The future is long AI stocks (America and India)

Looking at key themes and once-in-a-lifetime trading opportunities.

Maintaining a Cautiously Bullish Stance on U.S. Equities Amid Rising Risks

While I remain bullish on U.S. equities, I have reduced my position size as risks accumulate. The market's upward momentum is undeniable. You can adjust your position size based on how overextended a trend is, but it is not wise to fight the trend. Extreme conditions can always become more extreme.

Geopolitical Dynamics: India (stocks) is the winner

Geopolitics plays a major role in financial markets today; the world does not adhere to free market principles. I am bullish on Indian equities, which benefit massively from the U.S.-China conflict.

This week’s analysis will explore two key themes:

Part 1: identifying potential headwinds in the U.S. stock market.

Part 2: examining the once-in-a-lifetime opportunity in Indian equities.

Part 1: U.S. stocks remain in an uptrend despite mounting risks

The U.S. stock market remains in an uptrend. However, several risks are notable.

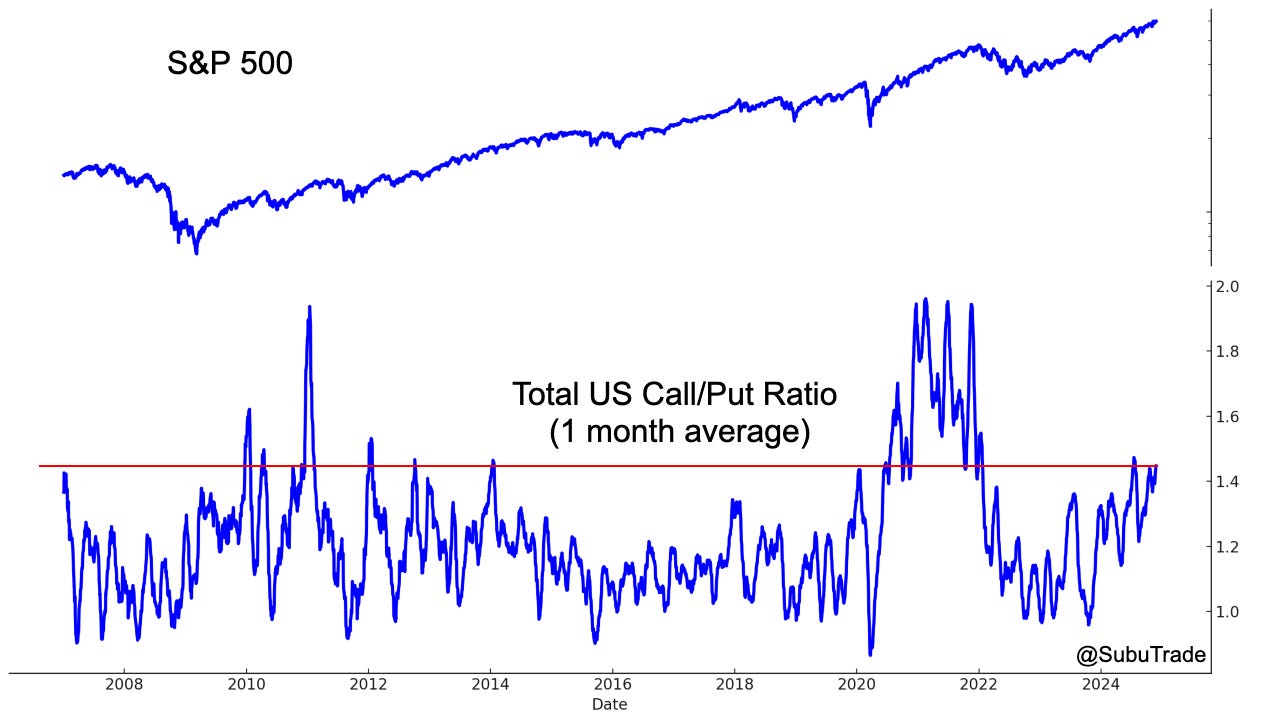

Options: a lot of call buyers, but not as crazy as 2020-2021

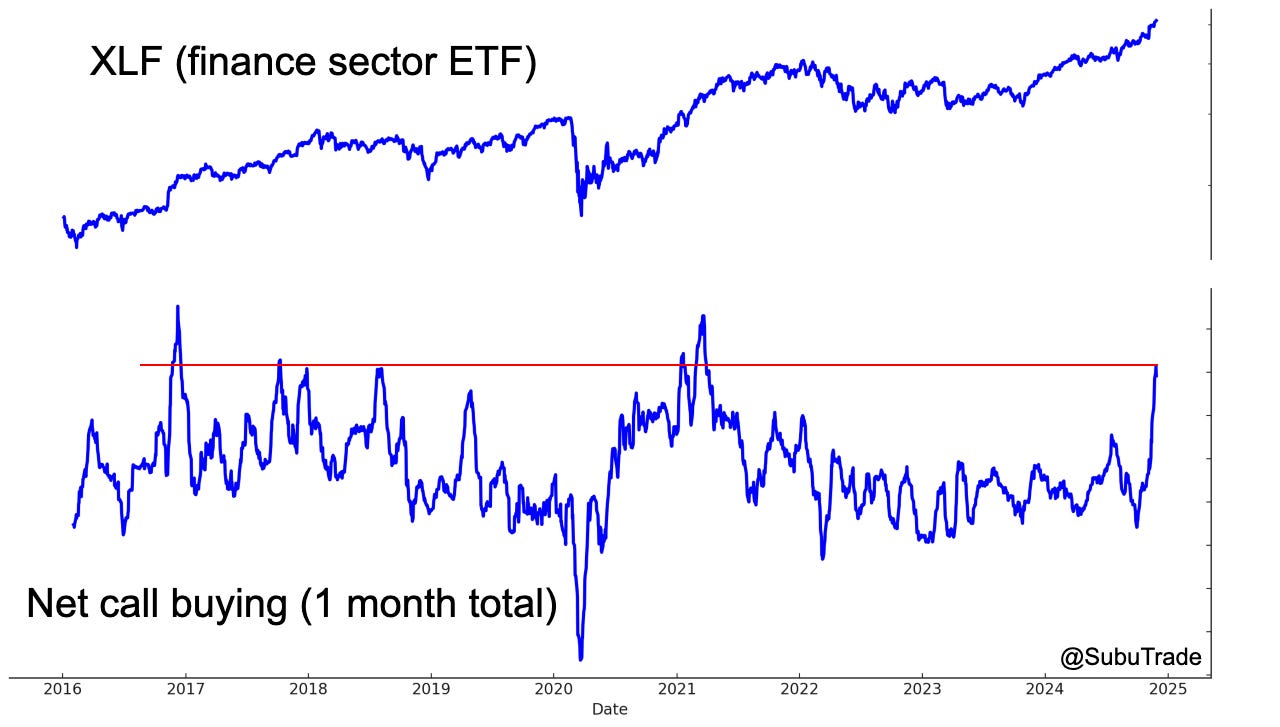

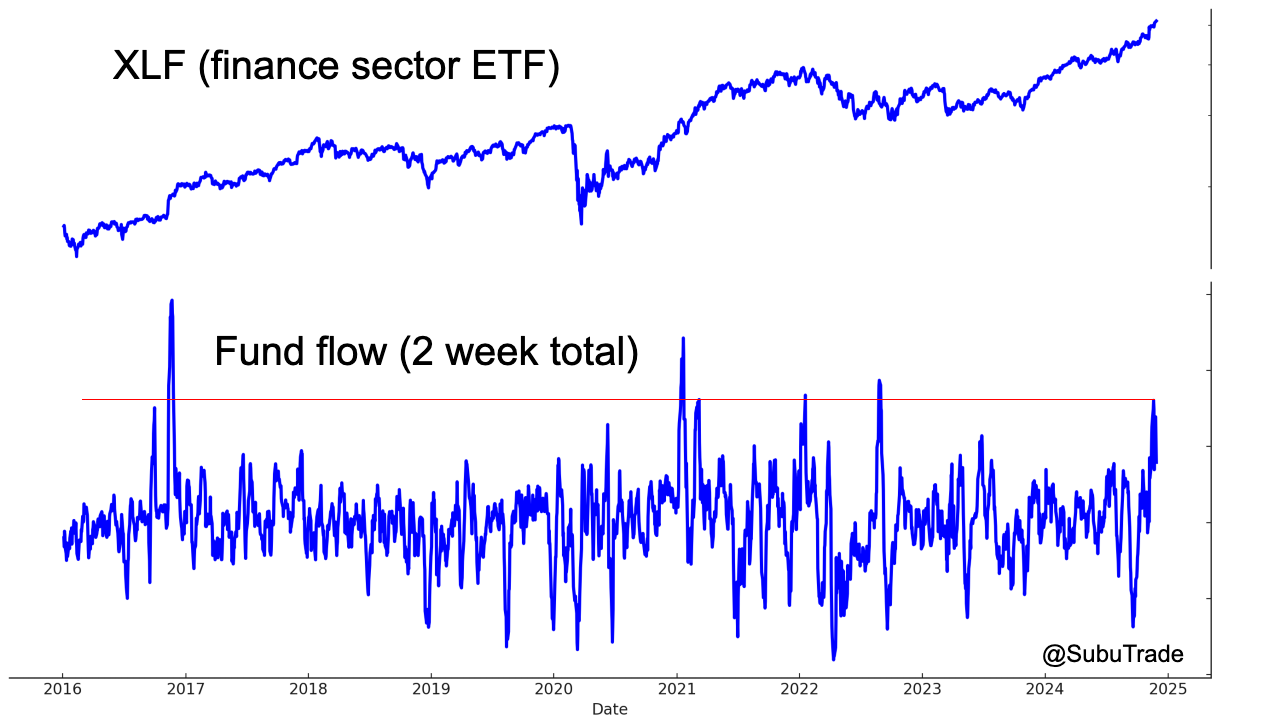

With the Federal Reserve in a rate cut cycle, once-lagging financial stocks are making a strong comeback. XLF (finance sector ETF) is up 36% year-to-date while the broad S&P 500 is up 27%. As a result, FOMO traders are going ALL-IN on XLF call options:

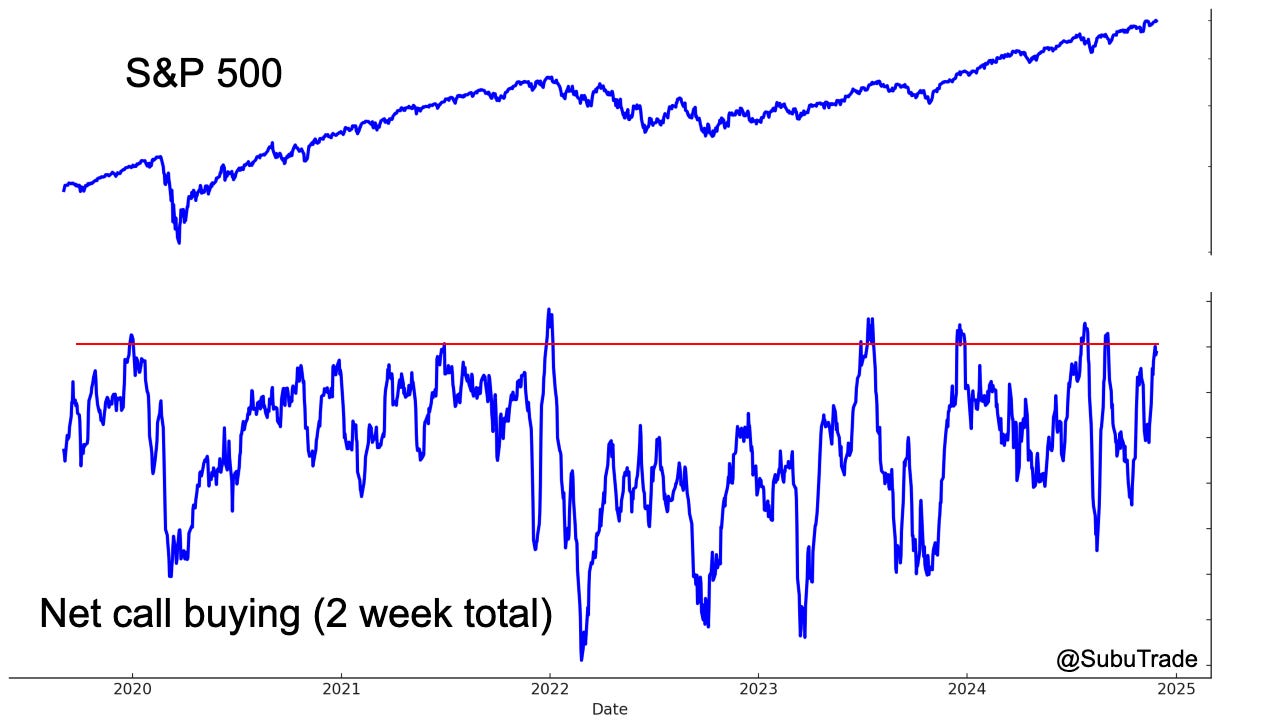

Outside of the financial sector, options are traders are still quite bullish on U.S. equities. Here’s the number of Calls-Puts in the S&P 500 etf (SPY).

Again, we can see strong call buying in broad markets:

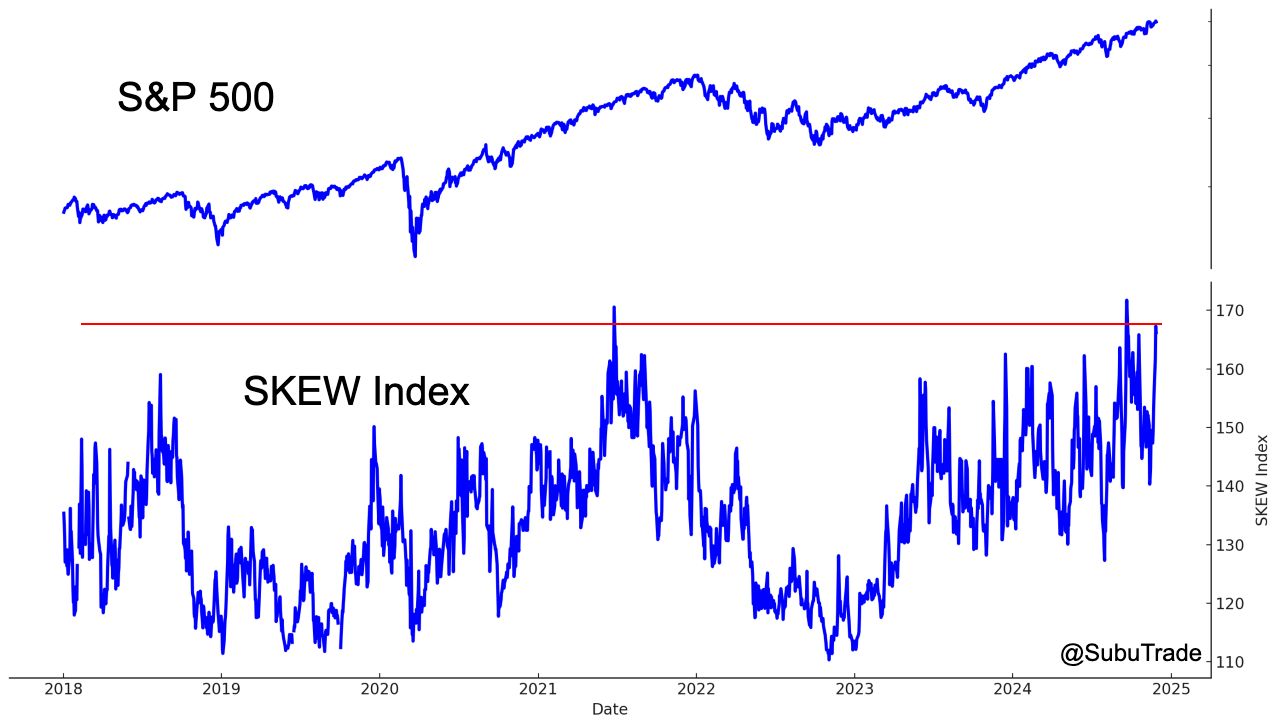

Some traders are betting on increasing risks of a black swan event (i.e. stock market crash):

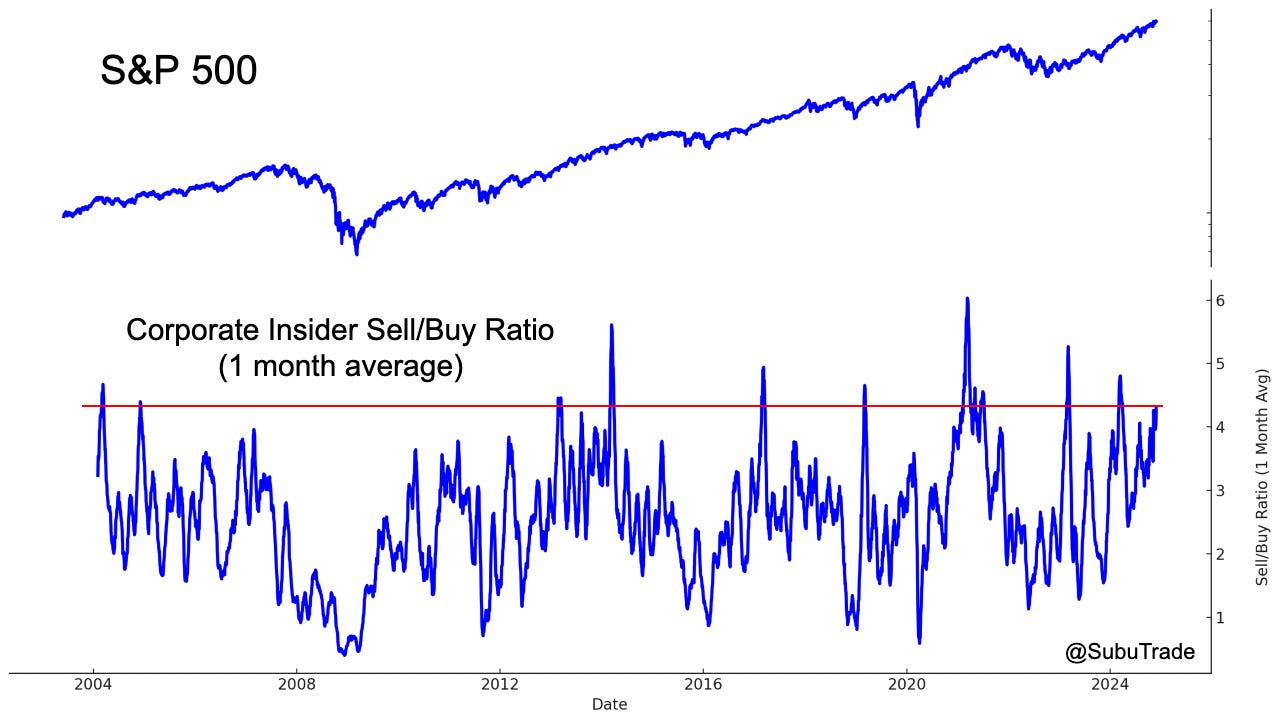

As Corporate insiders continue to sell

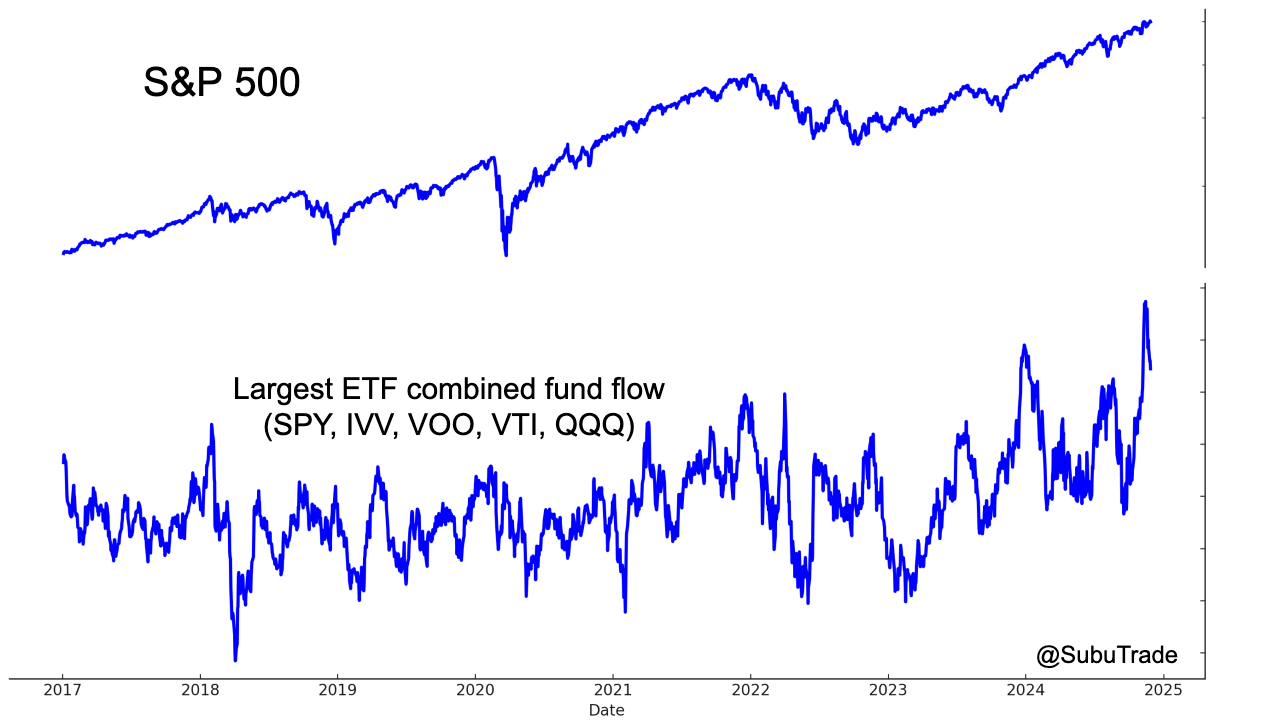

Fund flows are echoing a similar picture: investors are chasing the rally

The past 2 months have seen massive flows into S&P and NASDAQ ETFs (SPY, IVV, VOO, VTI, QQQ):

And just like in the options markets, we can see large inflows into XLF (financial sector ETF).

Part 2: Once-in-a-lifetime opportunity in Indian stocks

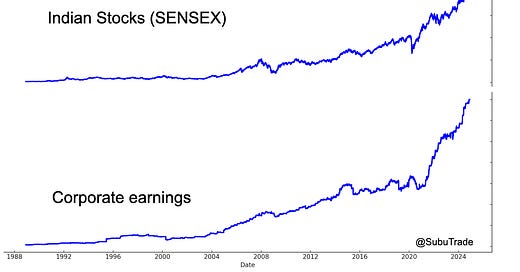

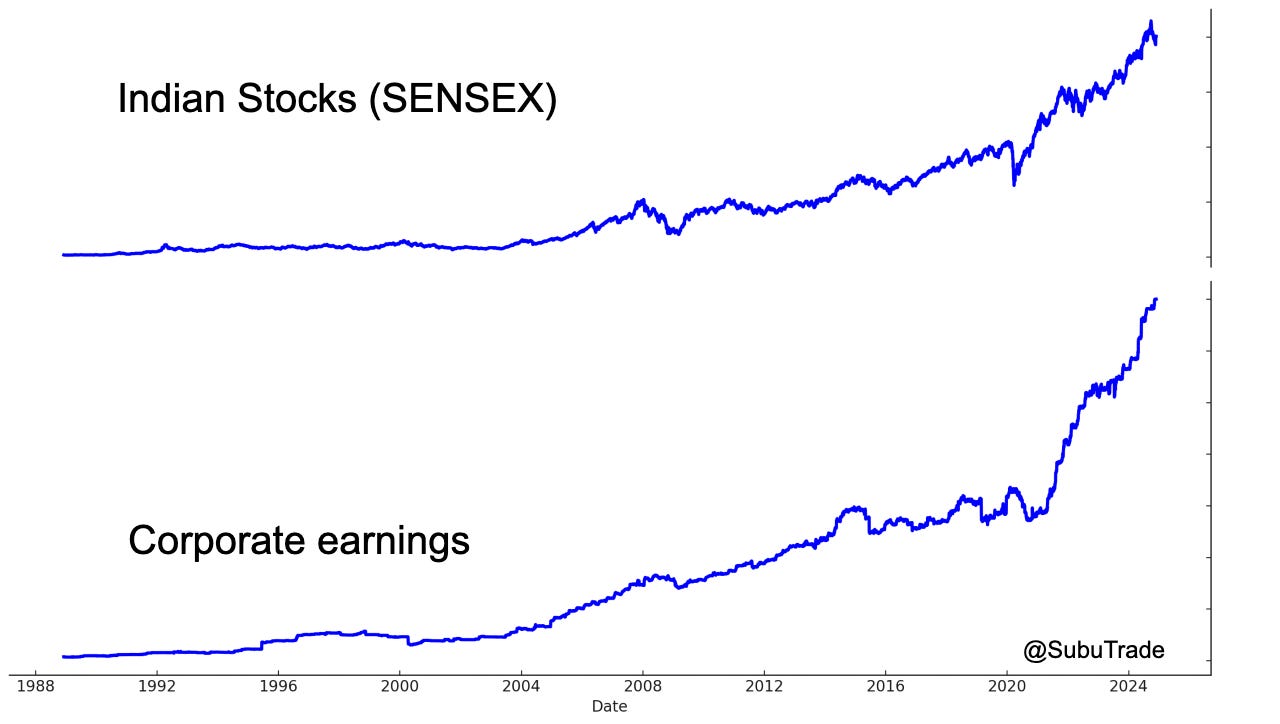

In Part 2 I will explain the once-in-a-lifetime opportunity in Indian stocks (and India in general). First, here’s a chart of India’s corporate earnings (for the index SENSEX):

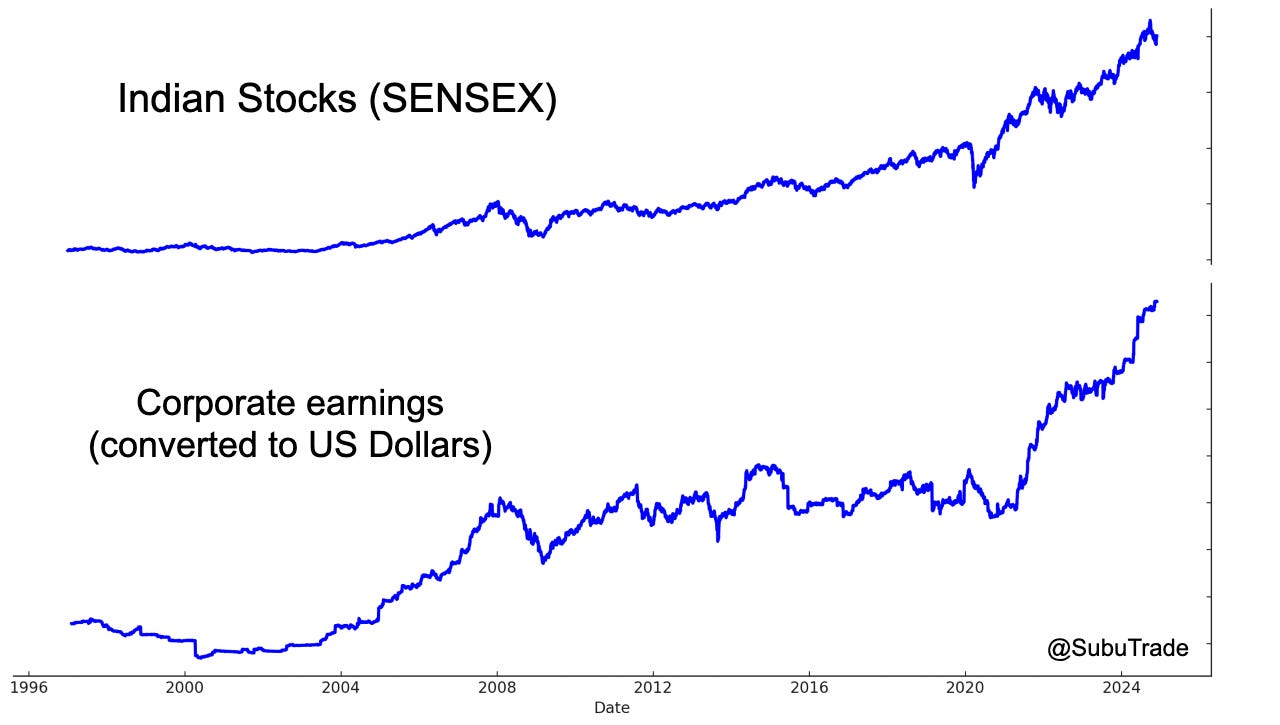

India’s currency depreciated significantly from 2011-2022 because India has high inflation. So we need to adjust these corporate earnings to U.S. Dollars:

*In the long run, any stock’s growth is driven by earnings growth.

As you can see, India’s corporate earnings surged post-covid. And this is just the beginning; I believe that we have just begun a multi-decade bull run in Indian stocks.

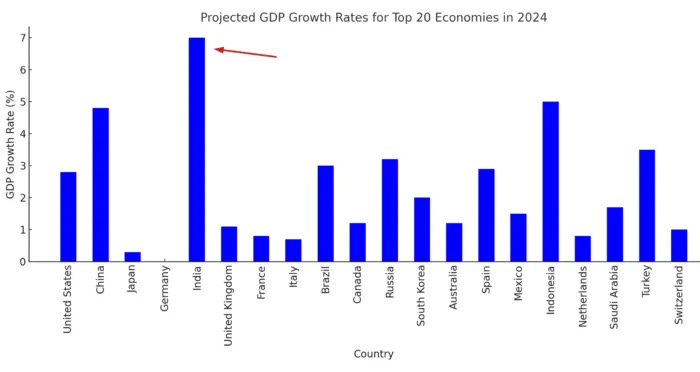

So what is driving this growth in India’s economy and corporate earnings? Why is India projected to be the fastest growing major economy over the next decade?

To understand India’s comparative advantage in the world today, we must first understand geopolitics.

The U.S. (#1 economy) and China (#2 economy) are locked in a classic case of “Thucydides Trap”, whereby the reigning superpower wants to give the up-and-coming power a beatdown. As a result, the U.S. and its allies are in an economic war with China today.

In this fight, the U.S. and its developed nation allies need help . Fertility rates are falling everywhere except in the poorest of nations. The West wants to grow its economy, and to do that, it needs more people (immigrants).

*GDP = (GDP per capita) x (population). If you can’t boost GDP per capita, boost the population (or so the thinking goes). For the record, in my opinion the belief that boosting population will automatically boost GDP is wrong and naïve.

Who will the U.S. and its allies take help from? Where will the West draw immigrants from?

India.

The Indian subcontinent accounts for almost a quarter of humanity, and its population is still rising. Indians have 2 unbeatable advantages in this world:

English-speaking

Communal

The English-speaking advantage is obvious: people who speak English have a much easier time immigrating than people who don’t speak English very well. But for those who do not understand the concept of “communalism”, we can turn to the Indian Prime Minister Modi who according to the Economic Times:

Modi's Indian diaspora outreach is linked to his foreign policy. Modi is trying to build a global community that is loyal to their host countries but ever ready to help the country of origin (India). He is fashioning another diaspora of another Israel. This gives the NRIs (non-resident Indians) a permanent sense of belonging since they are being drafted in the cause of the motherland.

This is why whenever the Indian government negotiates Free Trade Agreements with other countries, it always seeks more immigration for Indian citizens. India does not see immigration and brain-drain as a bad thing; the more Indians immigrate, the more India benefits on the international stage. Think of all the Indian CEOs in U.S. companies and the powerful Indian-Americans in U.S. politics (e.g. Raja Krishnamoorthy, Ramaswamy, Usha, Kash Patel, Tulsi Gabbard).

To make a long story short, I believe that we are living in a once-in-a-500-year event: the rise of the Indian Empire. India’s economy will grow to become the largest economy in the world, and Indians will slowly take over the West. India is already the largest source of immigrants to many western nations, and this will only increase as India’s GDP per capita grows and more people can afford to immigrate.

All of this translates into strong economic growth for India, which is based on 3 pillars:

Services outsourcing from western countries to India (think U.S. tech jobs moving to India). India’s services exports has almost doubled from $200 billion per year to $400 billion per year since the pandemic began.

Manufacturing outsourcing moving from China to India.

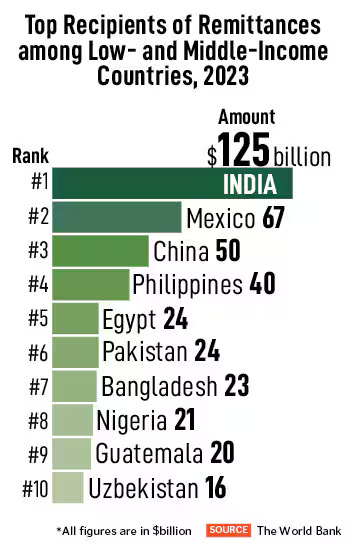

Massive foreign remittances from other nations to India. Indians living and working abroad are sending money back home to India.

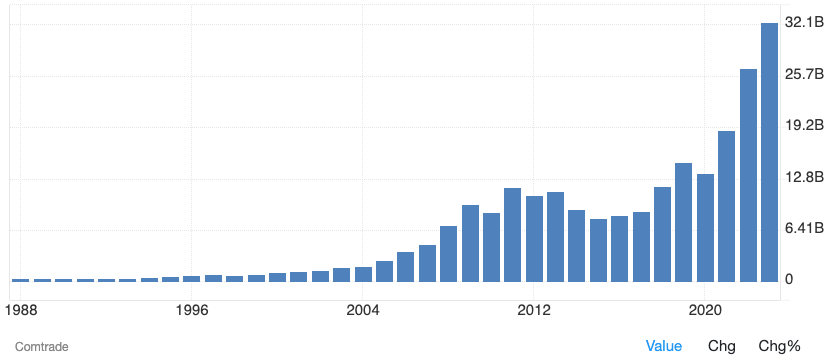

We can see this in several data series. As China’s manufacturing moves to India, India’s electronics exports is exploding. The following chart from TradingEconomics includes yearly data as of 2023. 2024 has seen further growth, which companies like Apple expanding their manufacturing in India by 30-40% per year:

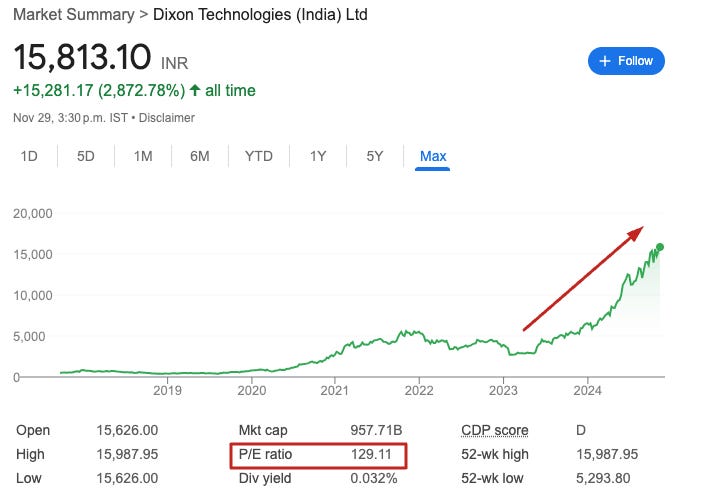

Hence, electronics manufacturing stocks in India like Dixon Technologies have exploded higher. Indian stocks have been in a correction over the past 2 months, but stocks that benefit from U.S.-China economic war like Dixon Technologies have not fallen at all. Investors BTFD. Dixon has a sky-high P/E ratio because analysts believe that Dixon will grow its profits by 50% a year for the next half decade:

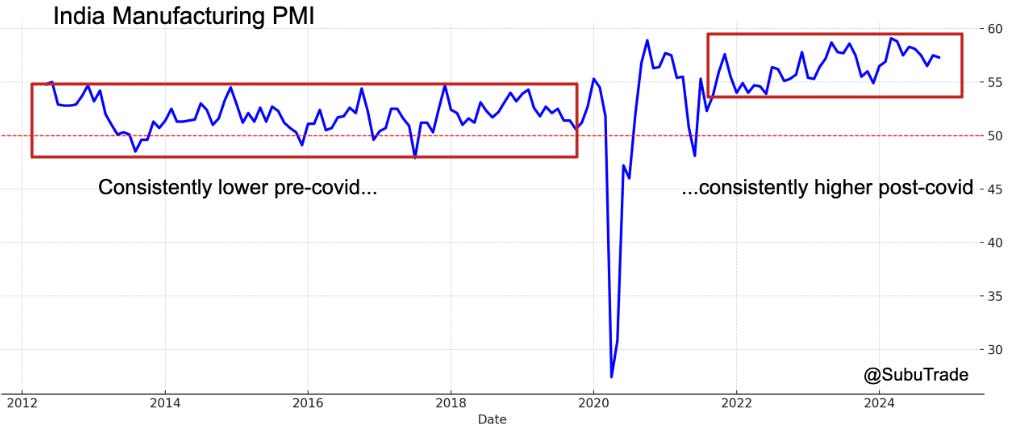

India’s manufacturing growth is reflected in its Manufacturing PMI, which has been consistently higher post-covid than pre-covid:

To sum up manufacturing, there is a clear alignment of interest between the U.S. and India. The U.S. wants to break the #2 (China) economy into smaller pieces. While some manufacturing will go to Southeast Asia, most of it will go to India over time. India’s economy benefits massively by helping the U.S. achieve its goal.

India also receives huge remittances from its massive (and growing) diaspora. This figure will only skyrocket as immigration from India increases in the future:

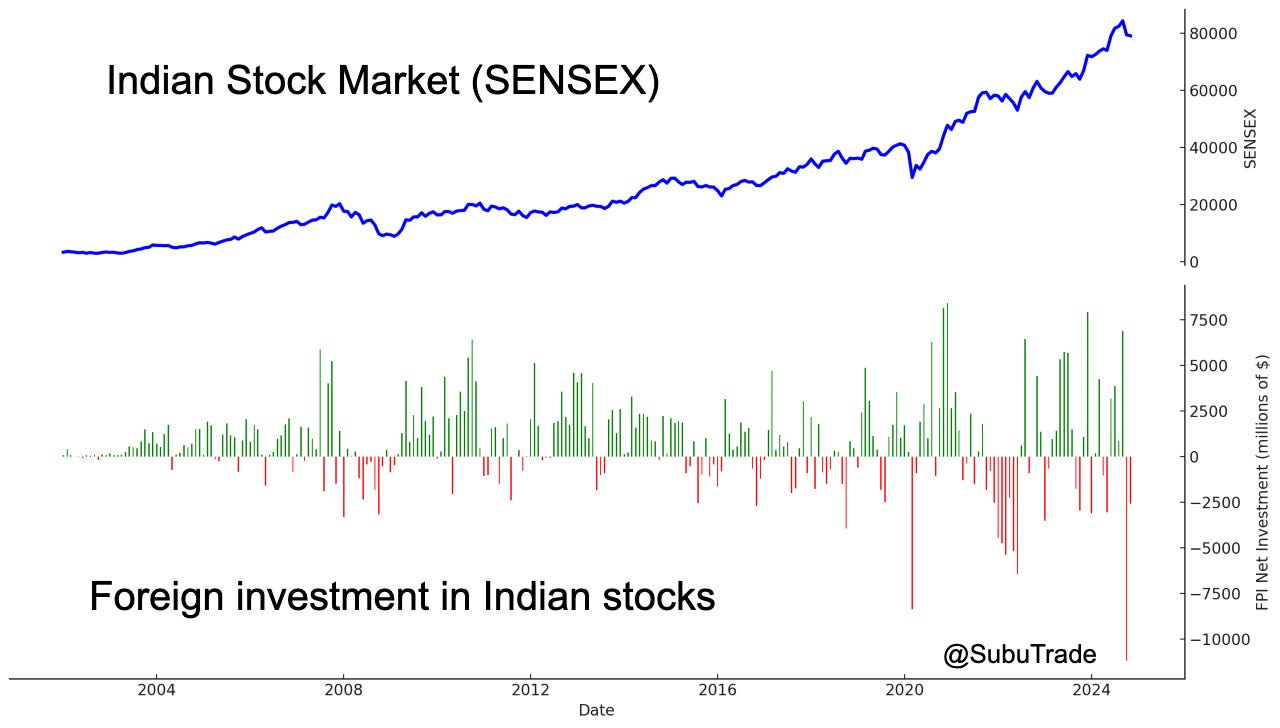

To repeat, we are at the beginning of a multi-decade bull run in Indian equities. And while foreign investors have withdrawn a record amount from Indian stocks in the past 2 months, savvy investors should be thinking of buying.

While I am bullish on Indian stocks, a key intermediate term risk to watch is the U.S. stock market. A U.S. stock market decline will drag down Indian equities. If such a decline occurs, that will be a terrific buying opportunity.

Key Insights and portfolio positioning

I remain long U.S. equities. The upwards momentum is unmistakable. However, I have decreased my position size to account for rising risks of a correction.

I remain long term bullish on Indian equities, but I do not think now is the appropriate time to buy. Either wait for Indian stocks to resume its up-trend or for U.S. equities to drag Indian equities down to a better buying point.

Agree with the India sentiment. They are poised to grow into a MAJOR superpower in this century. The factors are all in place.

good to see u back. what do you think of bitcoin? having hard time understand the bitcoin trade really (as still tied to fiat money to monetize)