Markets Report: pushing higher into resistance

Markets around the world are pushing higher, with some now running into potential headwinds.

U.S. equities, international equities, and precious metals pushed higher this past week. However, some of these rallies are somewhat overextended and may be poised for a short-term pullback or consolidation.

Today’s Markets Report:

U.S. Equities: Made marginal new highs this week, Up trend still intact. Long-term concerns for 2025 remain.

Gold, Silver, and Miners: Powerful momentum, could pullback/consolidate. Strong bullish narrative/theme remains intact.

Chinese Equities: Powerful momentum, now at major resistance. Could pullback/consolidate.

Indian Equities: Positioned as a key beneficiary of the U.S.-China economic conflict.

Treasury Bonds: Attempting to rally with other markets, but clearly the weakest market of the group, especially while the U.S. Dollar is falling.

*All charts and data updated as of today.

U.S. Equities

The S&P 500 made marginal new highs this week, though it remains unclear whether this marks the beginning of a sustained rally or a continuation of range-bound trading. For now, the primary focus remains on the prevailing Up trend.

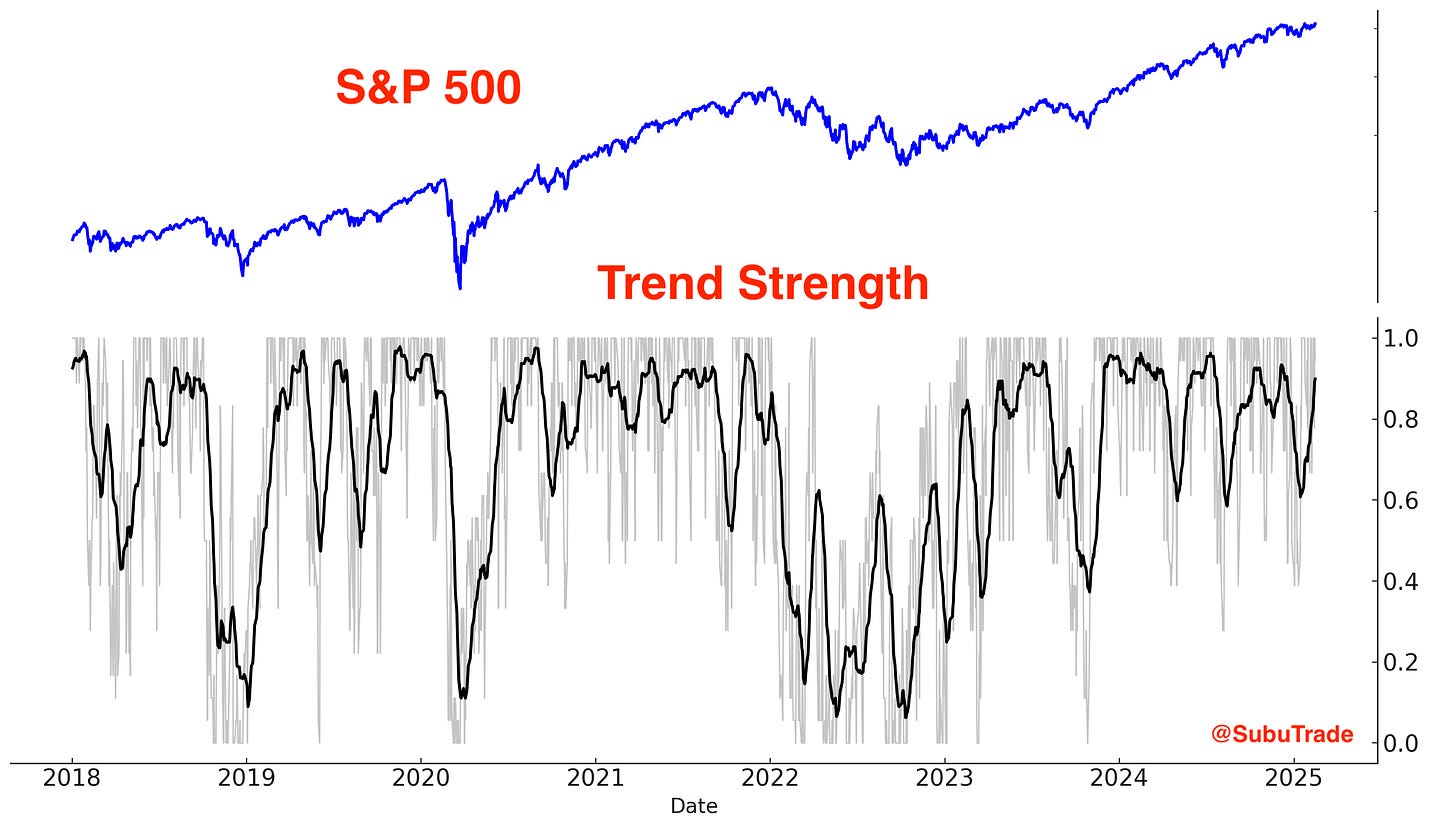

Trend:

The U.S. stock market remains in an Up Trend. The trend is your friend, until it ends:

Here’s the S&P 500’s average return when its Trend Strength breaks above 0.9 (e.g. now):

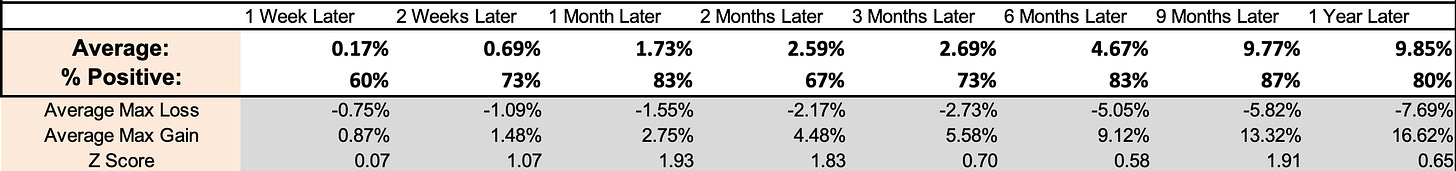

Options:

The S&P 500 Options Flow Index remains in neutral territory. This short term indicator demonstrates that neither bulls nor bears have a clear short term edge right now:

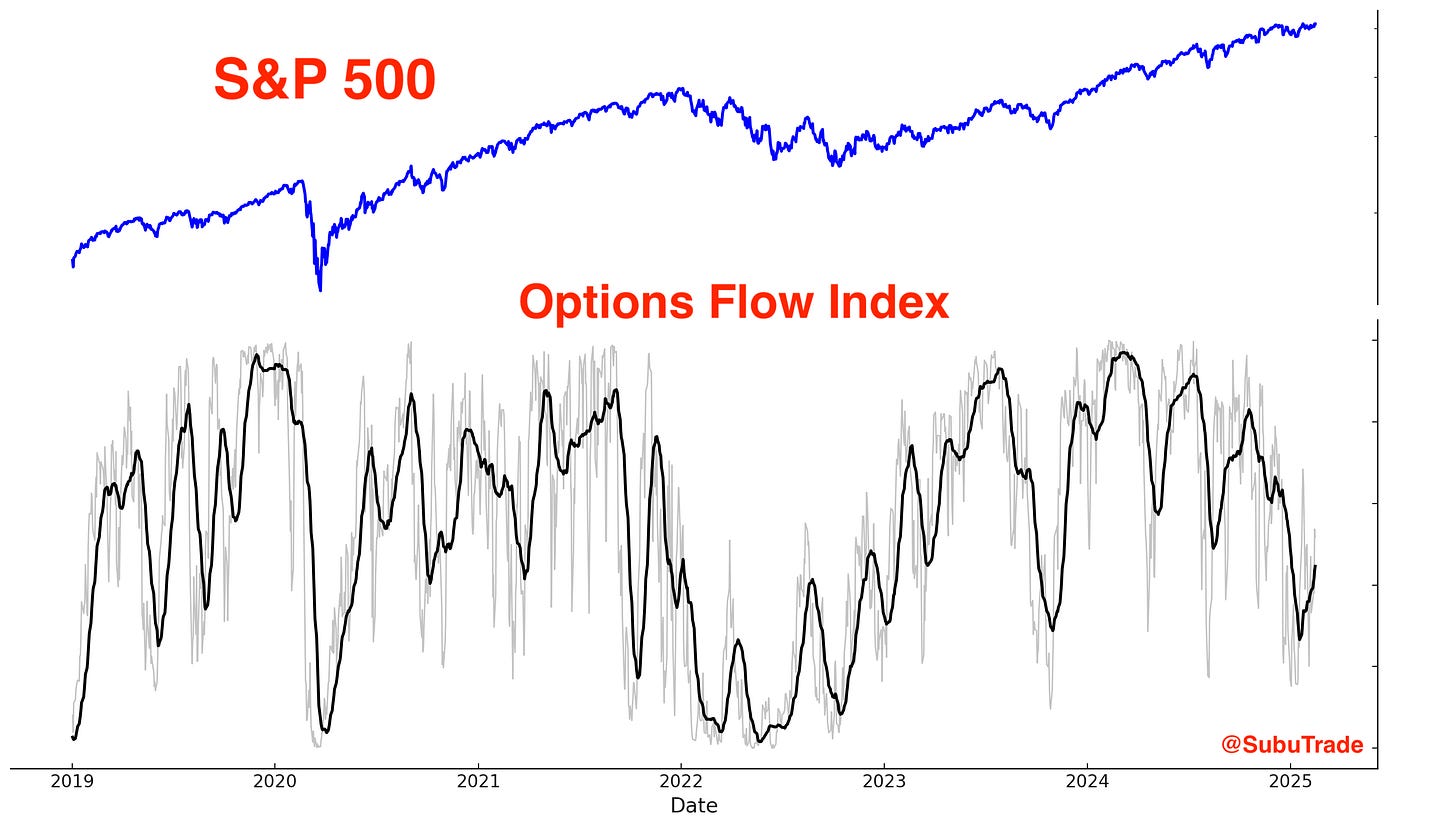

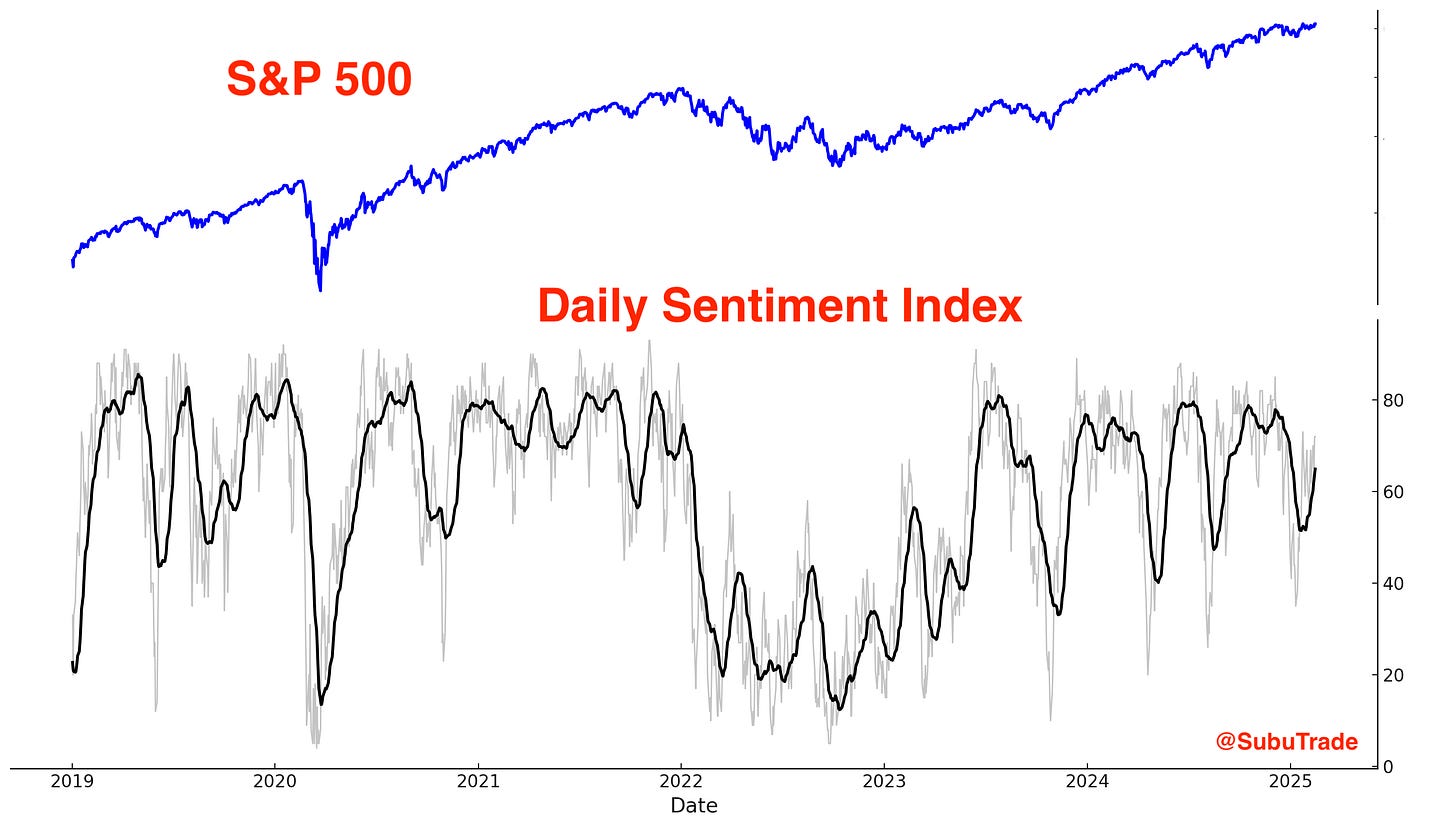

Sentiment:

Sentiment remains in neutral territory. This is to be expected considering that the S&P 500 merely made marginal new highs thusfar:

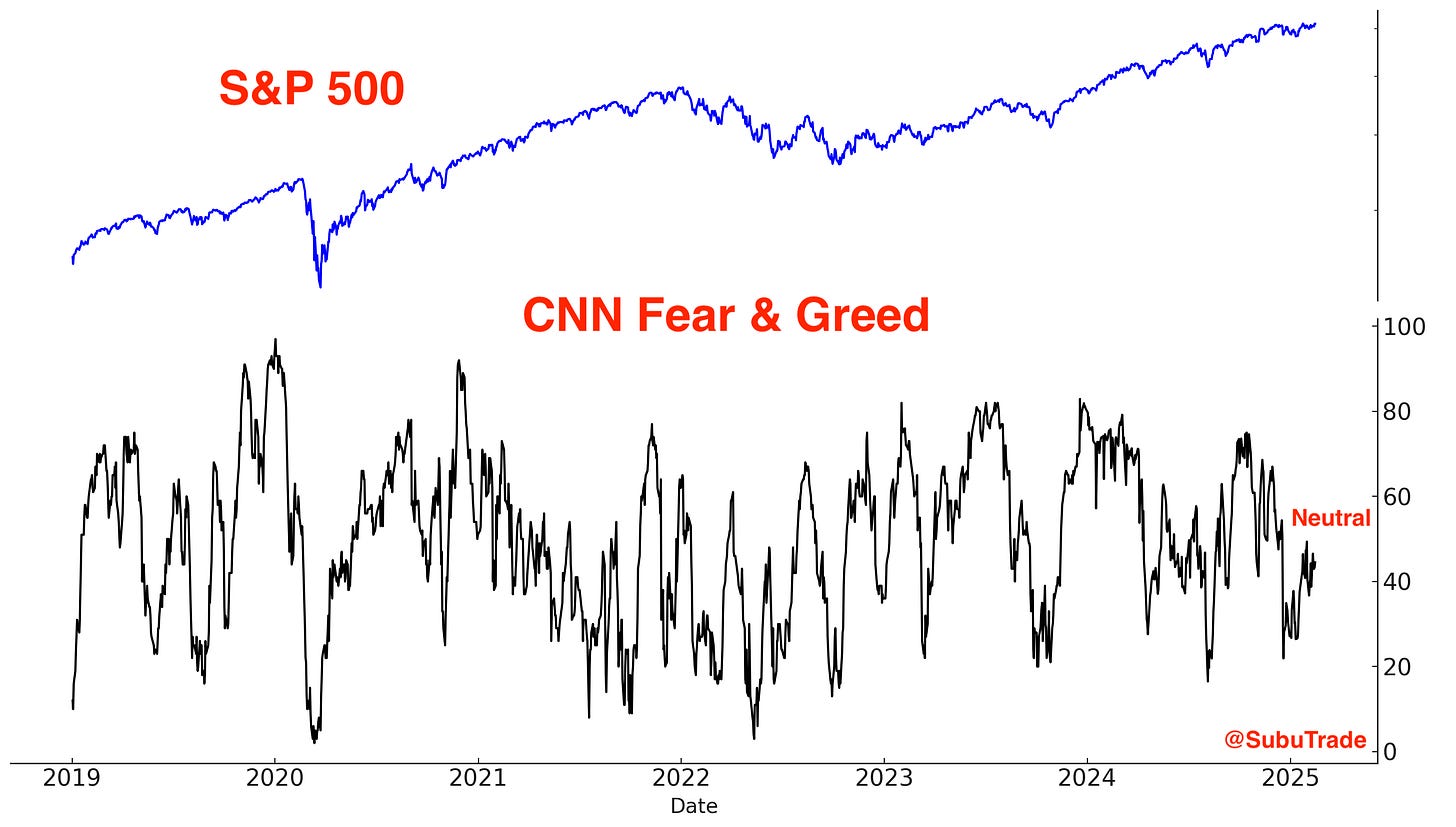

CNN Fear & Greed Index is also in neutral territory:

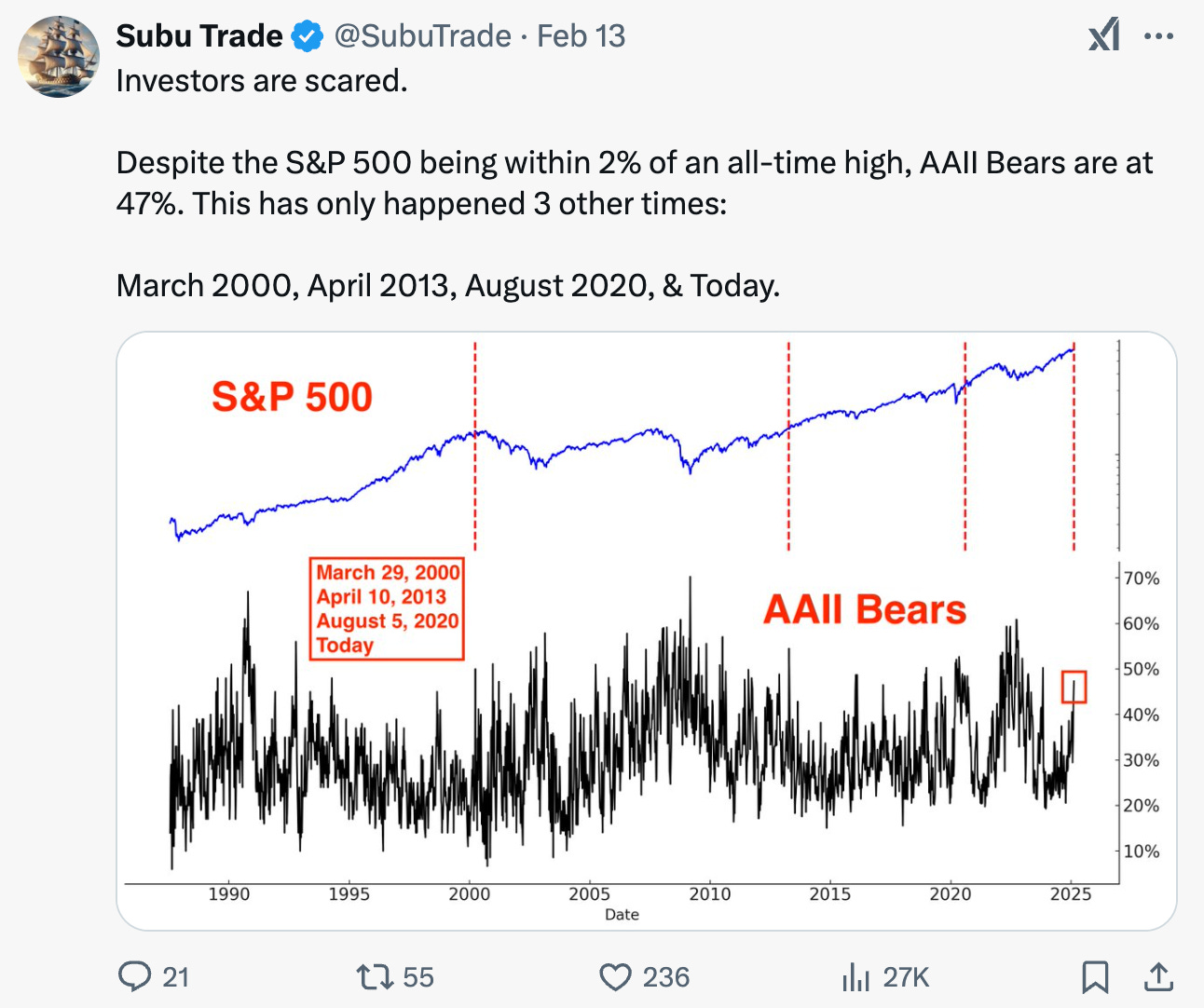

As I noted on Twitter/X: AAII bearish sentiment saw a notable increase this week—a rare occurrence with the S&P 500 near all-time highs. Historically, elevated bearish sentiment is more common when the S&P is trading at significantly lower levels.

This happened once at the very top of a bull market (March 2000) and twice in the middle of a massive rally (after a period of high volatility). While not inherently bullish or bearish, it reflects heightened investor anxiety, with market participants poised to exit at the first sign of trouble.

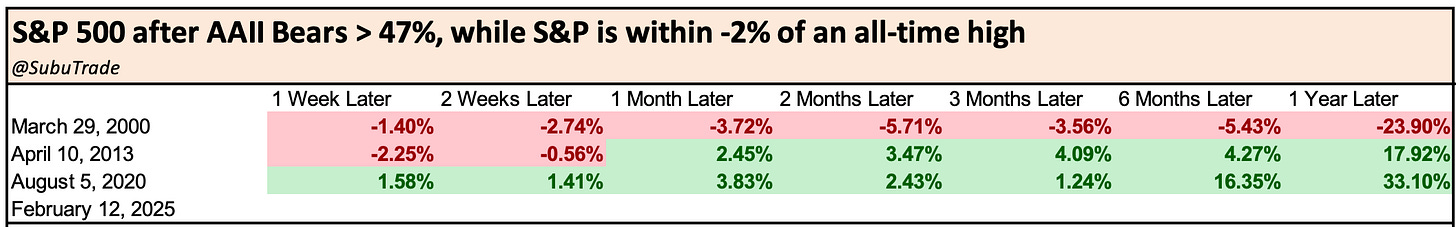

The Investors Intelligence survey illustrates a similar level of investor anxiety:

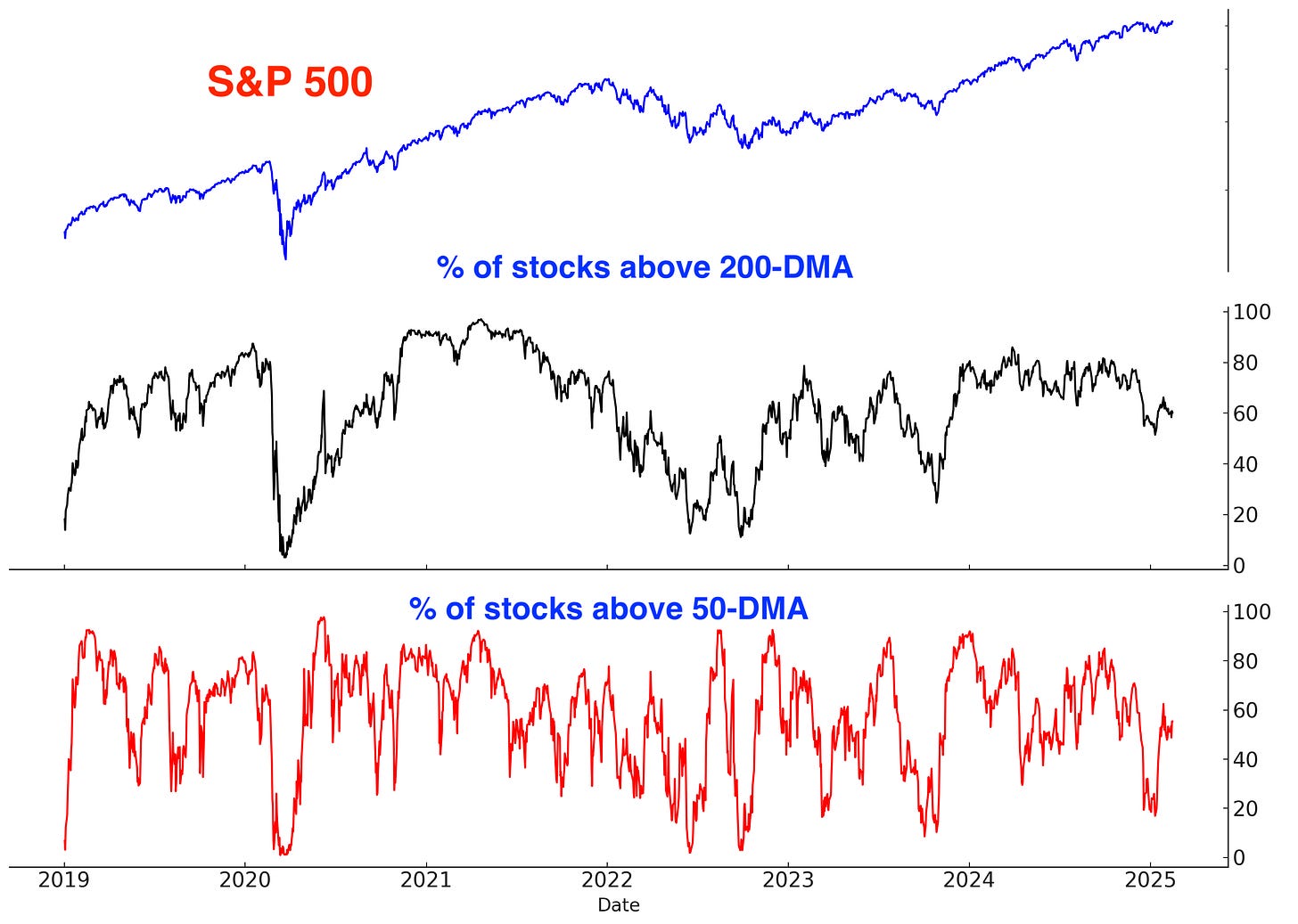

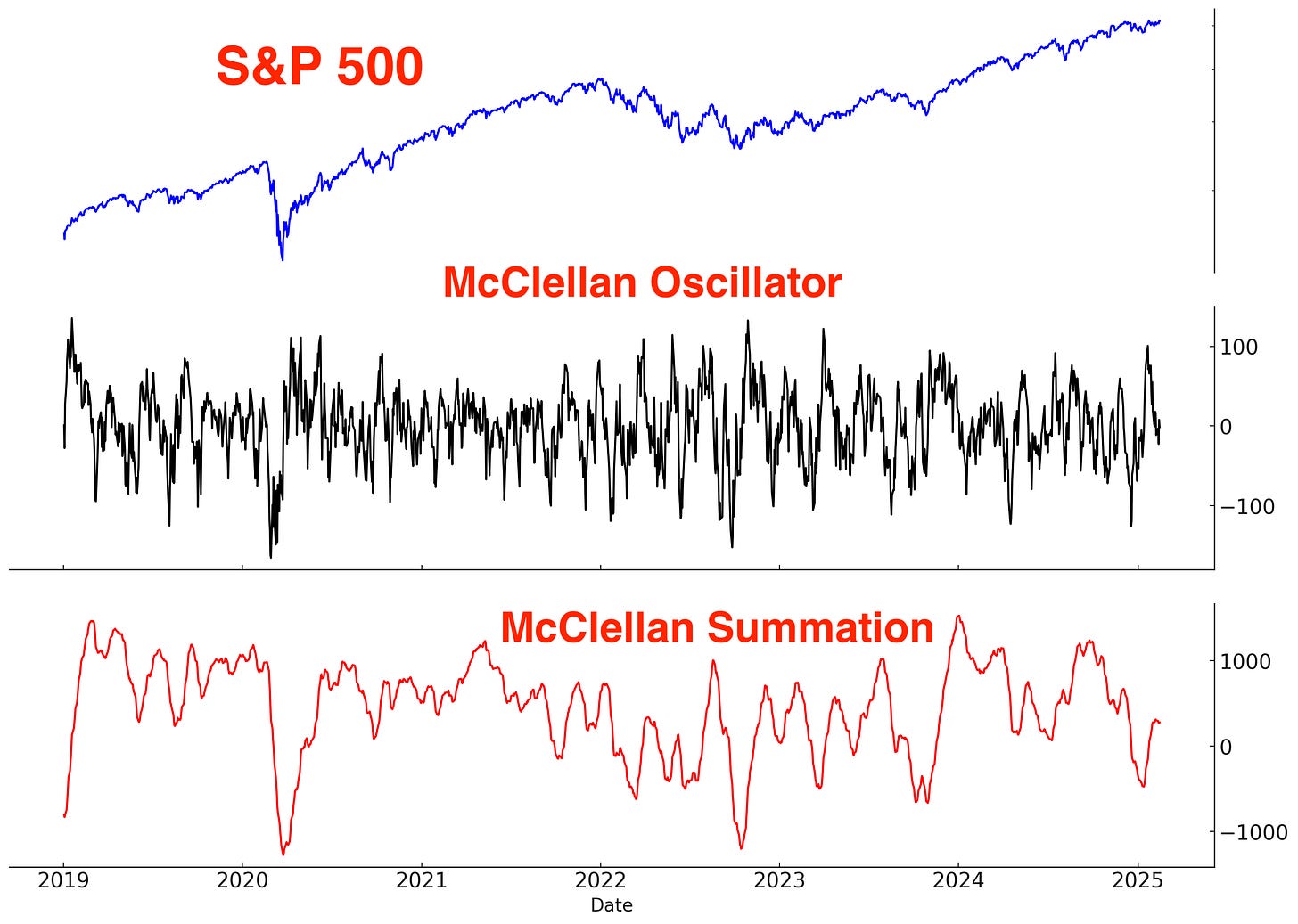

Breadth:

Breadth is neutral. Here’s the % of S&P 500 stocks above their 200 and 50 day moving averages:

Here’s the S&P 500 McClellan Oscillator and McClellan Summation Index:

Longer term concerns:

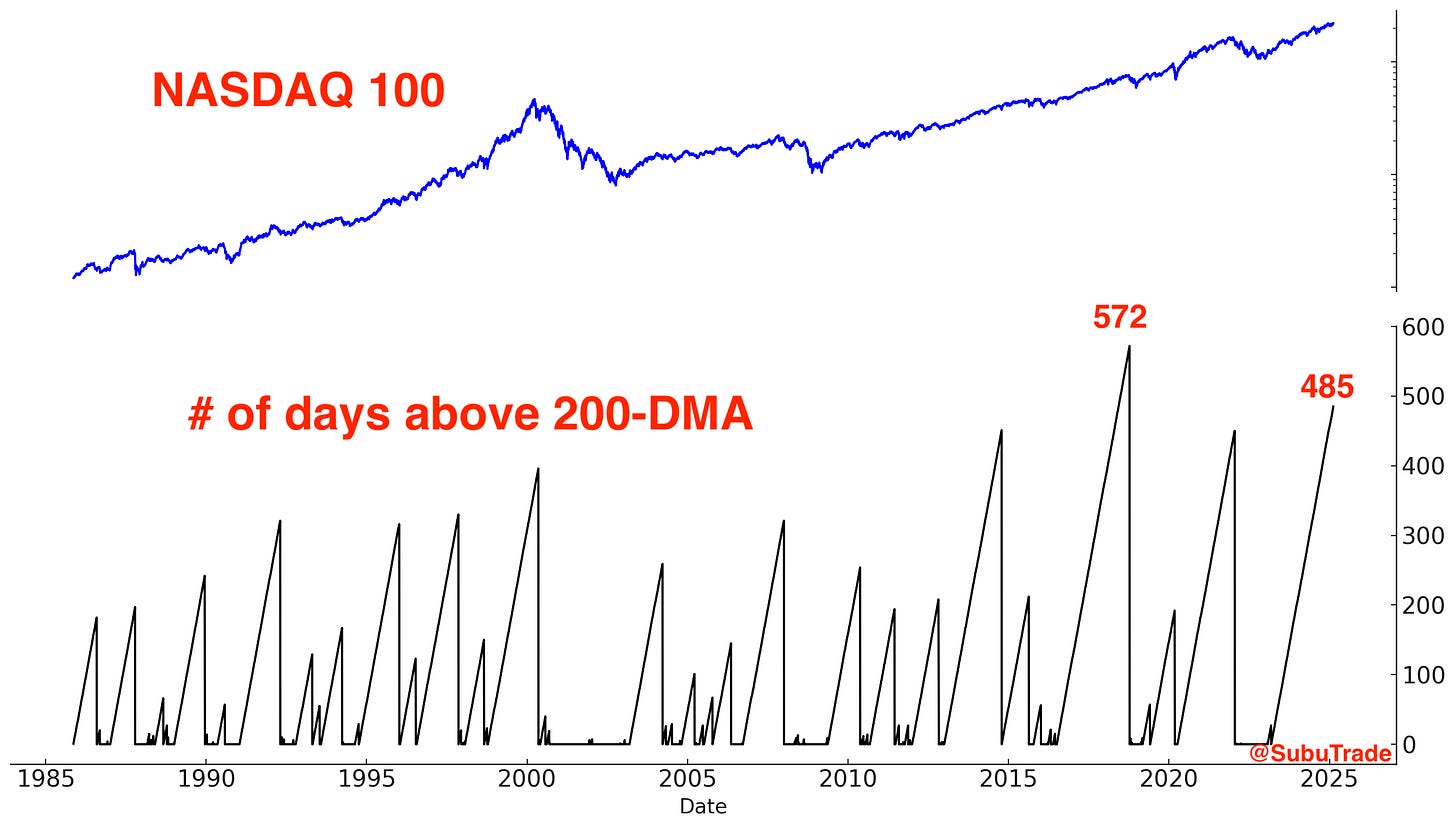

Long term concerns remain. The S&P 500 and NASDAQ 100 are in very long Up trends. The trend is your friend until it ends:

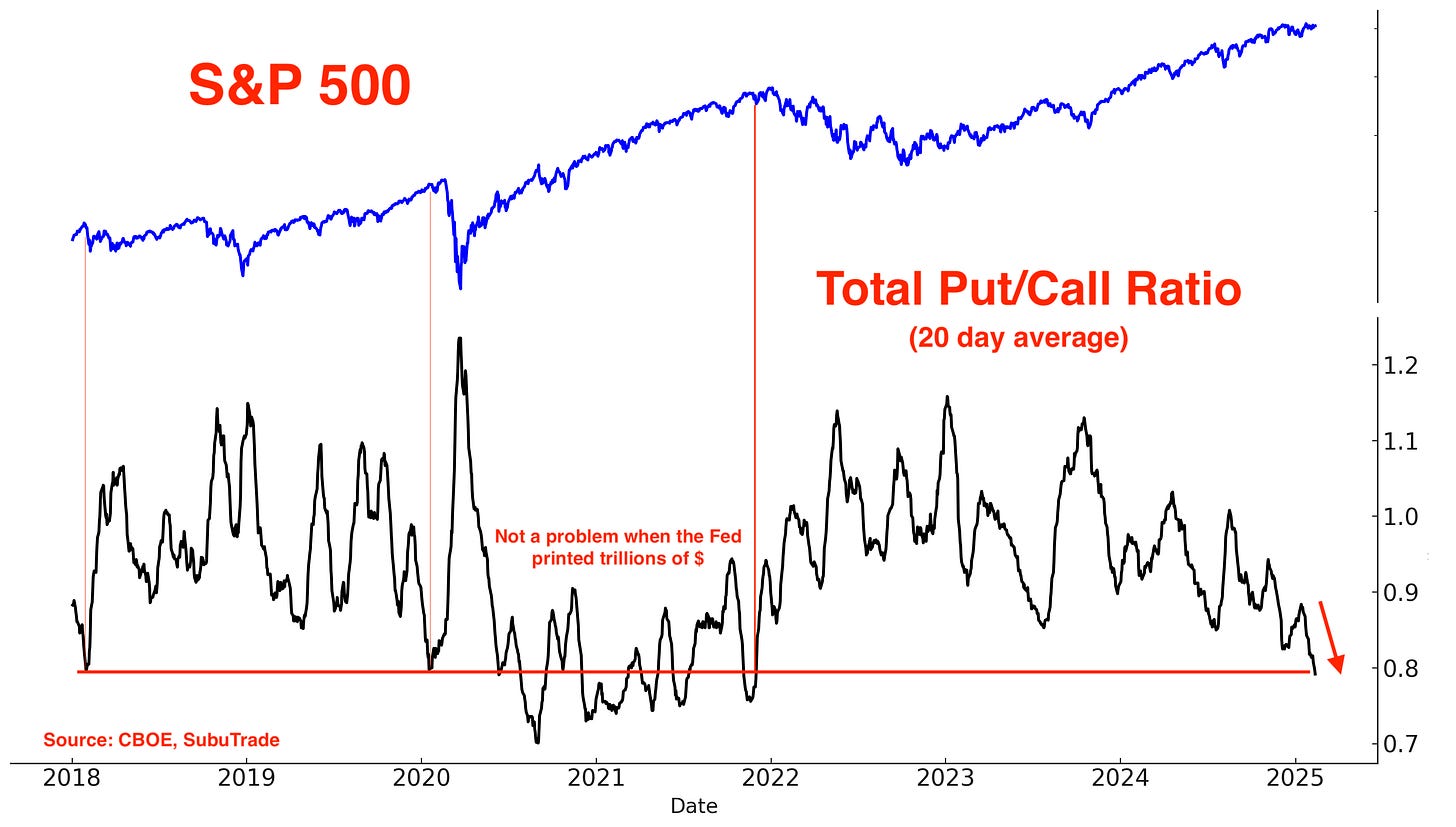

The CBOE’s Total Put/Call Ratio is still very low. This is a long term concern, although it did not matter in the 2020-2021 bull market when central banks printed trillions of dollars (does not apply today):

The SKEW Index, which essentially measures the probability of a stock market crash, is still extremely elevated:

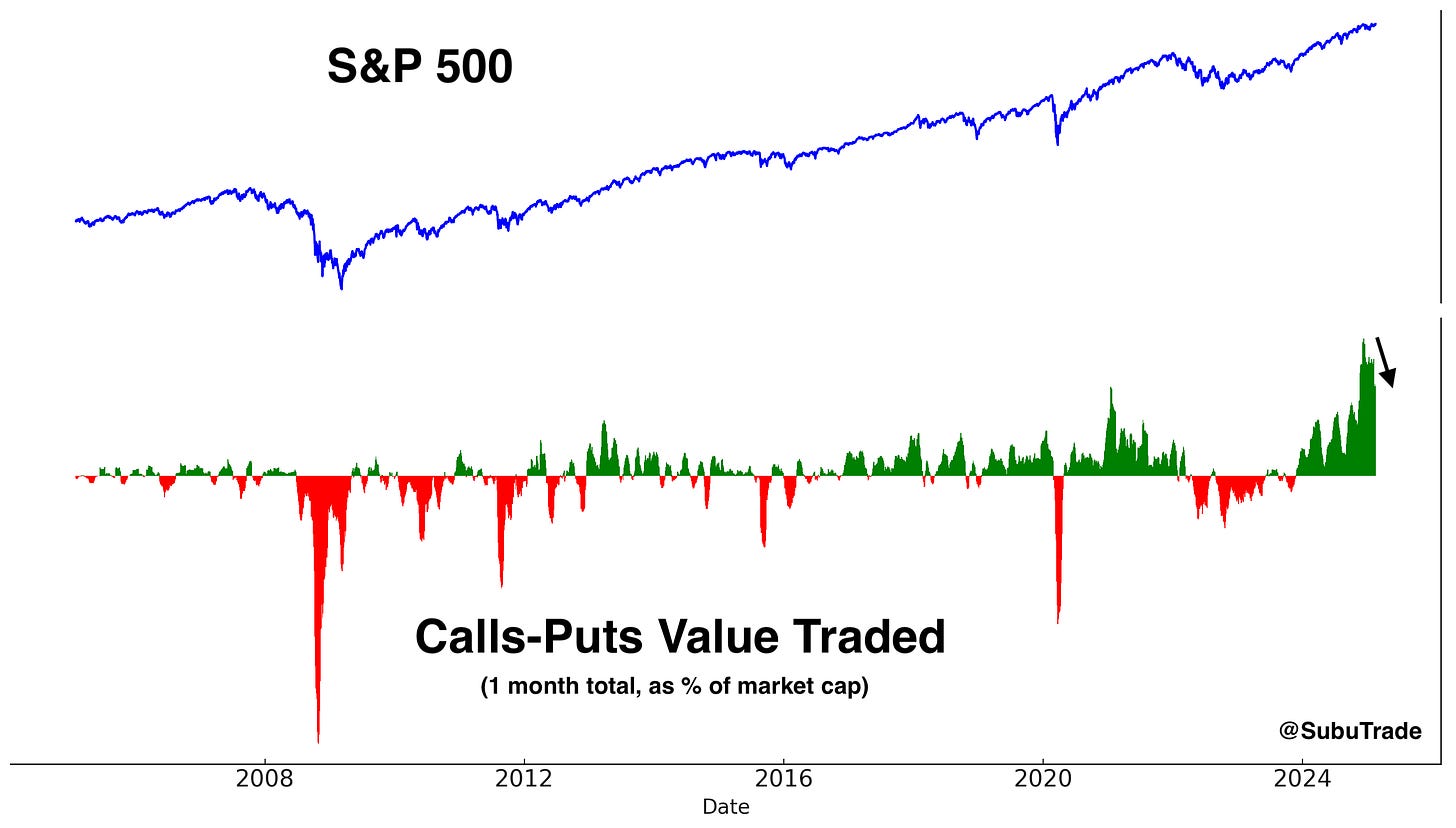

The value of Calls-Puts traded for the S&P 500 is still very high, but is slowly coming down:

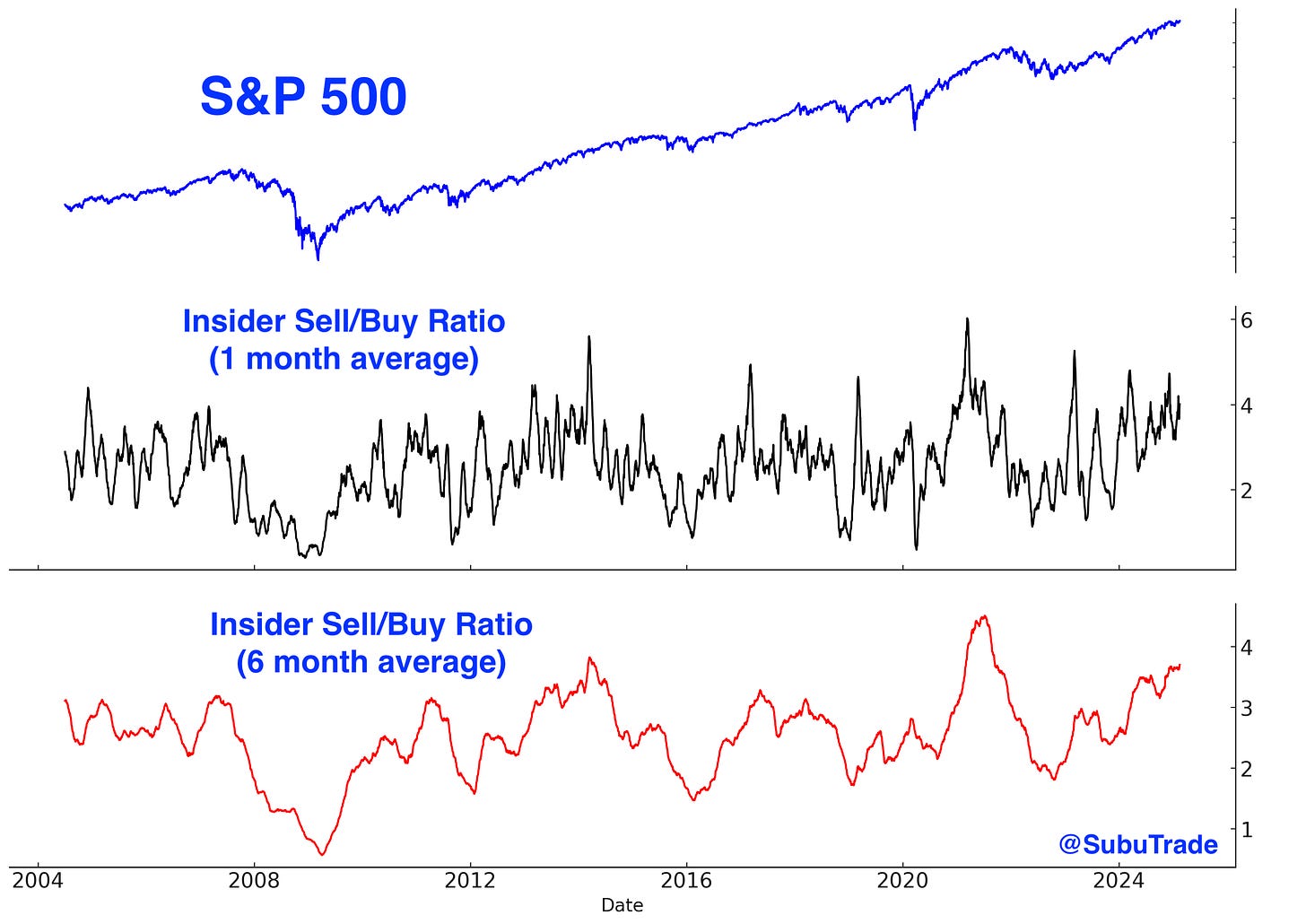

Corporate Insiders continue to use record-high prices as opportunities to sell stocks:

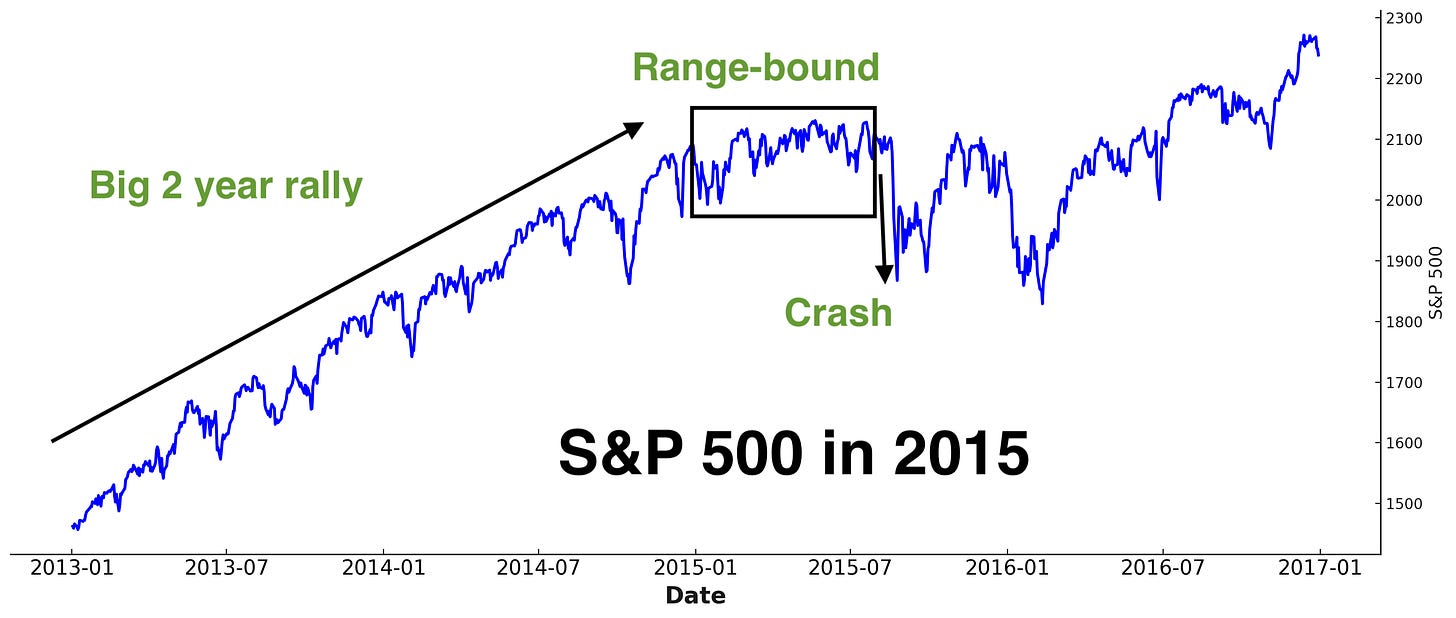

For now, the S&P 500 continues to mirror its 2015 pattern, characterized by sideways movements and marginal new highs.

With equities consolidating in recent weeks, I’ve been primarily focused on opportunities elsewhere: China, precious metals, and bonds. The recent rally in these markets could be running into headwinds.

Gold and silver

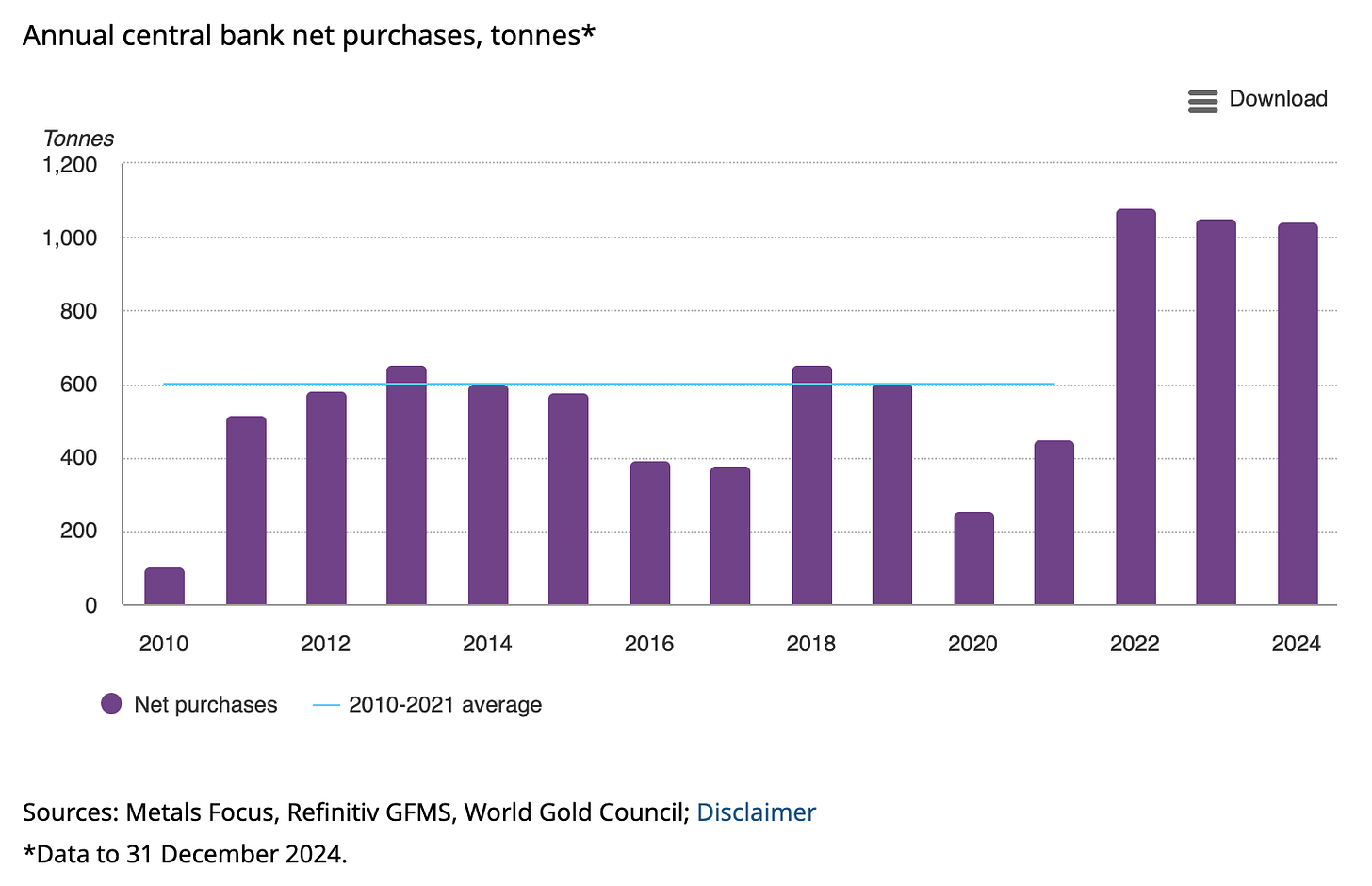

Last week I laid out the bullish narrative/theme for gold’s rally: global central banks are buying gold because they fear holding U.S. Treasuries that could be confiscated in the middle of a geo-political conflict (e.g. U.S.-China economic war):

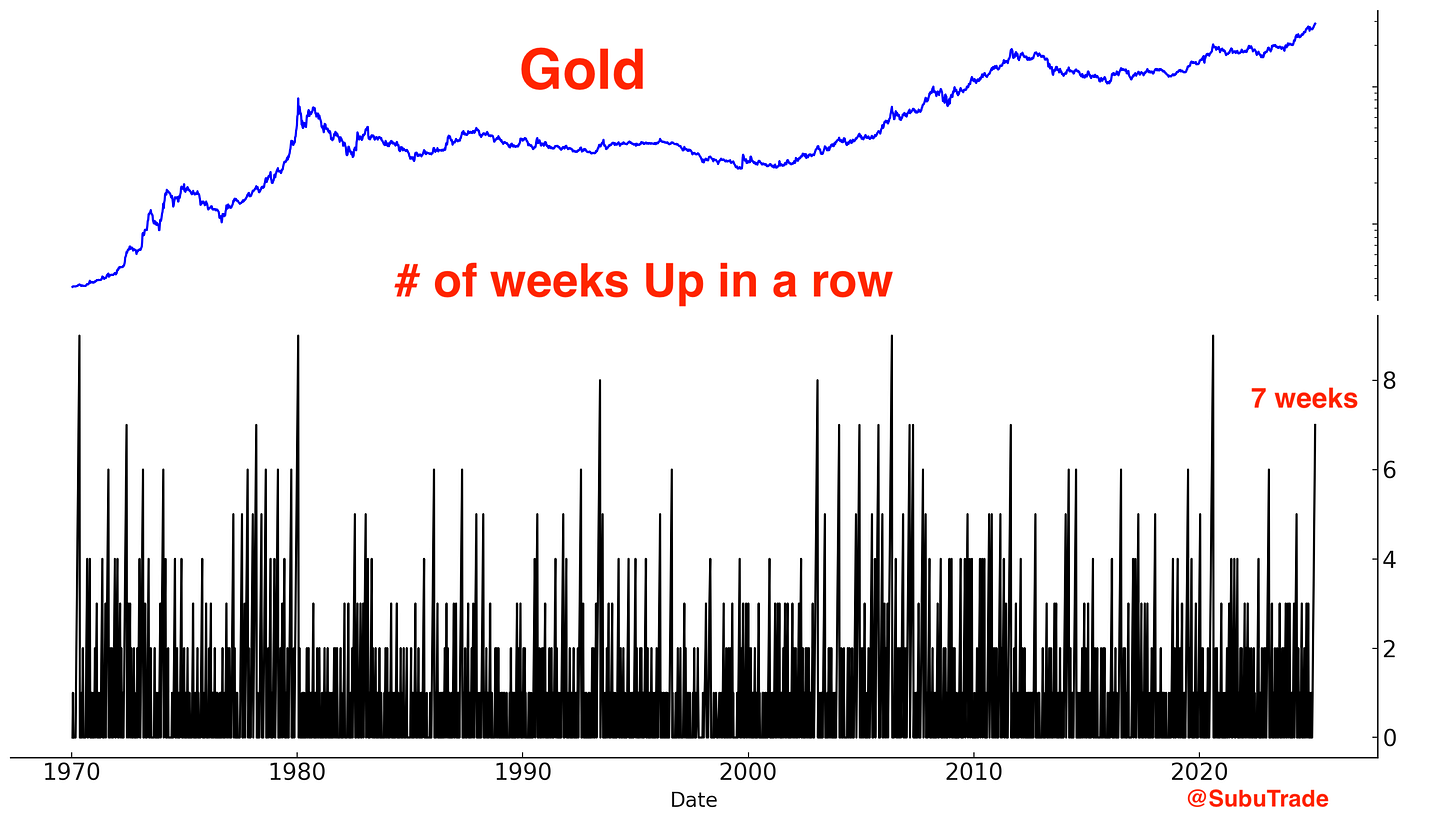

Gold has now rallied 7 weeks in a row:

This was a short term bearish concern even during gold’s bull market in the 2000s:

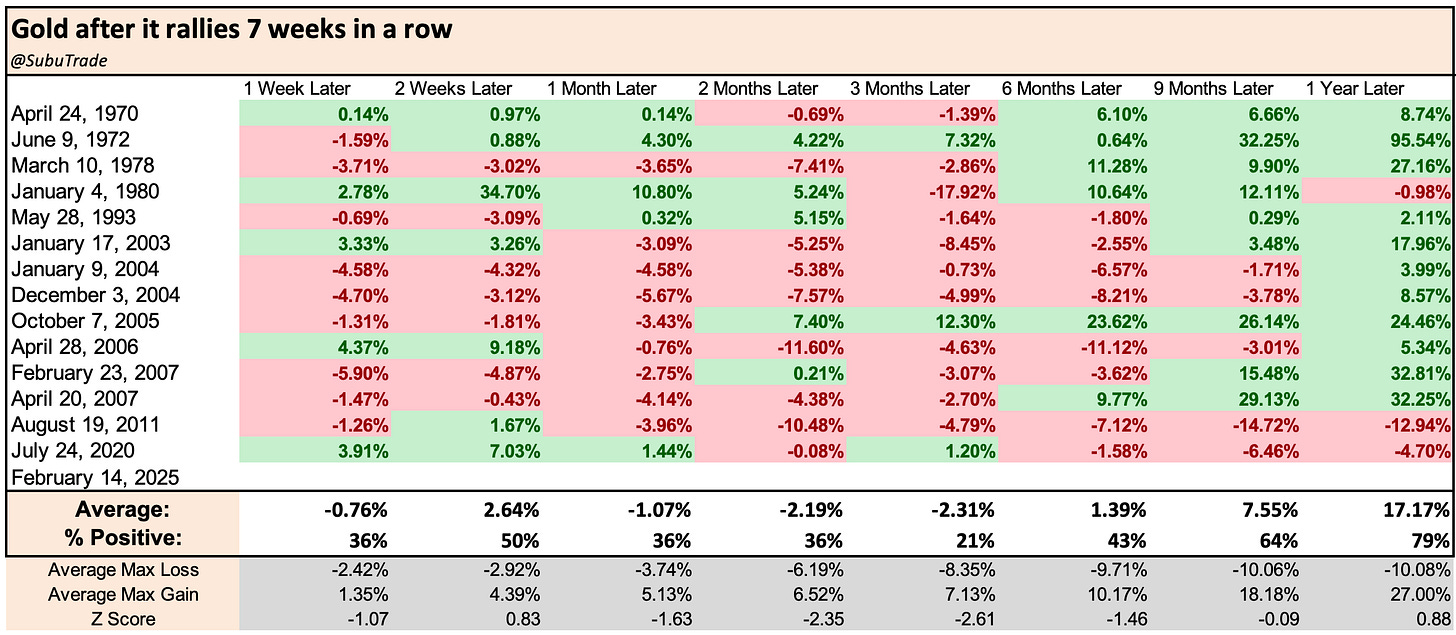

The GLD Options Flow Index also spiked. While this is a hallmark of bull markets, it is a short term concern.

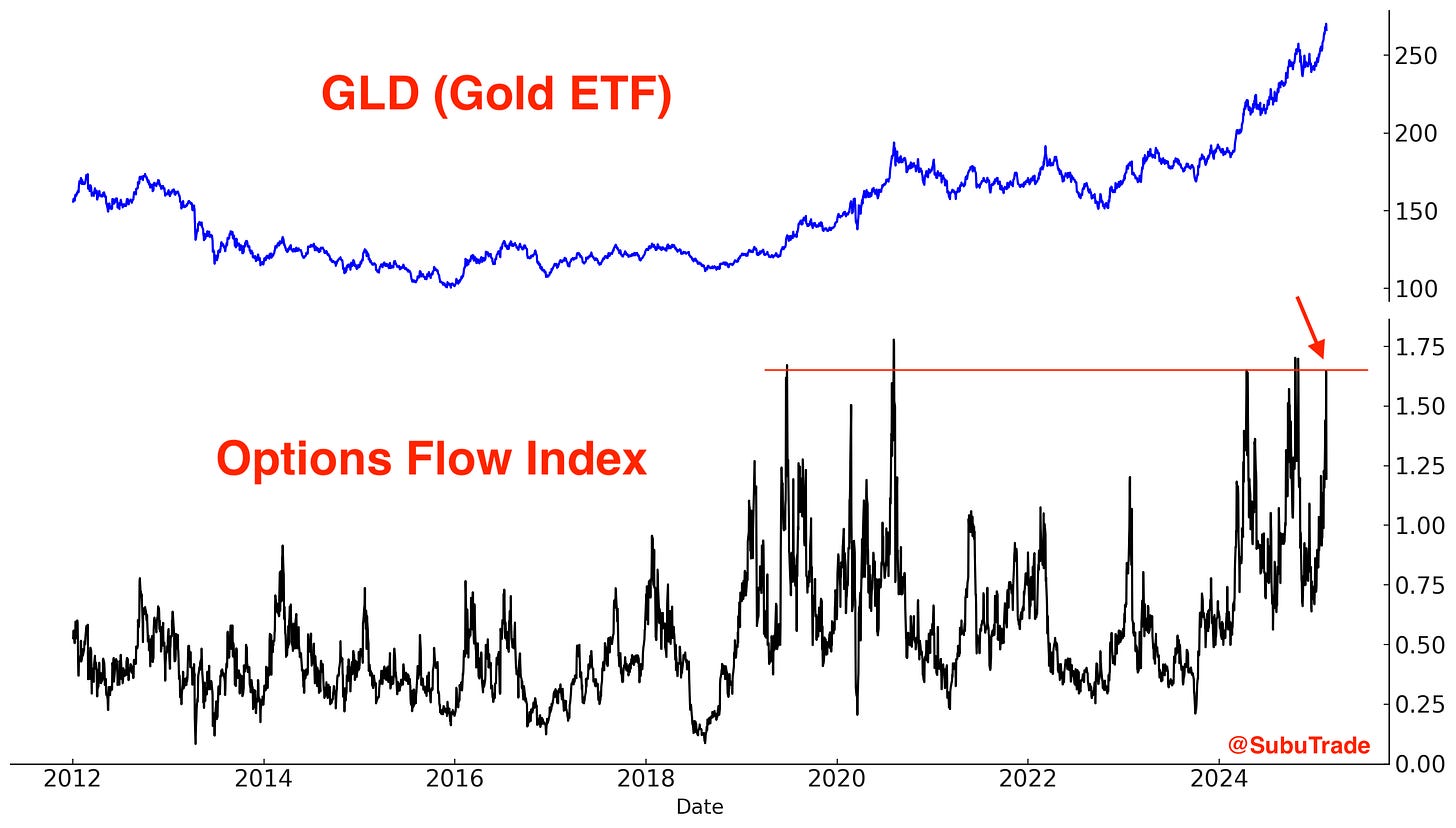

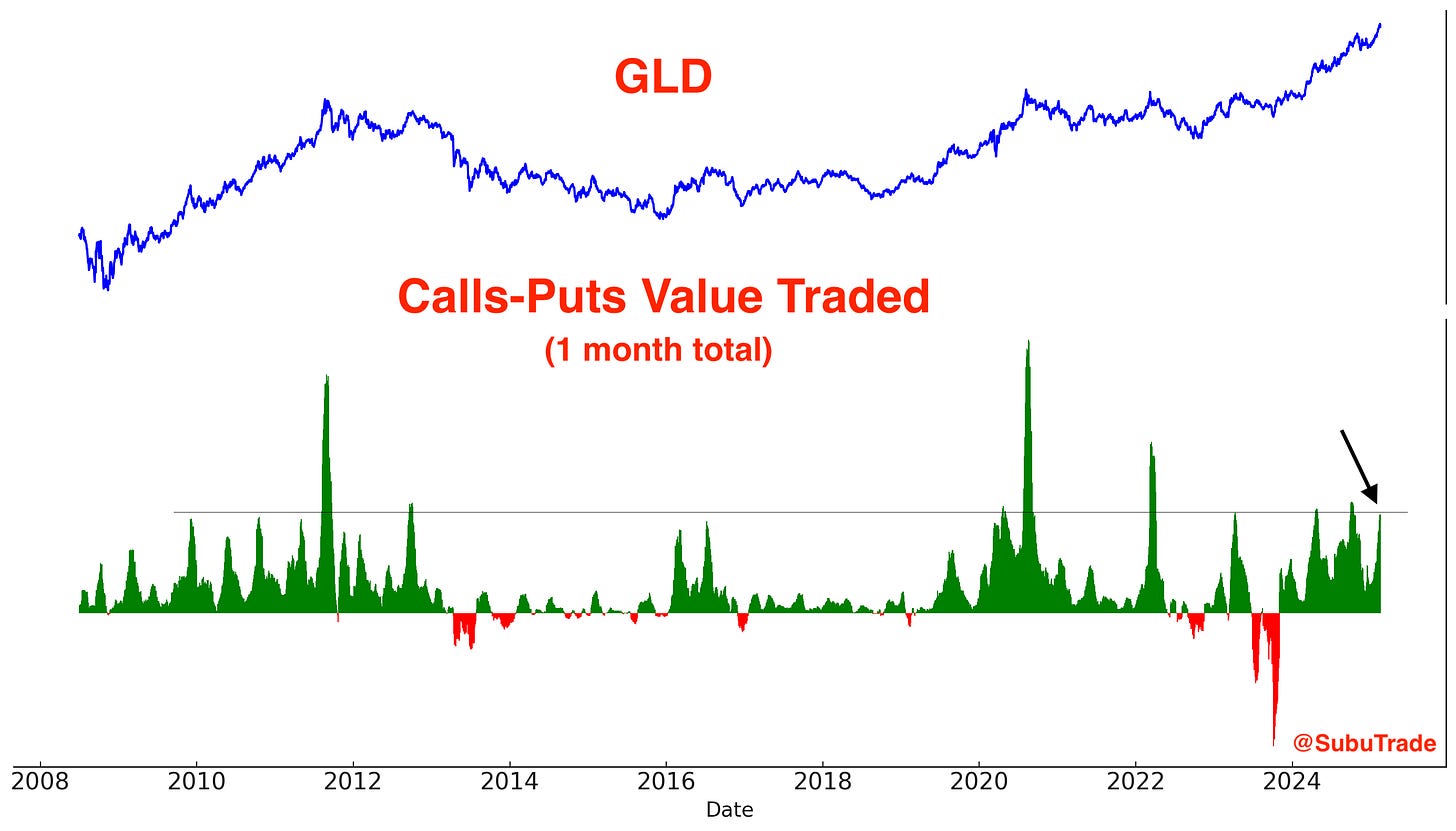

Similarly, the $ value of GLD Calls-Puts traded has spiked. This is a short term concern for gold bulls:

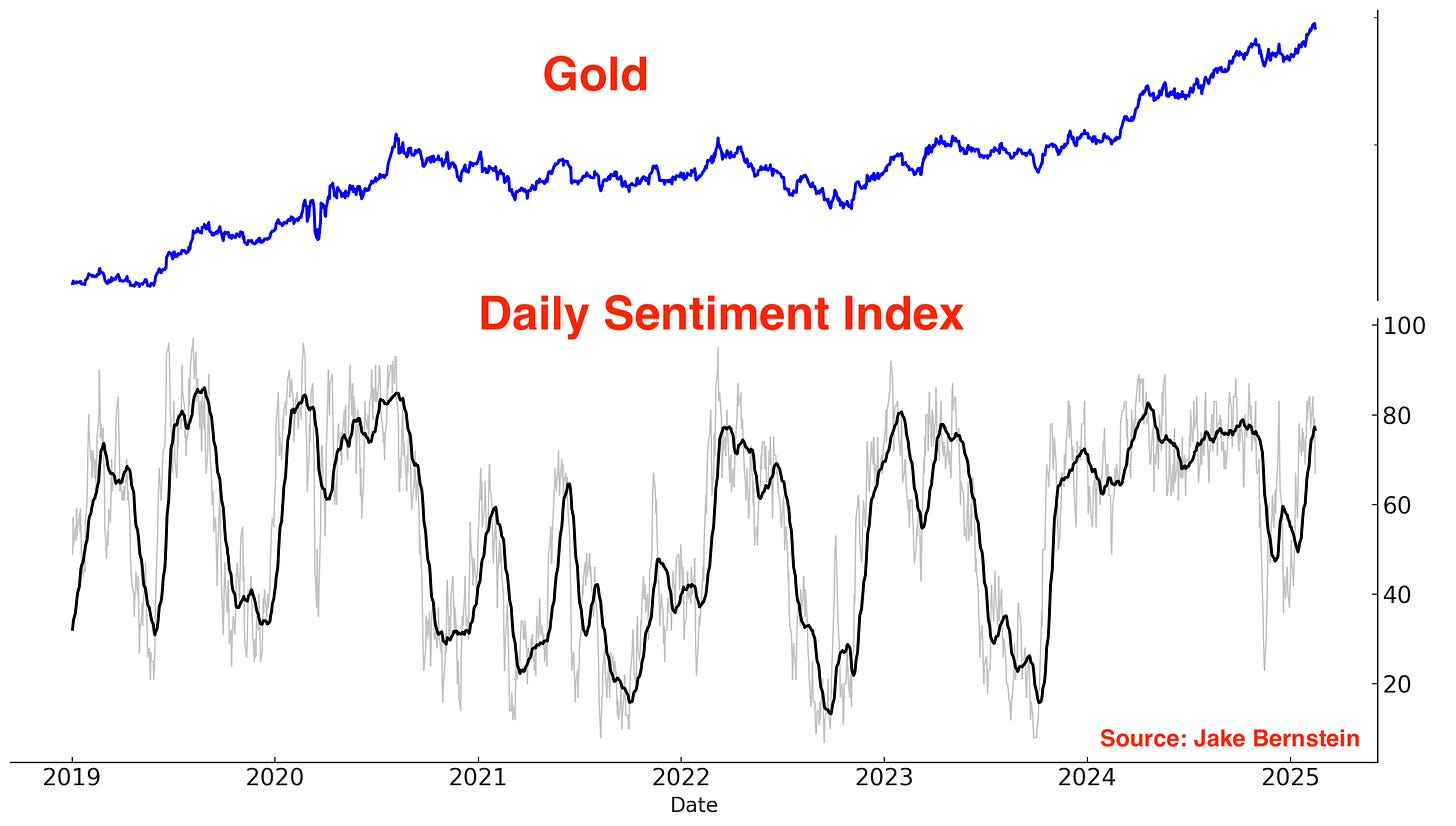

Gold’s Daily Sentiment Index is also quite high:

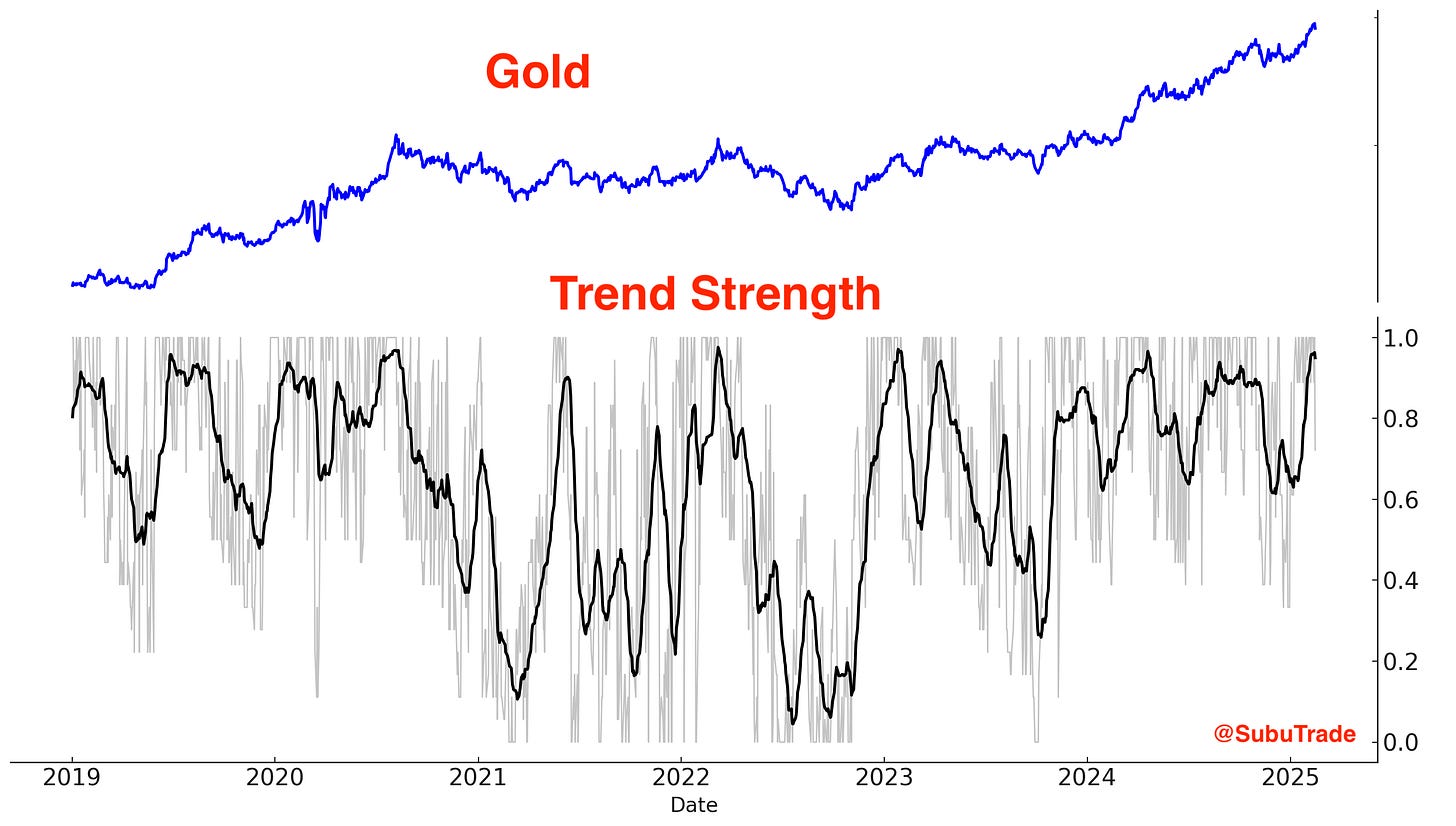

Gold’s trend strength is very strong — one could argue TOO strong, which could lead to a pullback/consolidation:

Gold and silver may see a pullback/consolidation before resuming their upward trends. Meanwhile, SLV’s short interest surged to an all-time high. Following this consolidation phase, silver could outperform in the next leg of the precious metals rally, as it has lagged behind gold thus far.

China & India

China

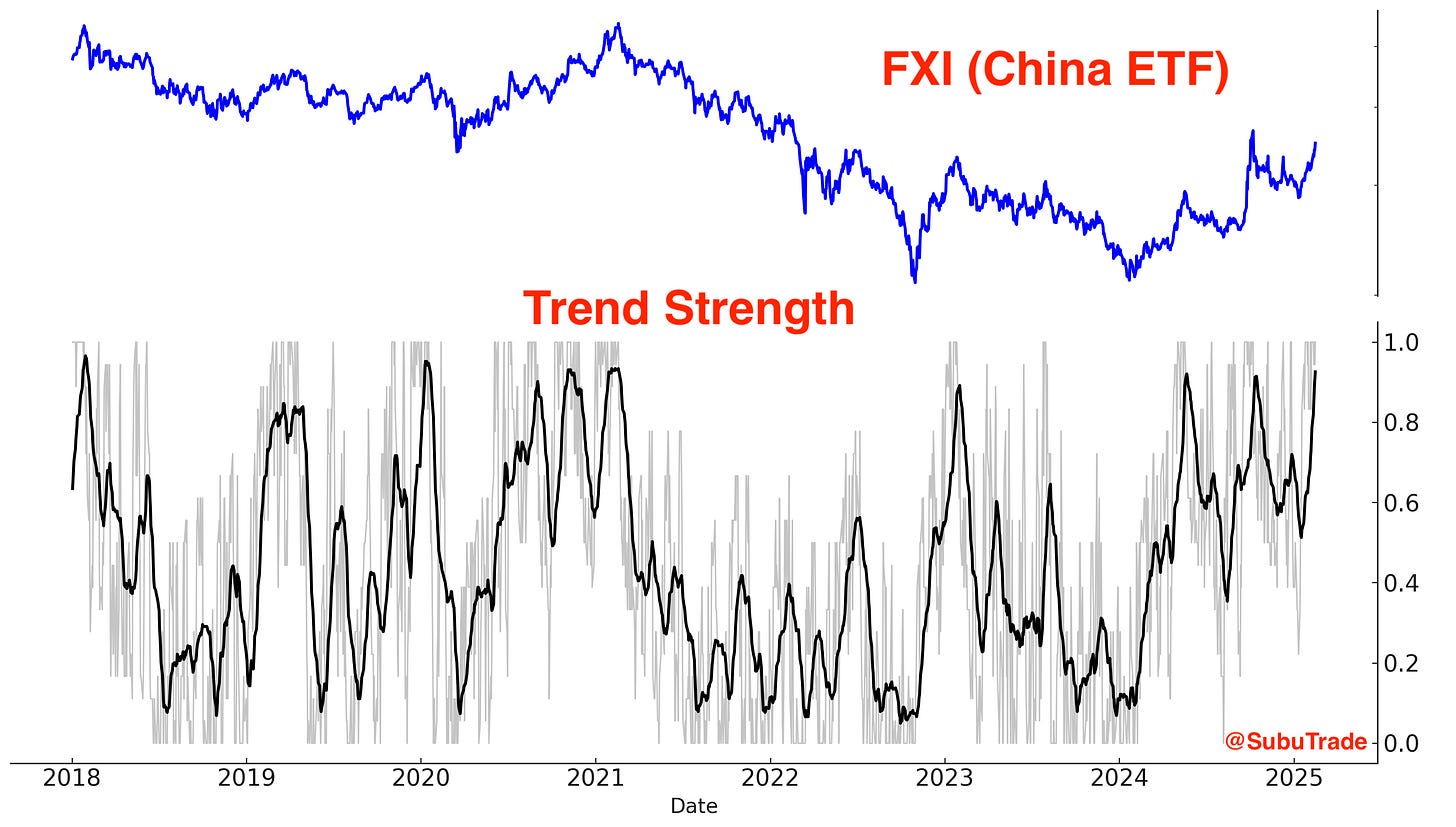

Chinese stocks rallied this week. Its Up trend is strong — one could argue TOO strong:

Chinese equities are now at major resistance. Short interest in China spiked to an all-time high. The last time this happened was at the top for Chinese stocks last October. Will bears be right again, or can bulls push Chinese equities above this multi-year resistance and squeeze the bears?

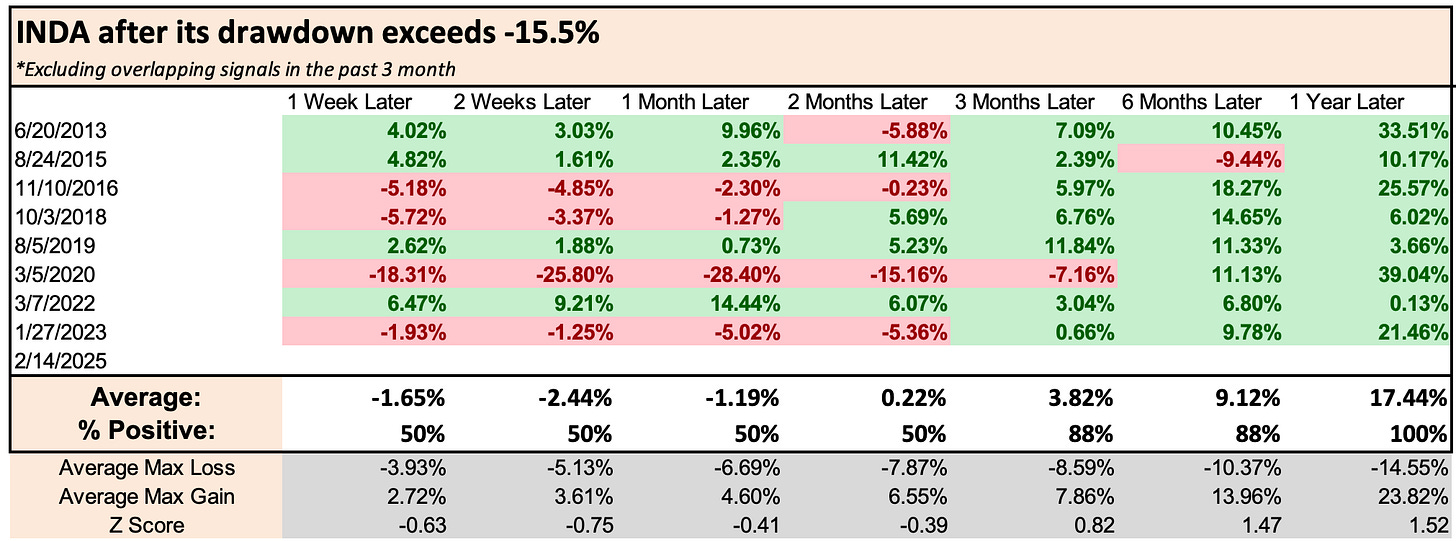

India

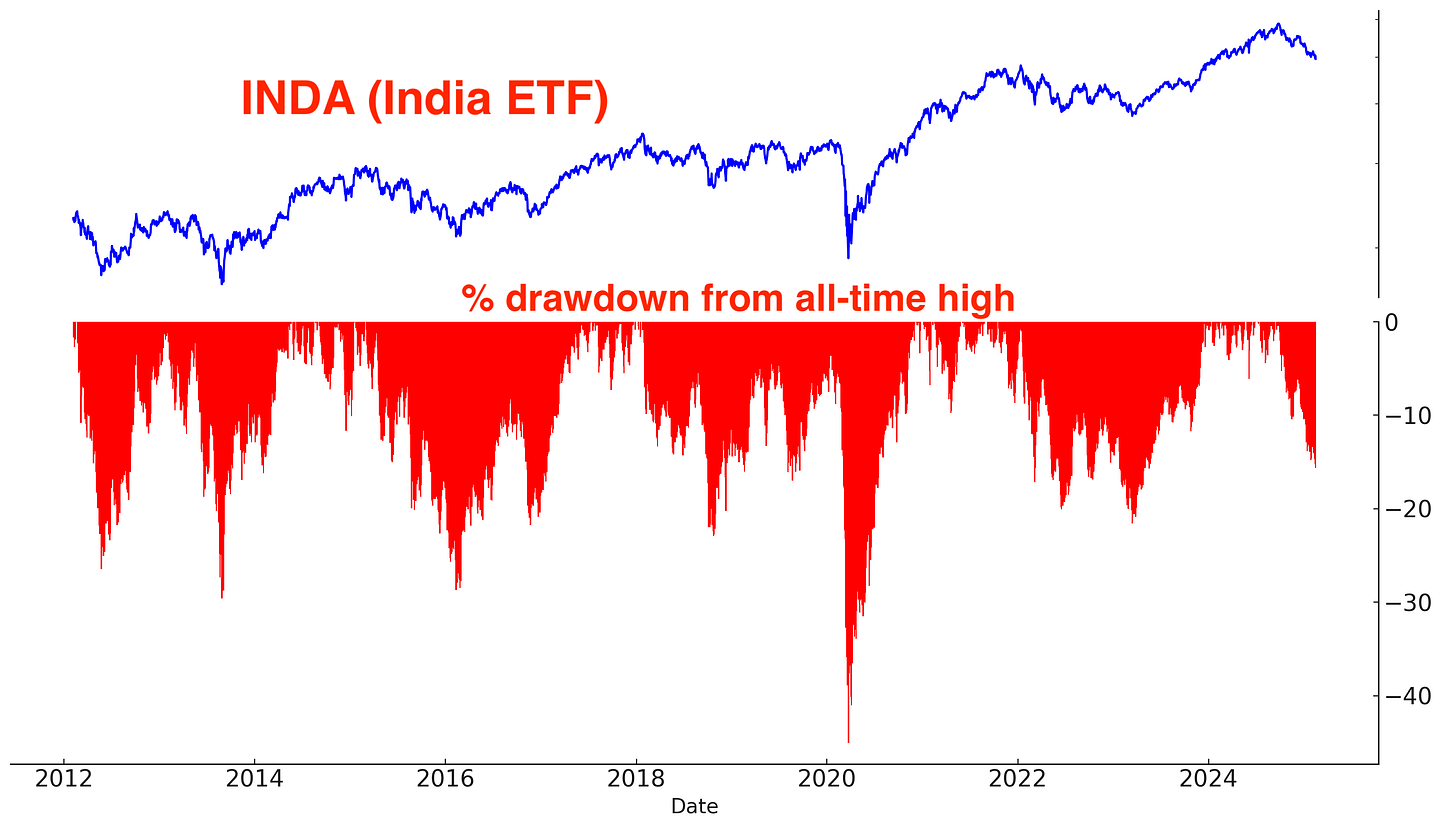

Despite being the world’s fastest growing major economy, India’s stock market is the mirror image to China’s stock market:

When things got this bad for Indian equities, it was a good time to buy for investors with a longer term horizon:

Remember: India is the main beneficiary of the U.S.-China economic war.

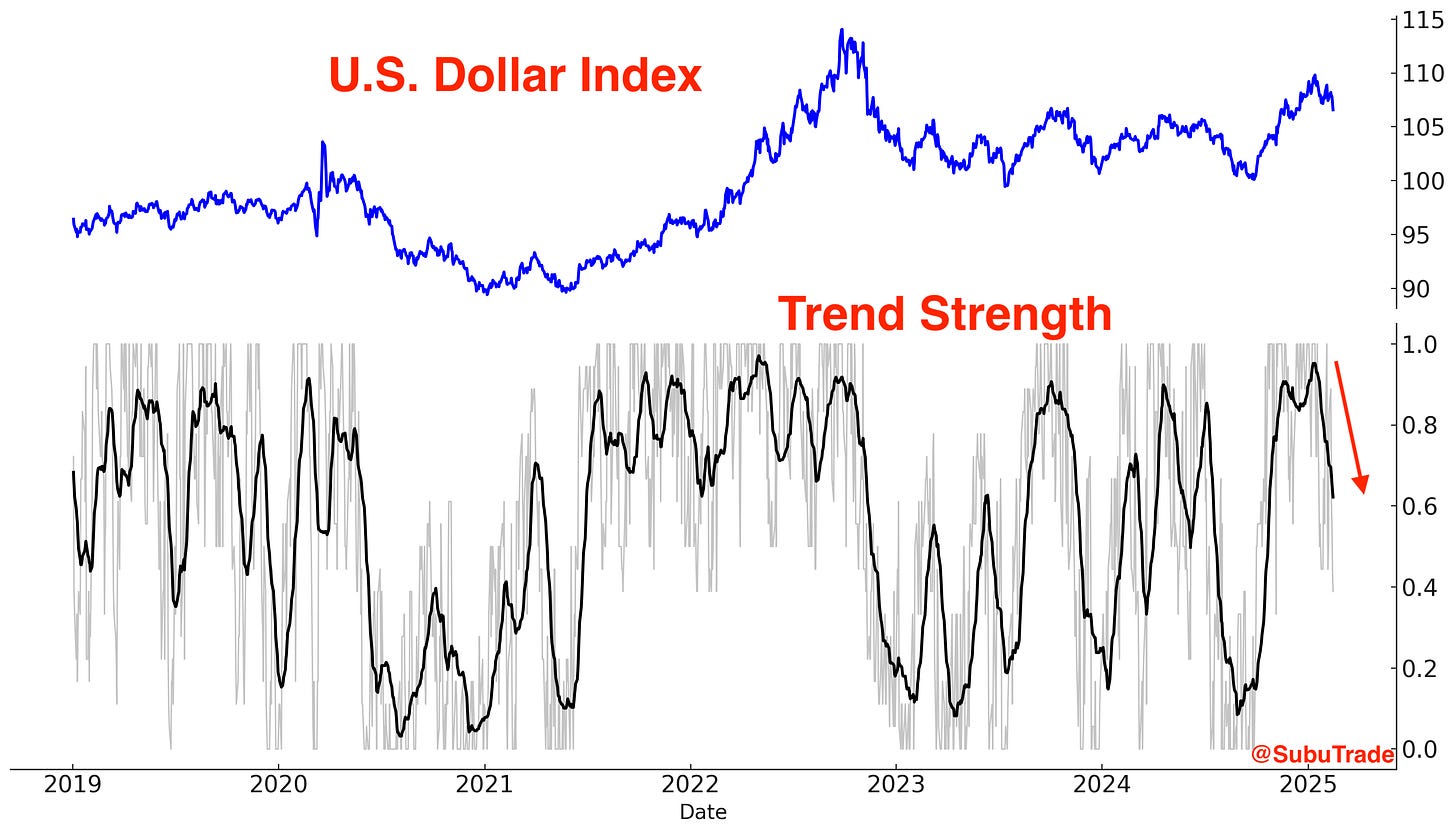

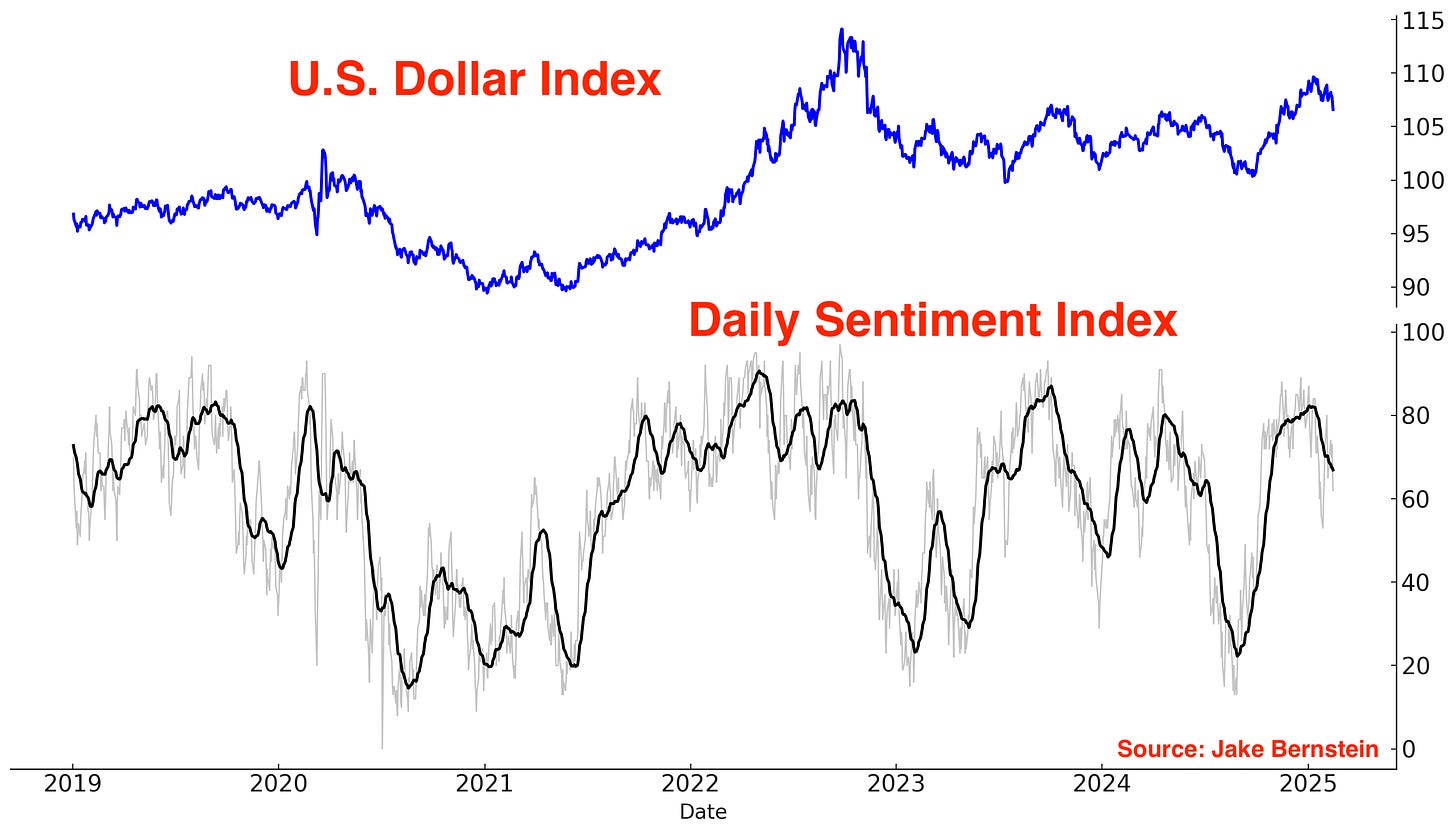

U.S. Dollar

The U.S. Dollar is falling, and this has been a tailwind for ex-U.S. equities in recent weeks. The U.S. Dollar is trending down:

The U.S. Dollar’s Daily Sentiment Index is also coming down:

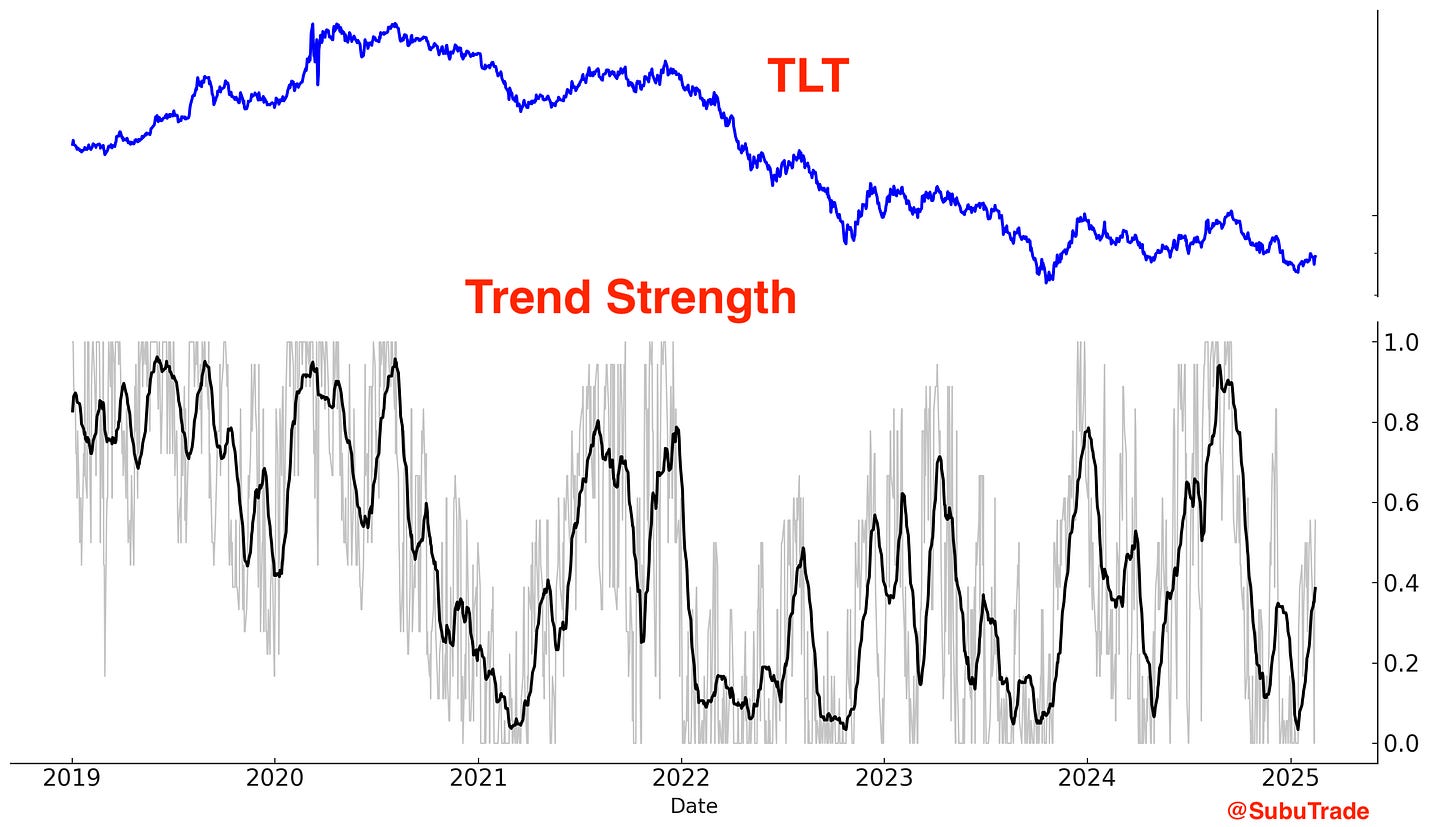

U.S. Treasury Bonds

U.S. Treasury bonds have been a disappointment so far. Treasury bonds rallied along with U.S. and Chinese equities, but Treasuries are noticeably weaker.

Treasury bonds are slowly reversing upwards:

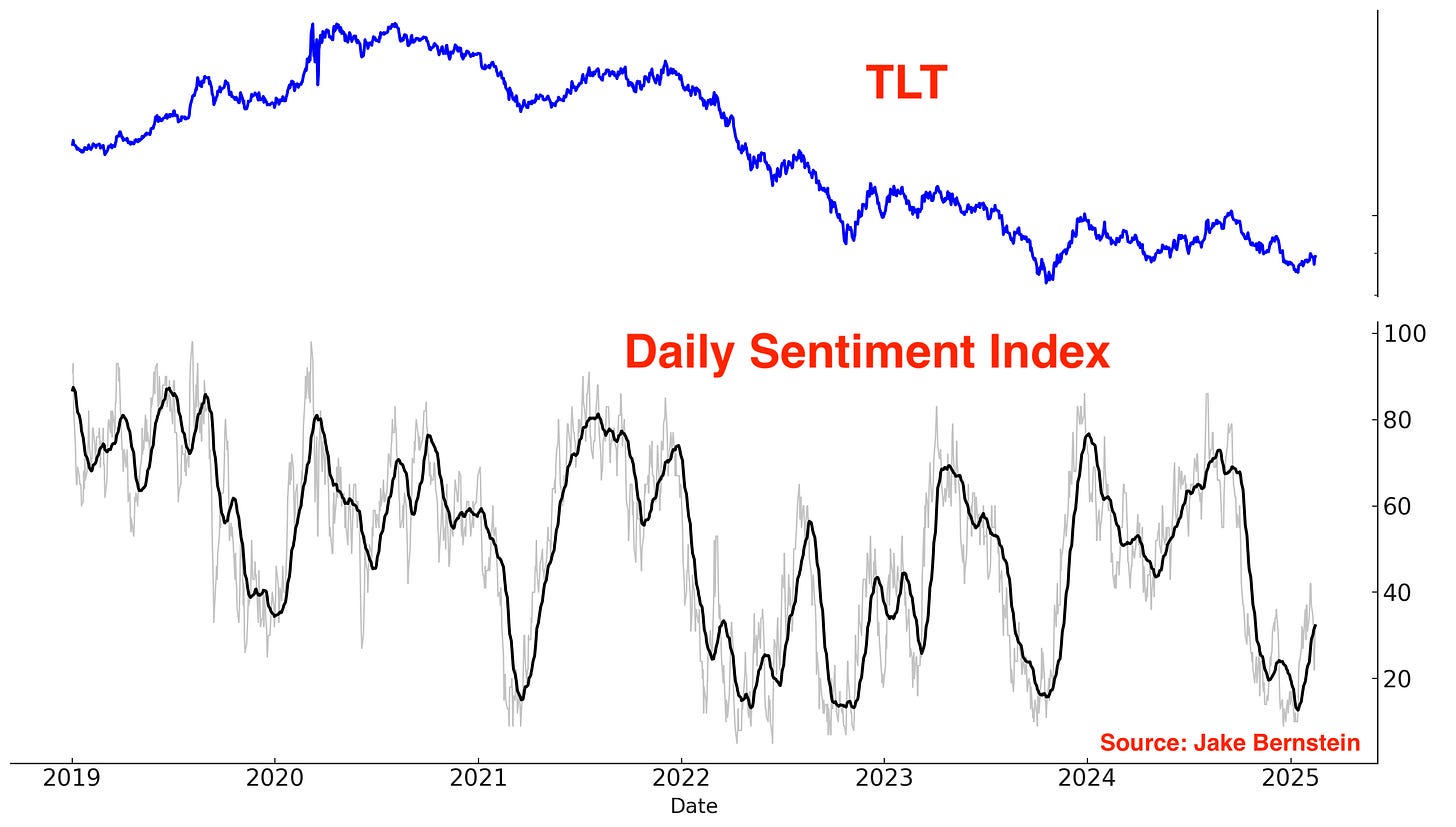

The 30 Year Treasury Bond’s Daily Sentiment Index is also coming up. This is a bond market rally, but clearly a weak rally:

Key Takeaways

The U.S. stock market has made marginal new all-time highs. It remains uncertain whether this marks the beginning of a sustained breakout or a continuation of the pattern seen in early 2015, where gains were limited to marginal new highs. For now, focus on the trend, which points Up.

Meanwhile, Chinese equities and precious metals have posted strong gains over the past few weeks. These markets are now encountering resistance and may undergo a period of consolidation or a pullback before resuming their upward trajectory.

Thanks for reading, and if you have any questions, feel free to email me at contact@subutrade.com