Did the Fed cancel Christmas? Here's how I'm trading this market

Here's how I'm trading this period of heightened market volatility.

This week saw stocks decline following Wednesday's Federal Reserve meeting. During times like this, it is crucial to remain focused and not get swayed by the noise. Before I explain how I’m dealing with this market, let me first clarify how I trade.

I am a macro trend follower, aiming to capture significant market trends across stocks, bonds, and commodities. To quote Reminiscences of a Stock Operator: “the big money is made by being right and sitting tight.” I focus on themes that drive major trends, such as:

Long tech stocks in 2020 (COVID money printing + work from home theme)

Long commodities in 2021 (inflation theme)

Short bonds in 2022 (inflation = interest rate hike theme)

Long India + U.S. tech stocks in 2023 to mid-2024 (earnings growth theme)

While I follow trends, I also adjust position size using contrarian signals. For example, if a rally becomes overextended in an uptrend, I may scale back exposure from 200% long to 50% long.

Beyond my core trend-following approach, I take 2 additional types of trades:

Mean-Reversion Trades: I short rallies or buy crashes only when the market reaches a multi-year extreme. These small positions are typically held for weeks-months.

Black Swan Trades: I trade significant market mispricings when an event's probability is underestimated (e.g., market estimates 1% probability, but I assess it at 5%). Black swan trades are not limited to bearish scenarios; there are also opportunities to capitalize on positive black swans. These trades always involve small position sizes but can generate substantial portfolio gains due to their asymmetric risk-reward profiles.

With that out of the way, here’s how I’m positioned today during this heightened market volatility.

Please follow me on Twitter/X if you haven’t already.

My portfolio

Core position

My core position remains long U.S. equities. By the end of last week my position size was 60% less than normal to account for downside risks. After this week’s decline I have reduced my position size to 70% less than normal.

I’ll increase my position if the market rallies.

I’ll decrease it if the market falls, but will take a counter-trend long trade on an extreme drop (which hasn’t occurred yet).

Mean-reversion position (non-core)

This week I took a medium-sized long position in TLT (Treasury bond ETF). I’m looking for a multi-week rally here.

Black Swan position (non-core)

I bought call options on various Chinese ETFs expiring April-July 2025. This is a small % of my portfolio but due to its asymmetric payoff, can result in large gains.

My long position has nothing to do with China’s stimulus, which is a non-event. This is a political bet: there is a small but rising probability that China’s President Xi may be removed, or at least significantly reduced in stature. I will explain this below.

To be clear, I am not long term (1+ year) bullish on China for all the obvious reasons. I am long term bullish on India. But this does not mean that China cannot sustain a multi-month rally, especially if there is political change in China.

Let’s dive in.

U.S. stocks (core position)

Trend & momentum

The U.S. stock market is now trending sideways and momentum has weakened significantly with this week’s decline. More importantly, the theme/narrative that is driving the rally is weakening. The AI+tech earnings growth theme that drove stocks higher over the past 2 years has already been priced in.

This will be a major challenge for the U.S. stock market in 2025. Without a new theme, I expect the U.S. stock market to be a lot more volatile in 2025 than 2024.

Sentiment

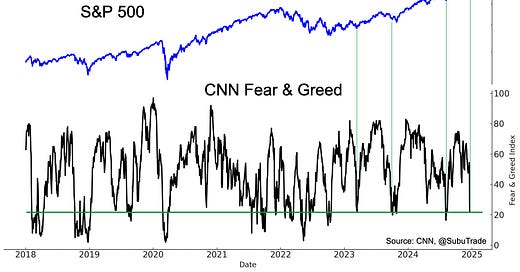

This week’s drop in U.S. equities, particularly in non-Big Tech stocks, pushed various sentiment indicators towards levels of extreme fear. These are combined into the CNN Fear & Greed Index, which has fallen to levels that typically marked bottoms over the past 2 years.

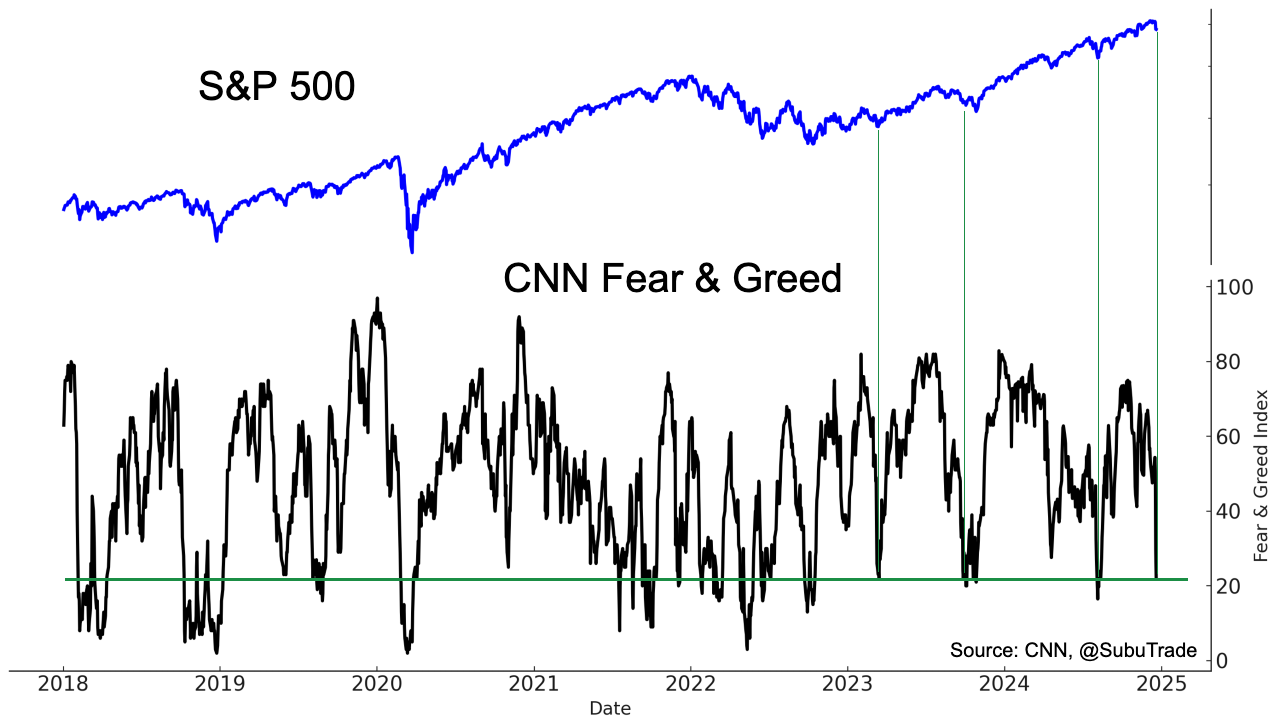

The Daily Sentiment Index has also backed off from extreme optimism levels. Any further selling in U.S. equities will push this indicator to truly oversold levels.

Breadth

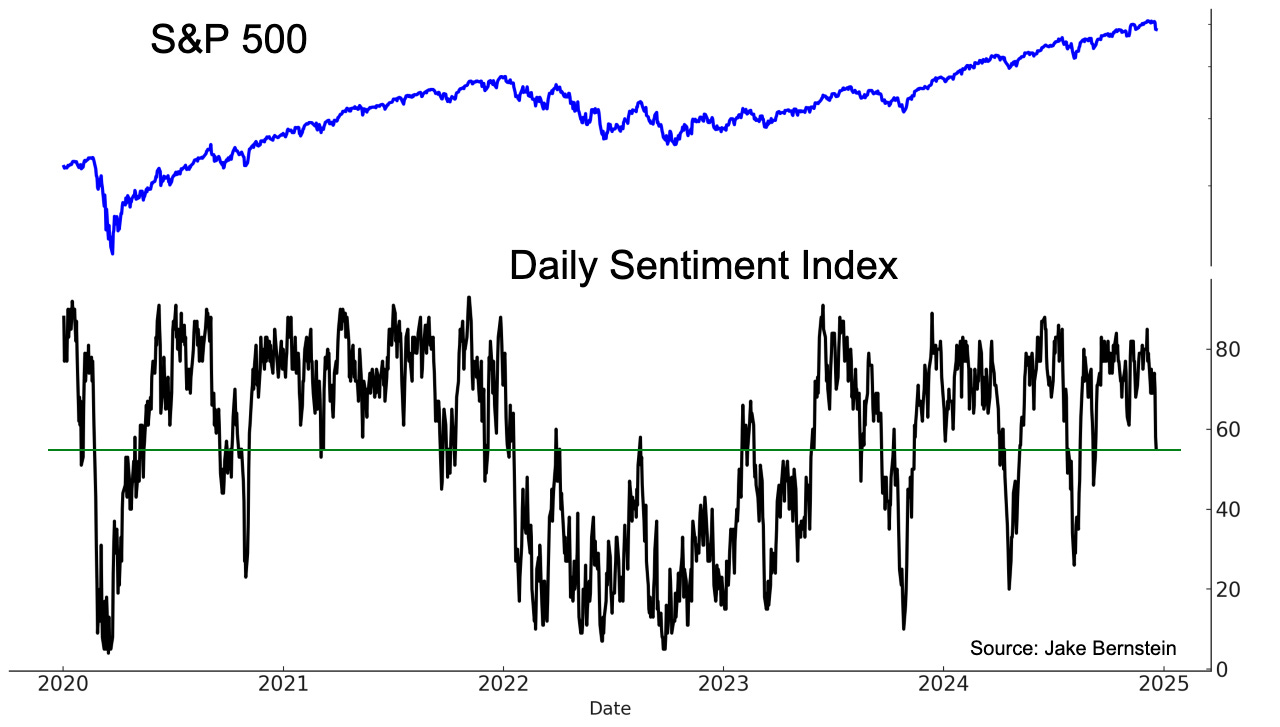

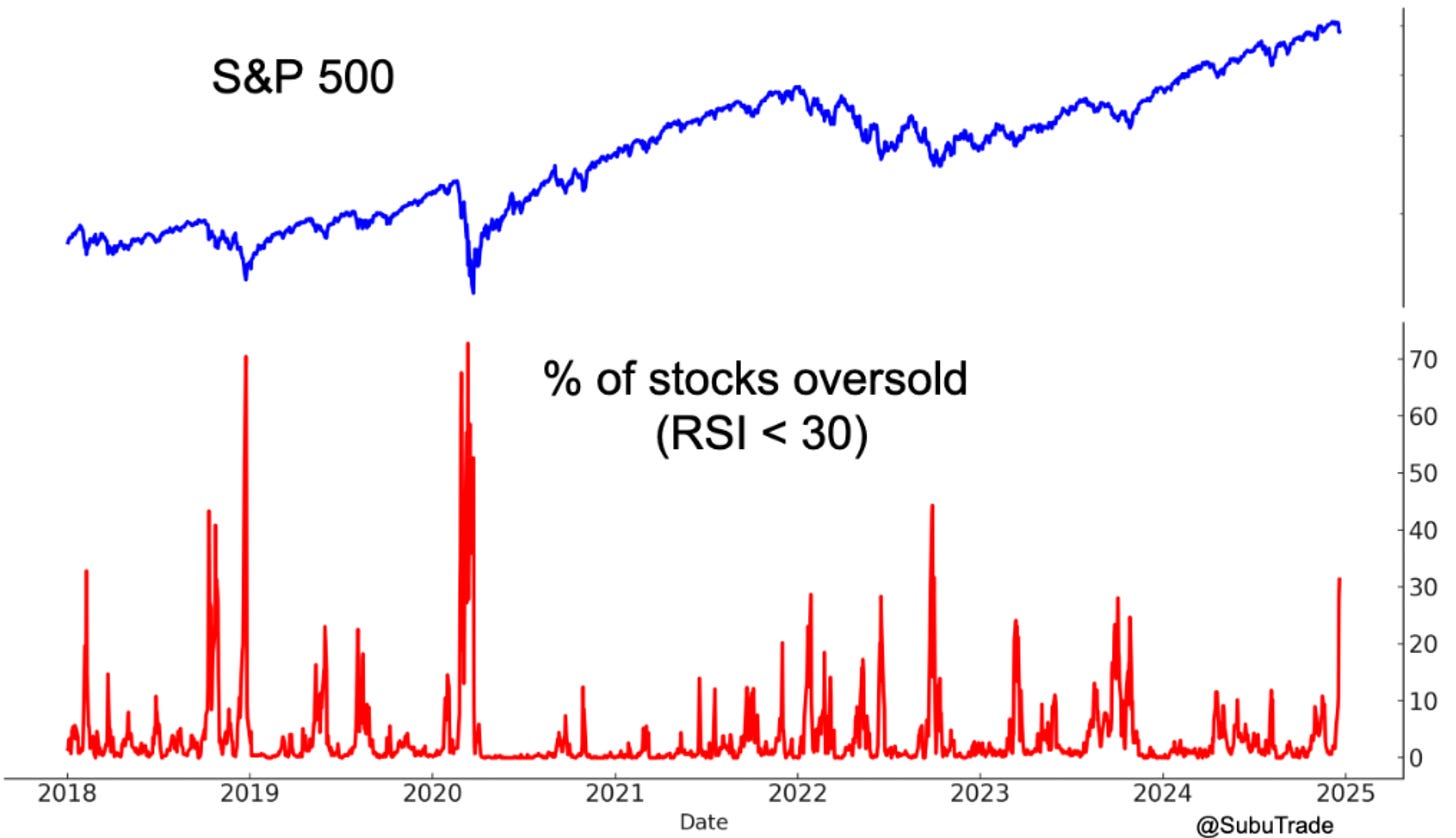

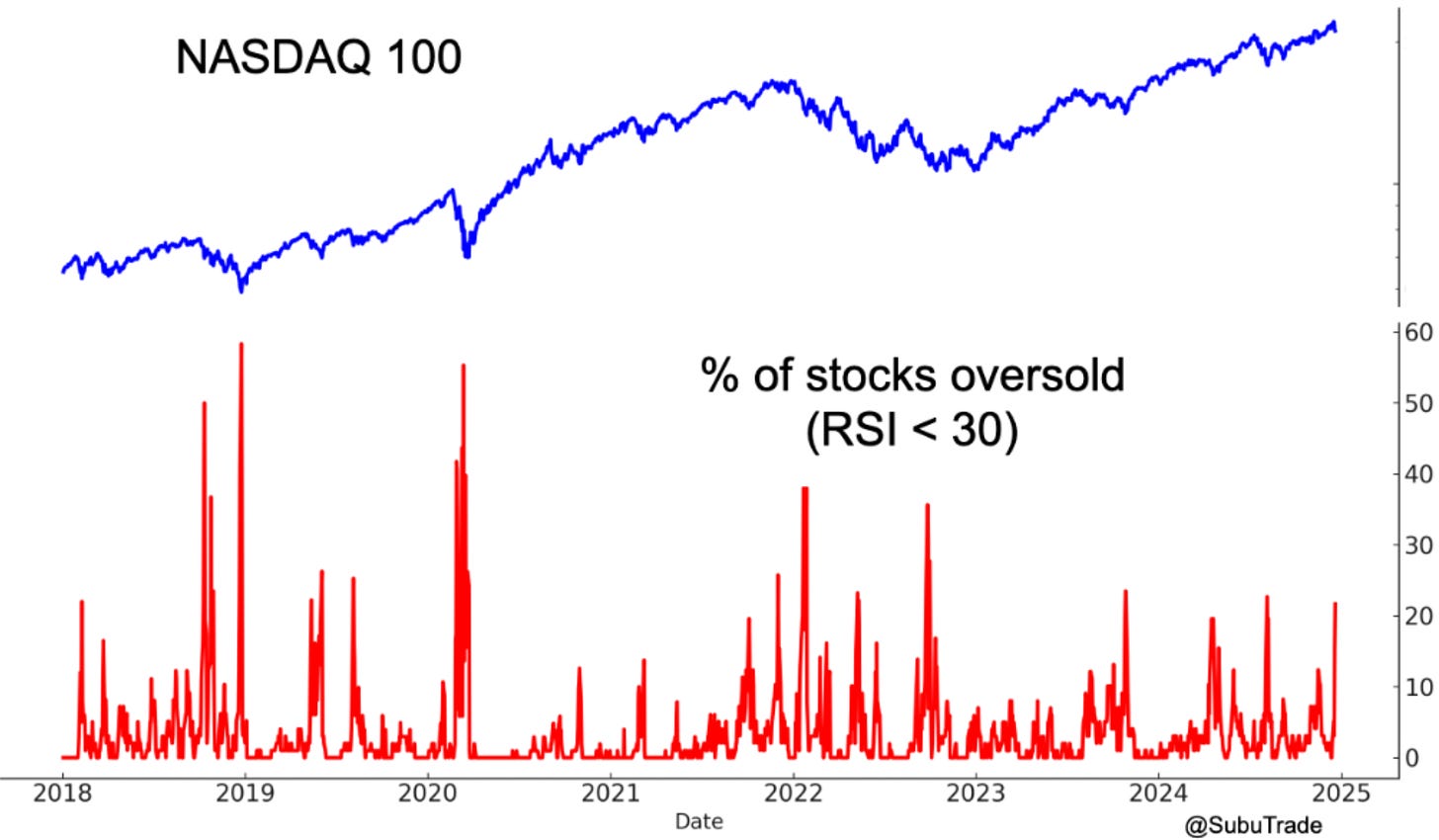

The broad selling across sectors has pushed the % of S&P 500 stocks that are oversold to 31%, which is the highest reading since markets bottomed in 2022.

Similarly, 21% of NASDAQ 100 stocks are now oversold:

Volatility

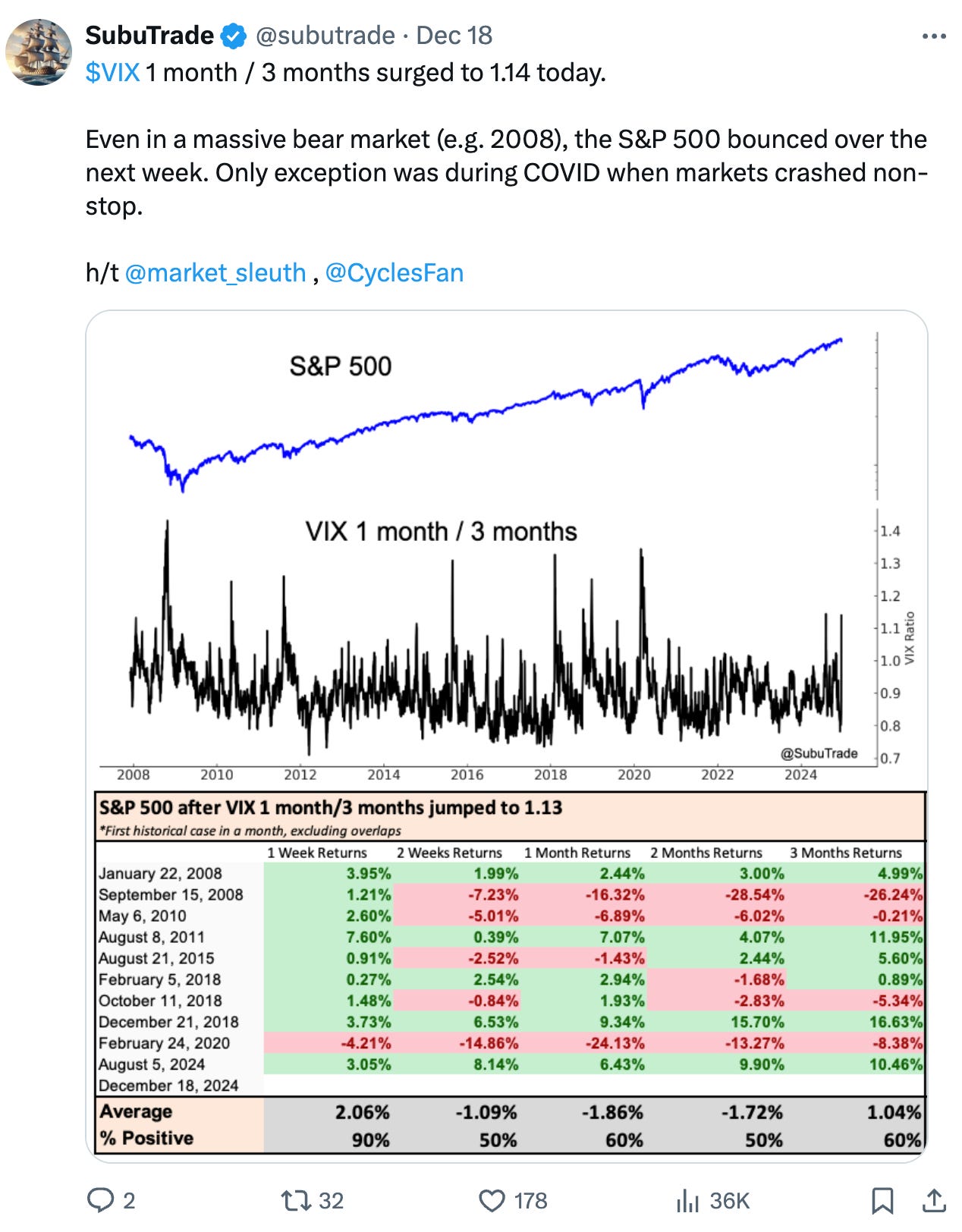

As I mentioned on Twitter/X, VIX spiked along with Wednesday’s stock market decline. The 1 month vs 3 month VIX ratio spiked to 1.14. Such levels of backwardation typically saw the S&P at least make a short term bounce over the next week. If the S&P then makes a new low, VIX usually does not make a new high.

Overall, the recent selloff in stocks was to be expected after weeks of indiscriminate buying among investors and traders. The selloff is not significant and has yet to exhibit symptoms of panic selling that clearly define market bottoms.

While it’s unclear if the U.S. stock market has bottomed right now, there is a much clearer signal in the bond market.

Treasury bonds (non-core position)

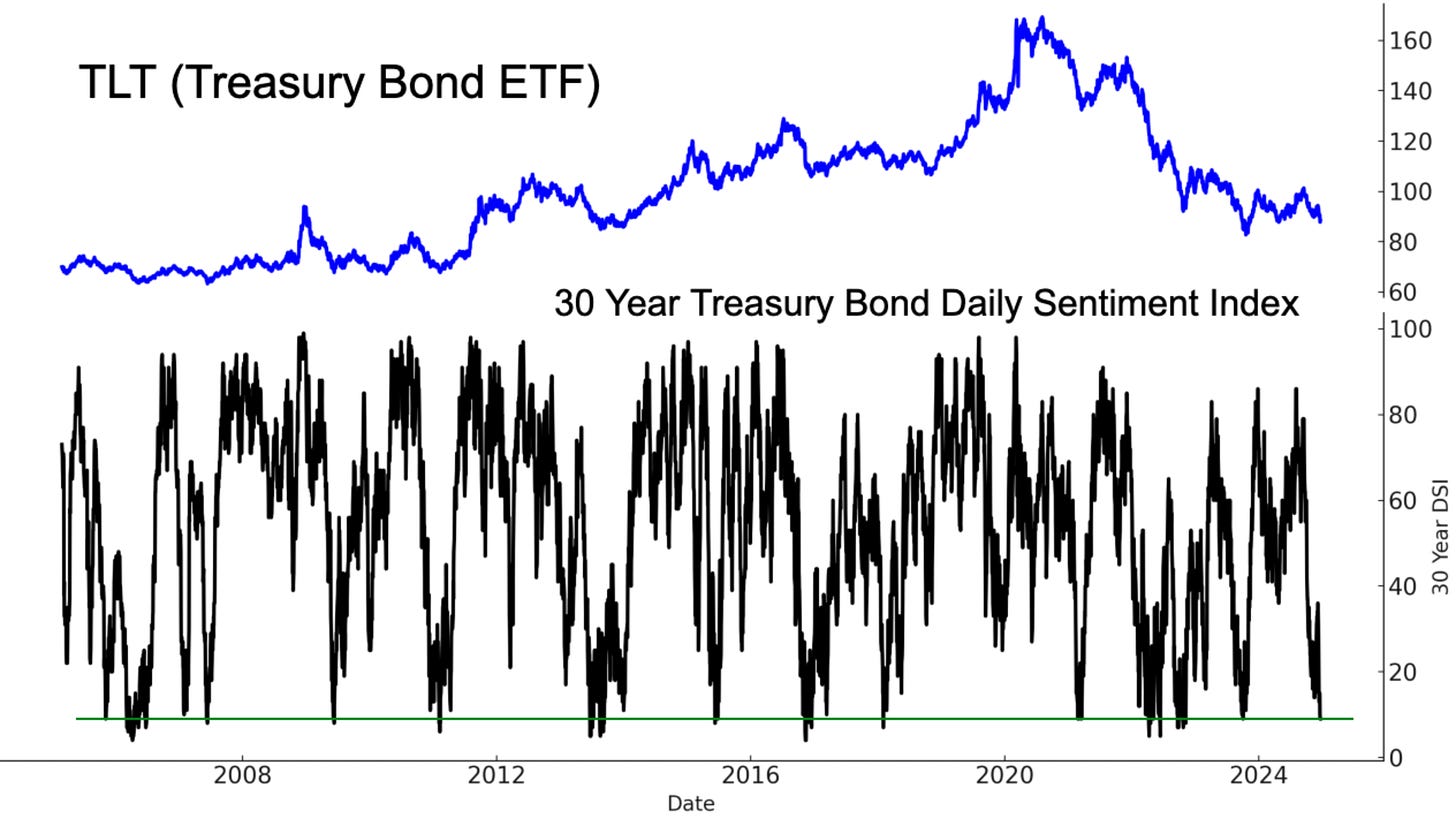

The past 2 weeks saw investors and traders dump Treasury bonds as if there was no tomorrow. Such panic selling makes for a good trade from the long side. Can bonds fall more? Yes, anything is possible. But at this point in time, risk/reward heavily favors bulls.

Here’s the 30 Year Treasury bond’s Daily Sentiment Index. It is currently in the bottom 1% of all historic readings.

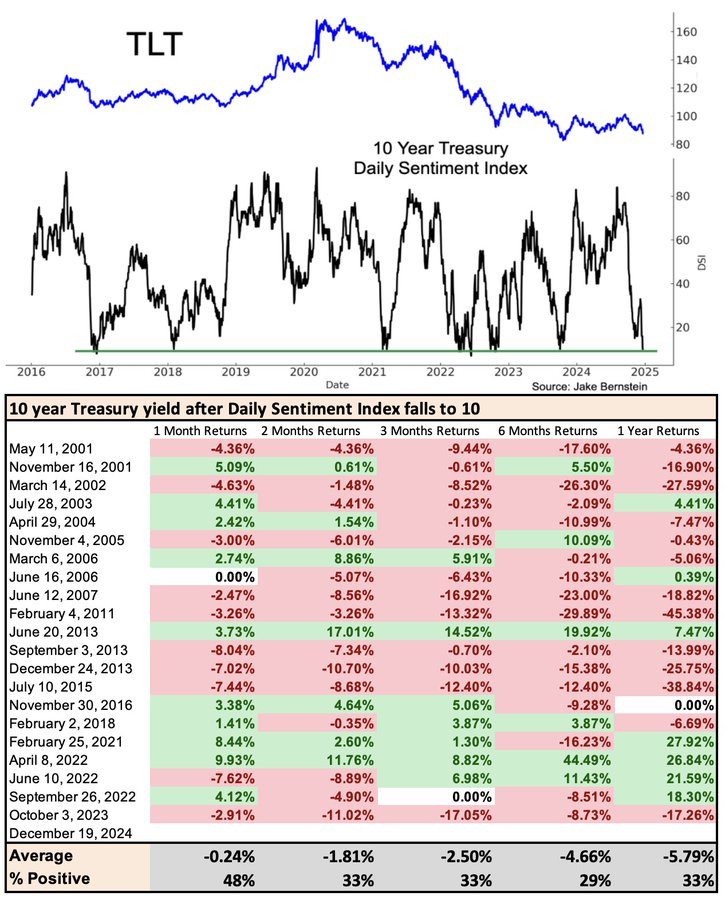

10 Year Treasury’s Daily Sentiment Index also exhibits similar levels of extreme pessimism. As I noted on Twitter/X: similar historical situations usually saw bond yields slump over the next few months as bond prices rallied:

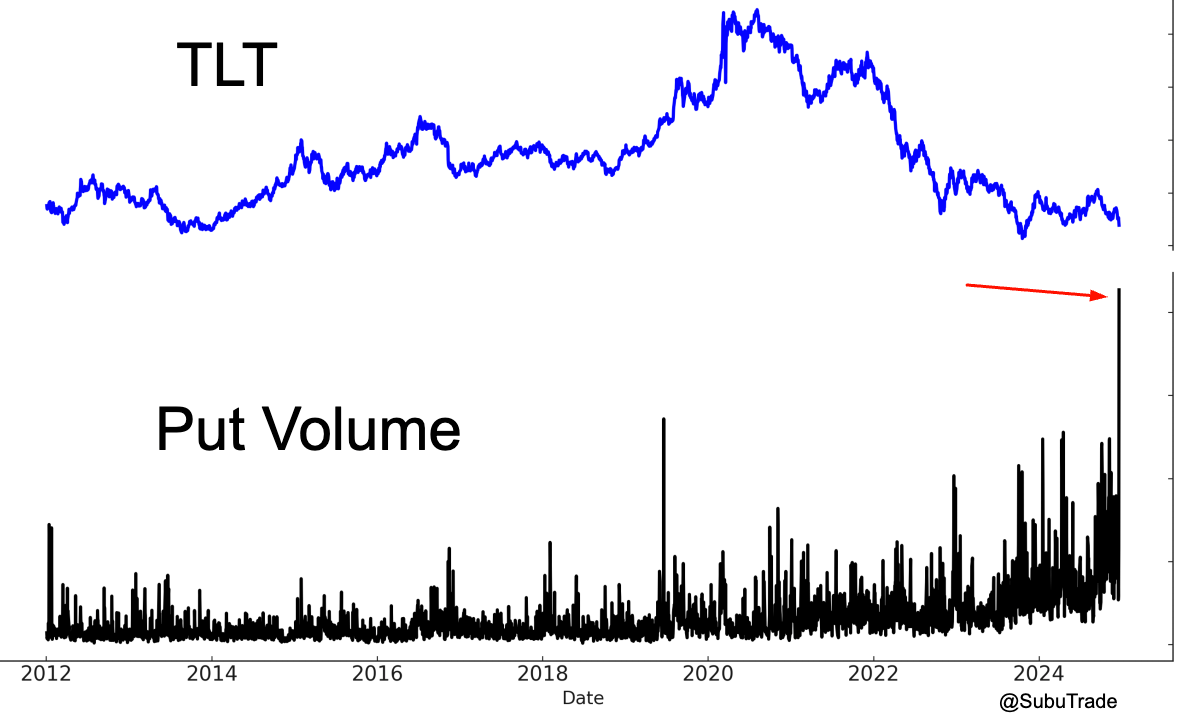

We can see this in the options market as well. Put volume for TLT (Treasury bond ETF) spiked to a record on Thursday, with 46% of those options expiring this week. Most of those traders betting on TLT falling further lost money.

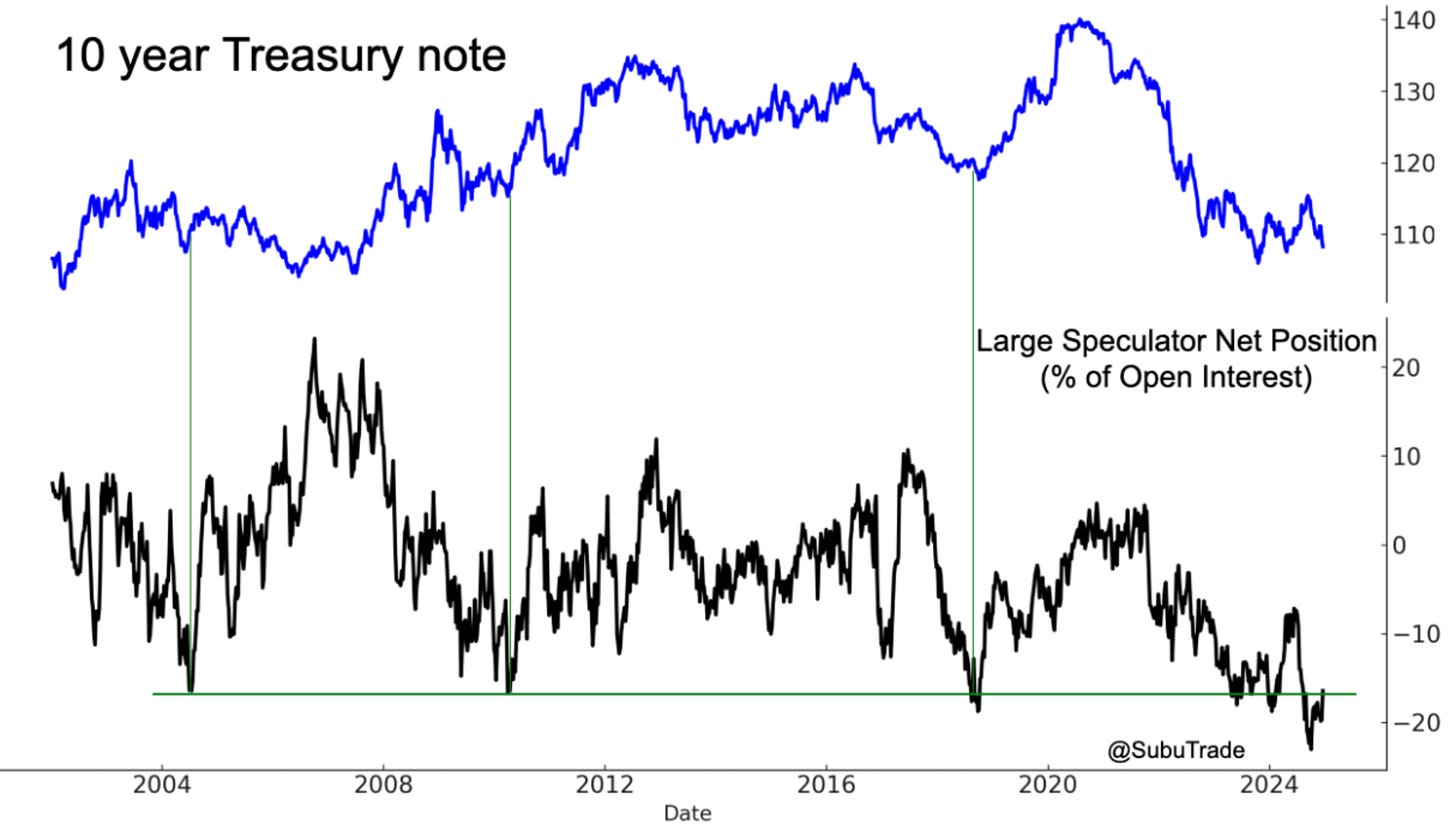

And as a reminder, here’s Large Speculator positioning towards the 10 year Treasury note (COT Report). Their extreme bearishness was typically a bullish sign for bonds.

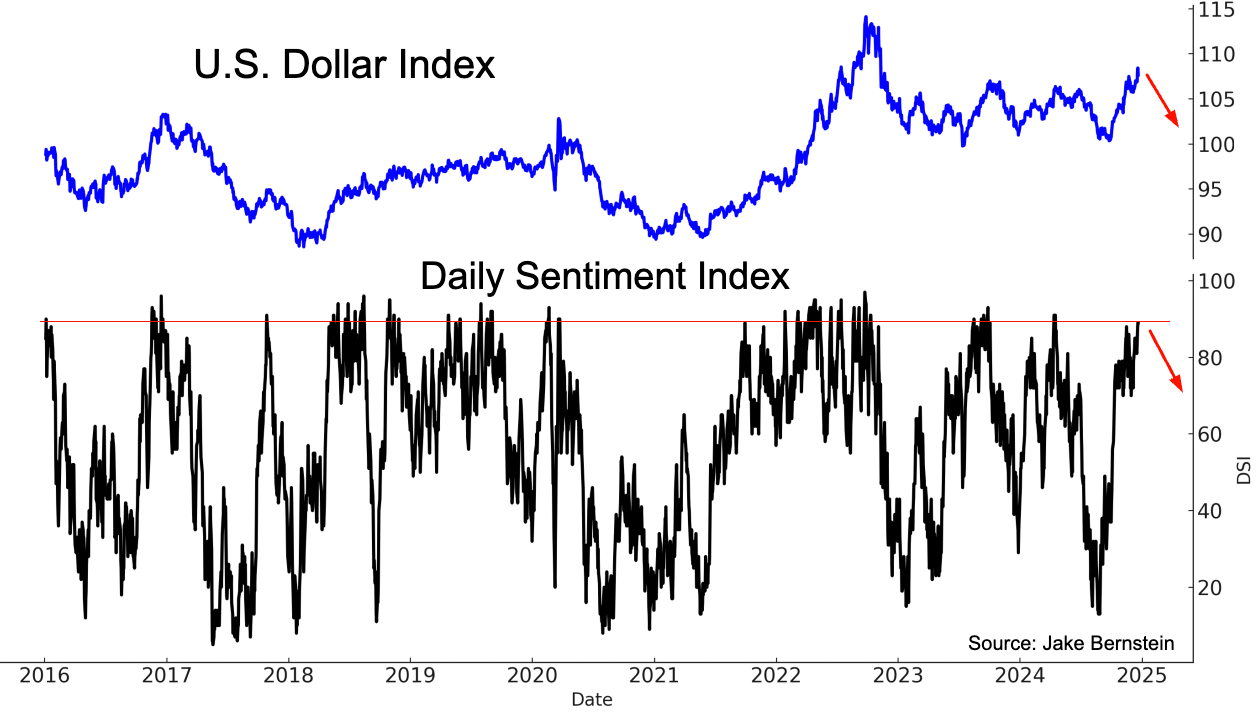

It’s worth noting that the recent spike in interest rates pushed the U.S. Dollar towards a 2 year high. The Dollar’s Daily Sentiment Index is now at 89, indicating levels of extreme optimism.

A reversal in the dollar will push bond yields lower and bond prices higher.

Overall I believe that bonds have the proper setup to create a multi-week/month rally. Beyond that, I do not have a strong 6-12 month outlook towards bonds.

China (non-core position)

Lastly I want to discuss China, which is my main black swan position for 2025. Again, not all black swans are negative black swans. Some are positive. Anything that is large and unexpected counts as a black swan.

The majority of investors and traders are long term bearish towards China right now, and rightfully so. China’s biggest problem is that it will lose this trade war vs. the U.S. and its allies. China, like most densely populated Asian countries, lacks resources. So to maintain a decent standard of living, Asian countries MUST export goods and services to nations that have a lot of resources (i.e. the West). If you’re an export-oriented economy (China) and your customers (the West) stop buying, you’re in deep trouble. It’s just that simple. All the other factors (debt, lack of structural reforms) are just noise.

With that being said, there is an under-priced possibility that Chinese stocks may spike in 2025. This has nothing to do with stimulus; China is running out of money, so it cannot fund a large stimulus package. Afterall, which government doesn’t want to spend money??.

The bull case for China in 2025 rests on a small but increasing probability of political change. Here’s an important piece of news, via Bloomberg:

On the surface it looks like President Xi is purging key Chinese military leaders. Nothing could be further from the truth.

China may be a one-party state, but there are always 2 factions within the party (left vs. right). The military leaders that Xi “purged” are from his faction; these were people that he handpicked and elevated into these positions.

Why would Xi “purge” HIS people, unless he wasn’t the one who purged them?

In reality, it is the opposition faction that purged Xi’s underlings, which implies a significant weakening of his power. More importantly, China’s military newspaper recently came out with a series of articles stating that “we should not allow 1 man to maintain absolute power - we should govern via a group”. China’s military newspaper is the mouthpiece of China’s military and any articles published need to be officially sanctioned before they’re allowed to be published.

In a dictatorship like China’s, this is important because whoever controls the military has the power. Xi’s stature in the military and CCP is noticeably weakening. If Xi is removed or publicly reduced in political stature, such political change is enough to generate a MASSIVE multi-month spike in Chinese equities. Everyone is fixated on the bear case for China. In times like this, it’s important to ask “what can go right??”

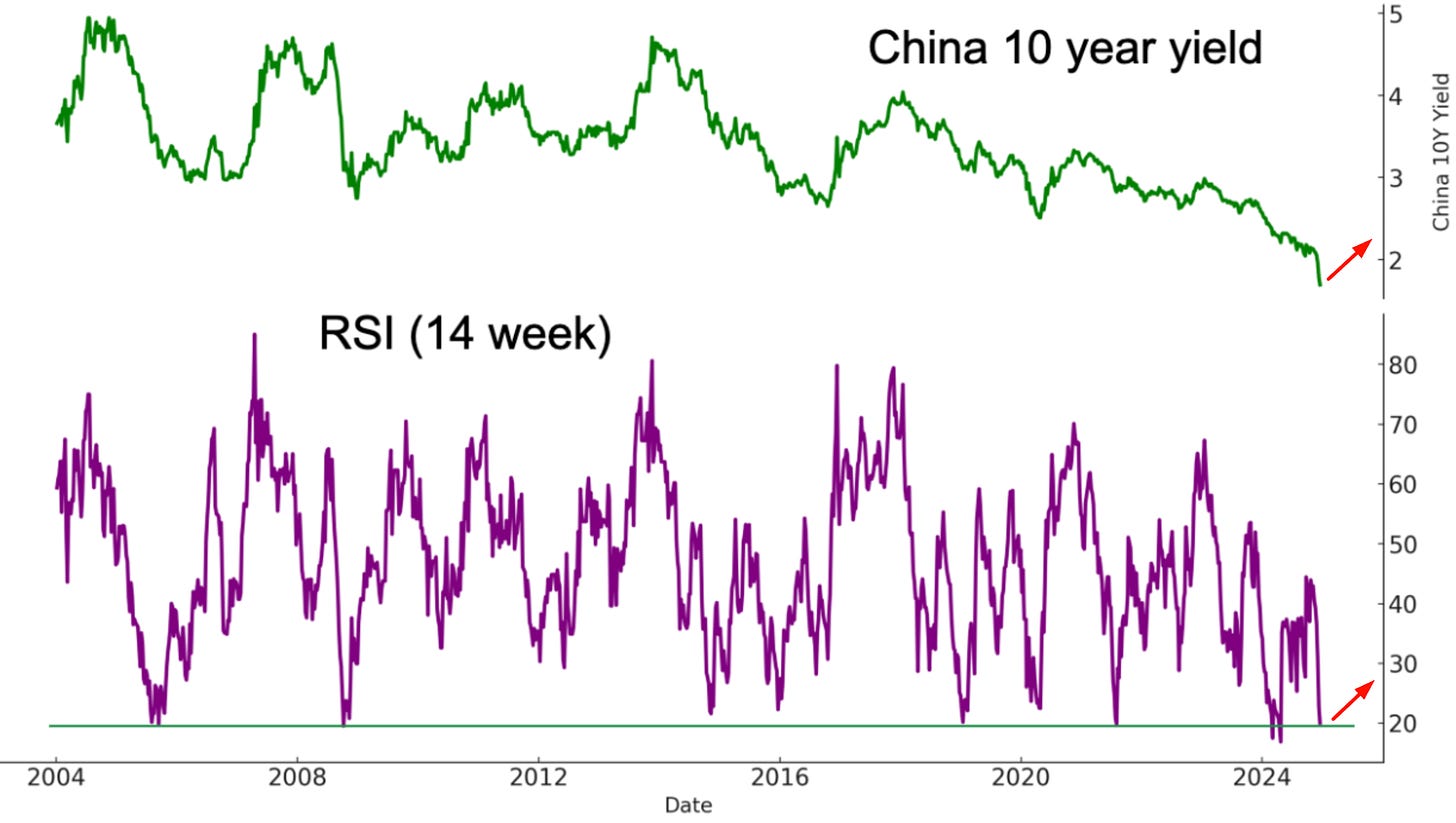

With that being said, I will also note the crash in China’s 10 year government bond yield. If this figure stabilizes, it will be a boost to Chinese stocks.

Again, I want to emphasis that I am not long term bullish on China and neither do I think that the above scenario even has a >50% probability of happening.

I think China’s growth story is over. But this does not mean that Chinese equities cannot make a multi-month rally.

I believe the market is significantly underpricing the scenario I mentioned, hence why this is worth a multi-month trade.

While I am long term bearish on China, I am extremely long term bullish on India and believe that the 21st century will be India’s Century (see my blog post here).

Conclusion

To recap:

My core position is still long U.S. equities. My position size is 70% less than normal due to a weakening of momentum + the lack of proper panic selling.

I have a medium-sized long position in Treasury bonds (TLT). This is a non-core position.

I have a small long Chinese equities position using call options. This is a non-core black swan type of trade. The market assumes that the probability of a large spike in Chinese stocks is extremely small. I still think the probability is small, but not as small as the market believes.

I’ll be posting my trades on X/Twitter in real-time, so please follow me there if you’re interested in seeing that.

Merry Christmas!

Great Post!! Tank you very much.

Hi there, thanks for sharing!

Those are great charts! How do you make them? Also.

"A reversal in the dollar will push bond yields lower and bond prices higher". Shouldn't it be the other way around? That the change in rates effects the dollar?

Many thanks!

Oleg