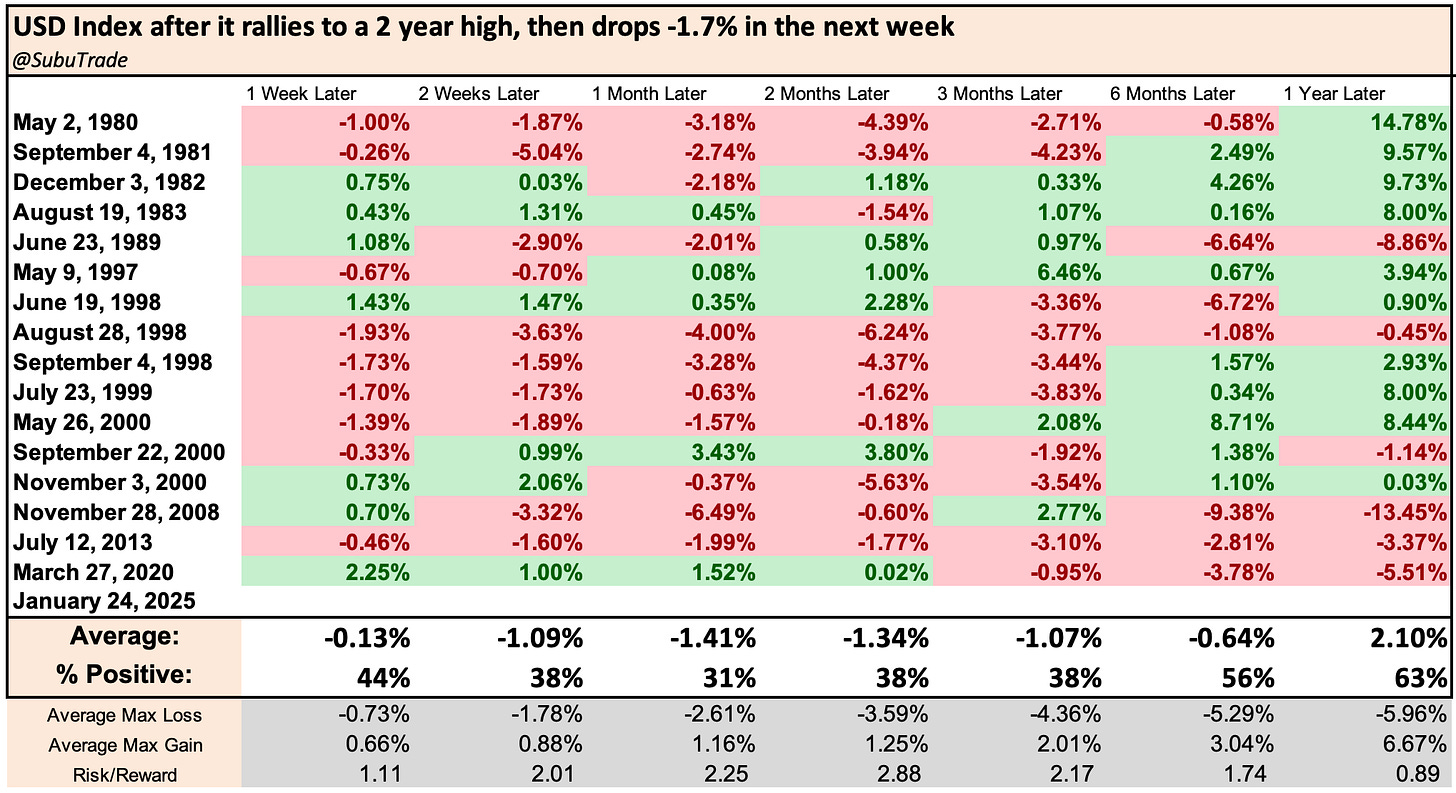

This has been an interesting reversal. The U.S. Dollar Index rallied to a 2 year high last week, then fell -1.7% this week.

Historical cases saw the U.S. Dollar fall over the next month….

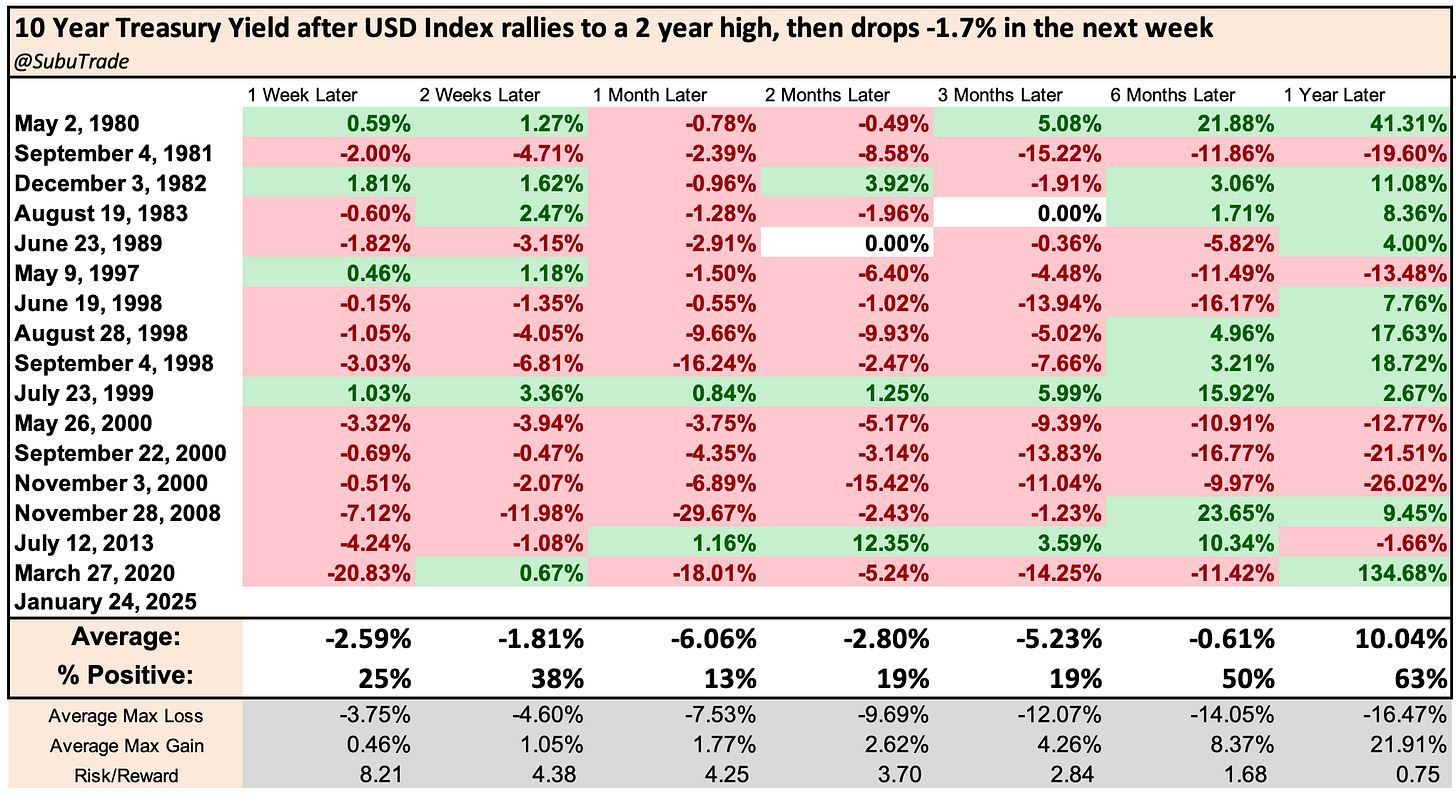

While interest rates fell and bond prices rallied….

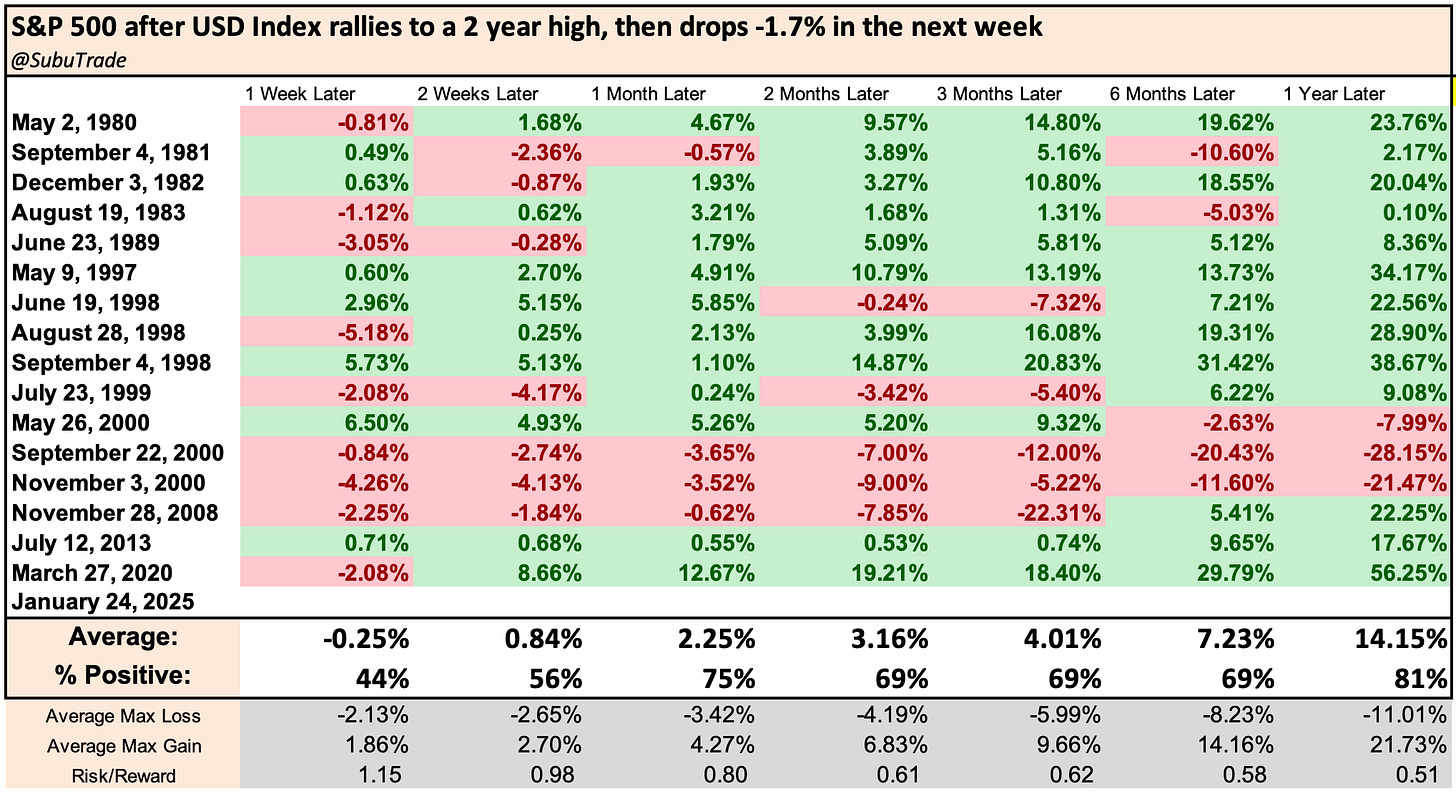

Here’s what the S&P 500 did next:

The U.S. Dollar’s pullback is directly opposite to the bond market’s bounce:

Summary

U.S. stocks: room to move higher, but I think the rally will be limited. 2025 will not be a repeat of 2023-2024’s strong rally.

Chinese equities: good setup for a rally, now just needs a trigger to spark the rally.

Indian equities: long term bullish on India, short term sell-off has triggered a good risk:reward opportunity for bulls.

U.S. Dollar: peak could be already be in, pullback may continue.

U.S. Bonds: bottom could already be in, bounce may continue.