Markets Report: unstable world and unstable markets

World trade is fragmenting, with many nations jostling for advantage. Against this backdrop, global markets are also extremely jittery.

We are navigating uncertain times, with the Trump administration escalating trade conflicts with key global partners. Predicting policy shifts is futile; instead, it is prudent to take a broader perspective and focus on the bigger picture.

Today’s Markets Report:

U.S. Equities: Long term concerns for 2025 are piling up.

Chinese Equities: Gaining momentum but vulnerable to potential setbacks from escalating U.S. trade conflict.

Indian Equities: Positioned as a key beneficiary of the U.S.-China economic conflict.

Gold, Silver, and Miners: Breaking out with a strong bullish narrative.

Treasury Bonds: Weak price action, not rallying as it should.

*All charts and data updated as of today.

U.S. Equities

My outlook remains unchanged: U.S. equities are likely to trade within a range, offering little momentum for either bulls or bears. At present, there is no strong catalyst to drive markets massively higher or lower. Looking at the big picture:

Long term concerns

Momentum: “We are going to win so much, you may even get tired of winning”

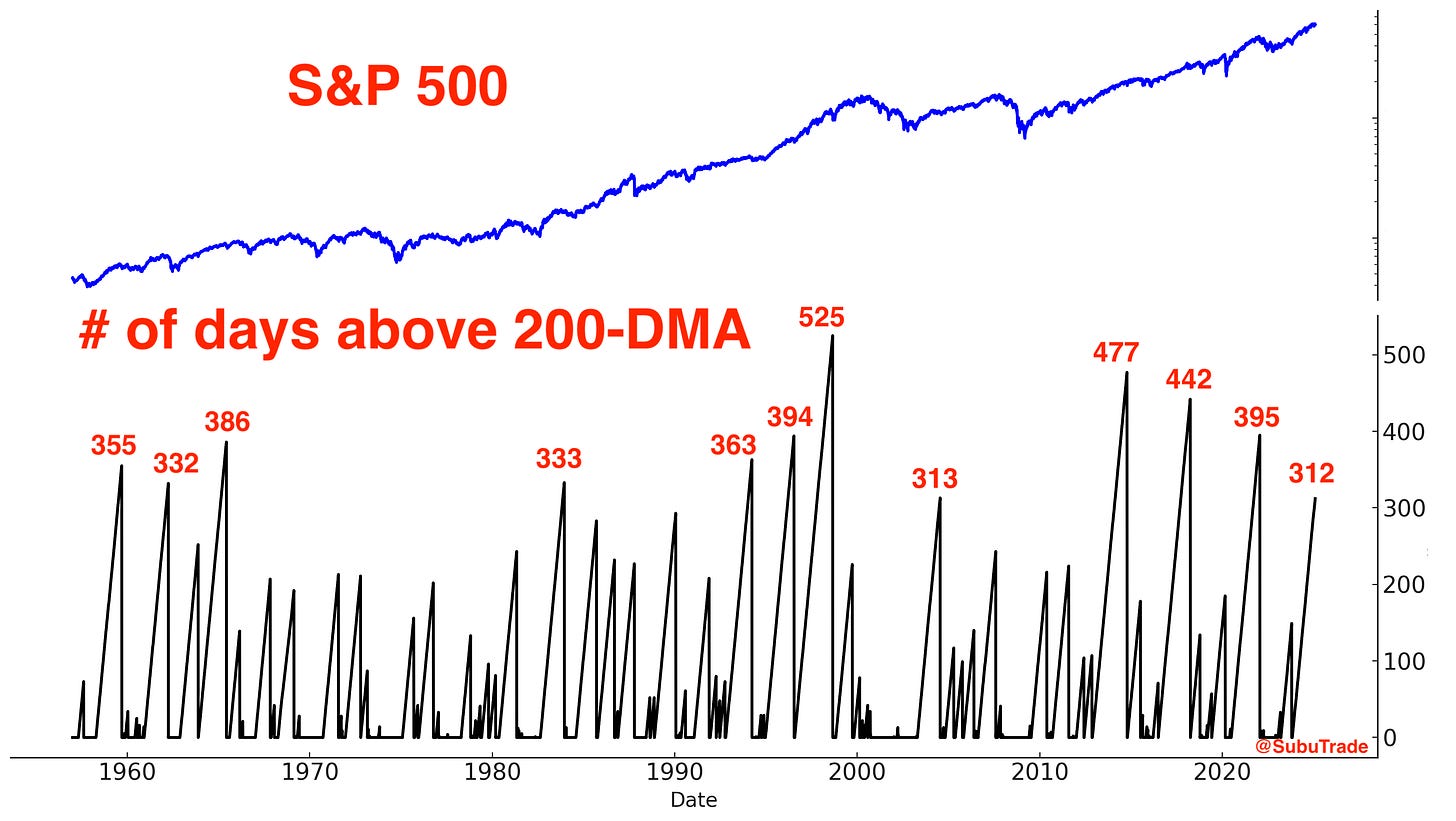

The S&P 500 has remained above its 200-day moving average for 312 consecutive days—an unusually extended streak that is likely to end this year. Currently, the 200-day moving average sits -6.8% below the S&P’s level.

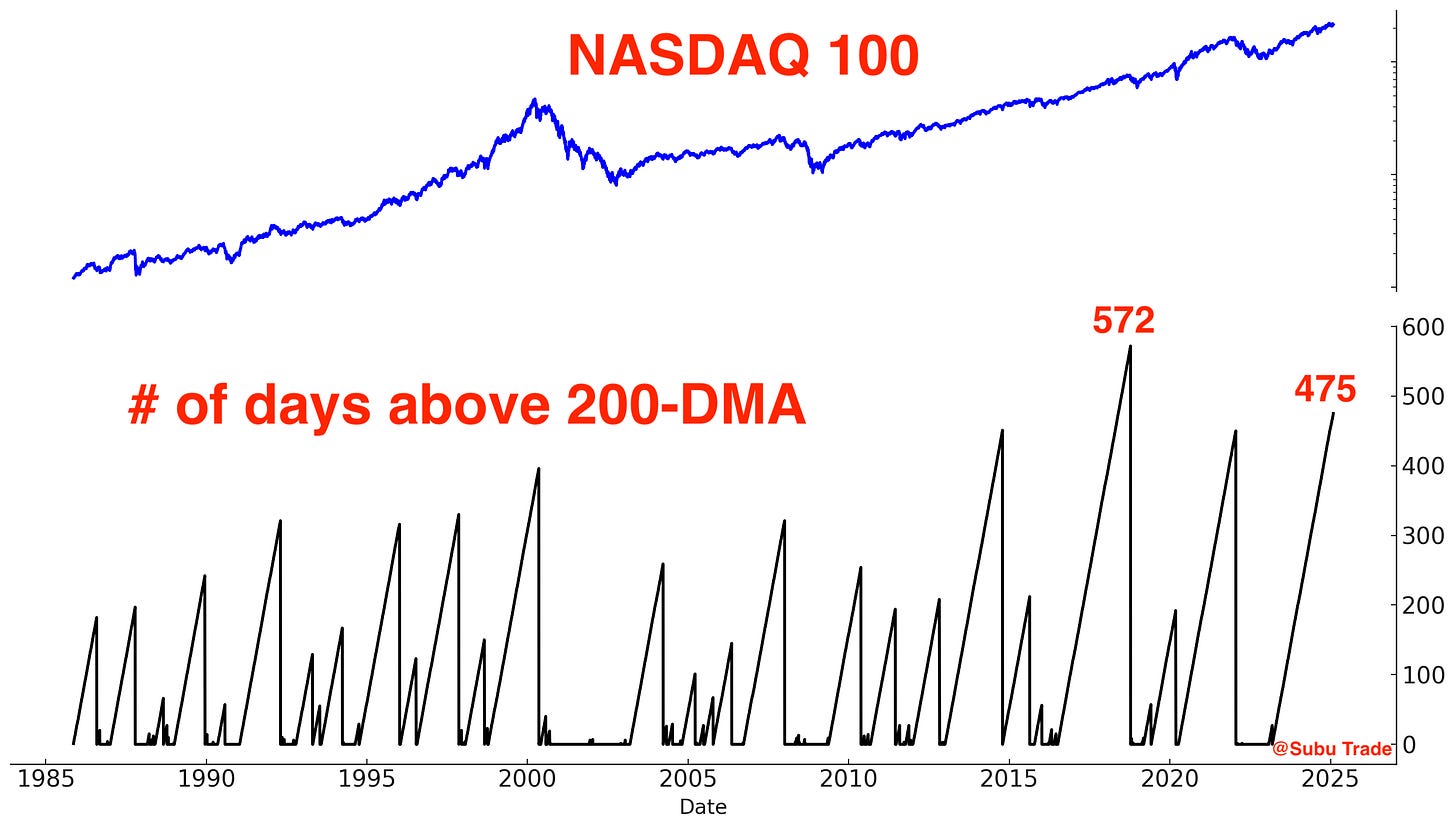

The NASDAQ 100 has remained above its 200-day moving average for 475 consecutive days—the second-longest streak on record. Currently, the 200-day moving average sits -7.7% below the index's level.

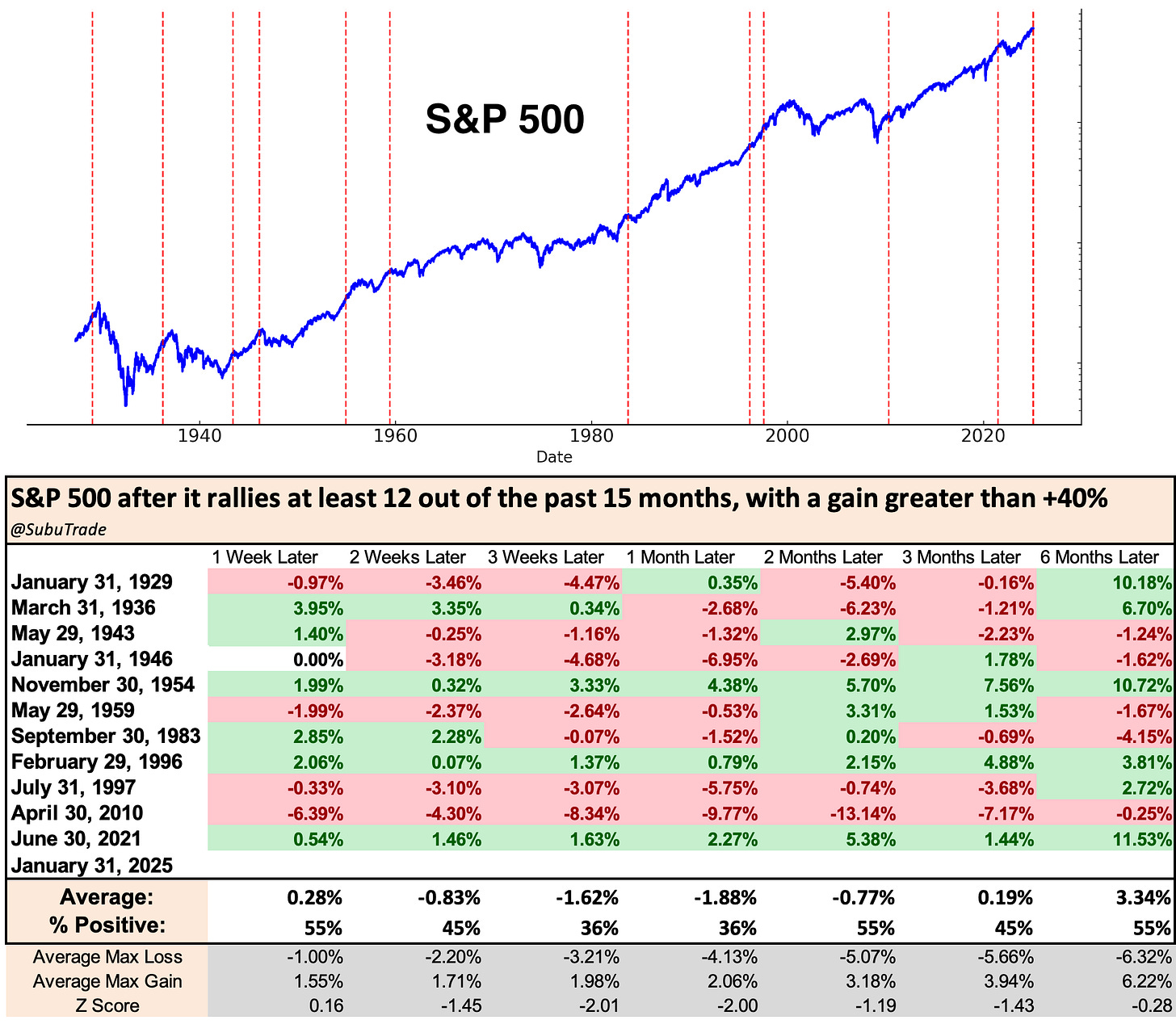

We can look at this in a different way: the S&P 500 rallied in 12 out of the past 15 months, with a total gain greater than +40%.

This is an uncommonly large and consistent rally. Historically, the S&P 500 struggled over the next month:

The one big bullish exception was in June 2021, which doesn’t make the long term implications any less concerning (blow off top followed by high inflation and 2022 bear market).

Options Flows

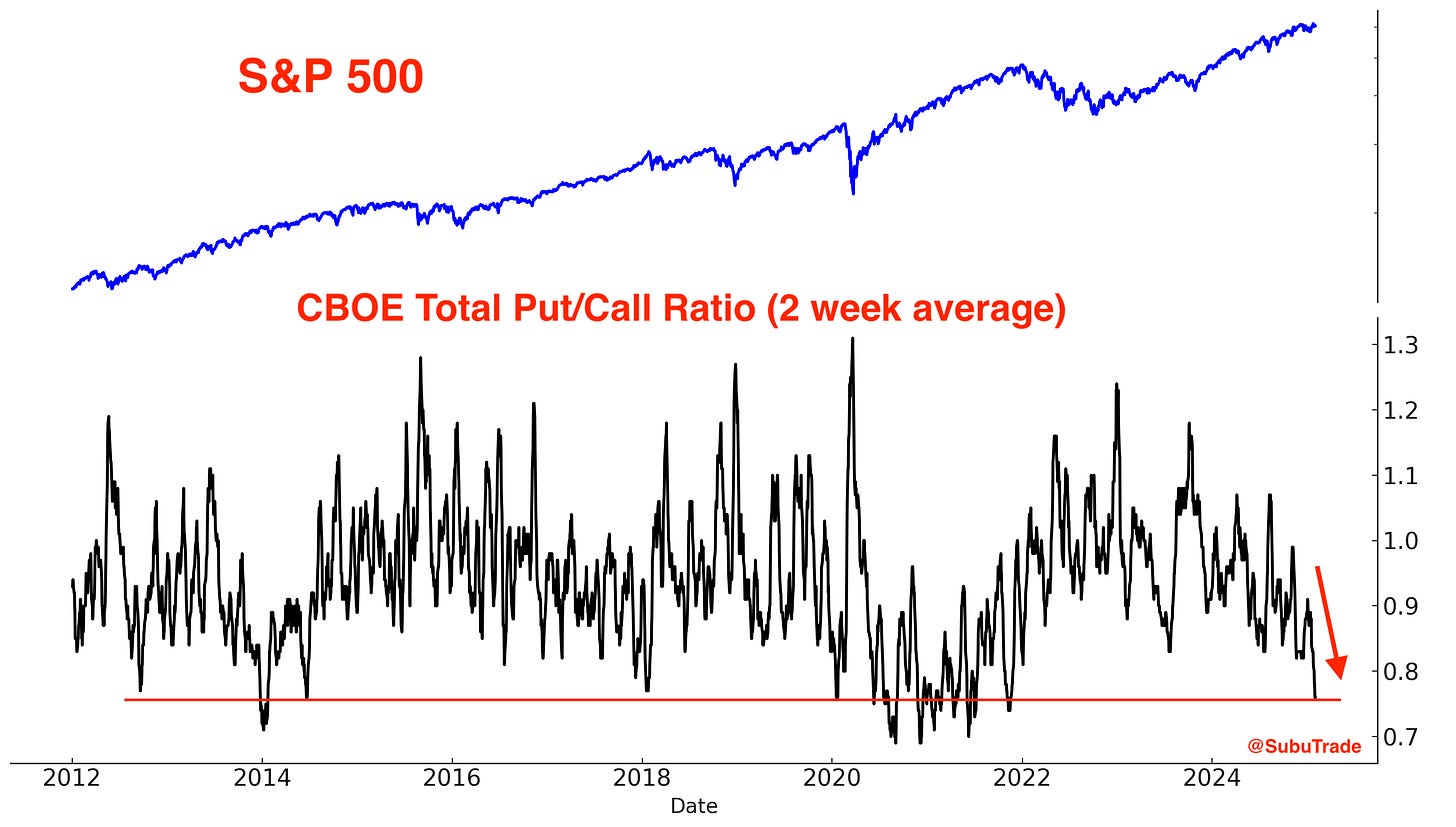

The CBOE Total Put/Call ratio sank to the lowest level since late-2021, just before equities peaked.

*A low Put/Call ratio is bearish for stocks.

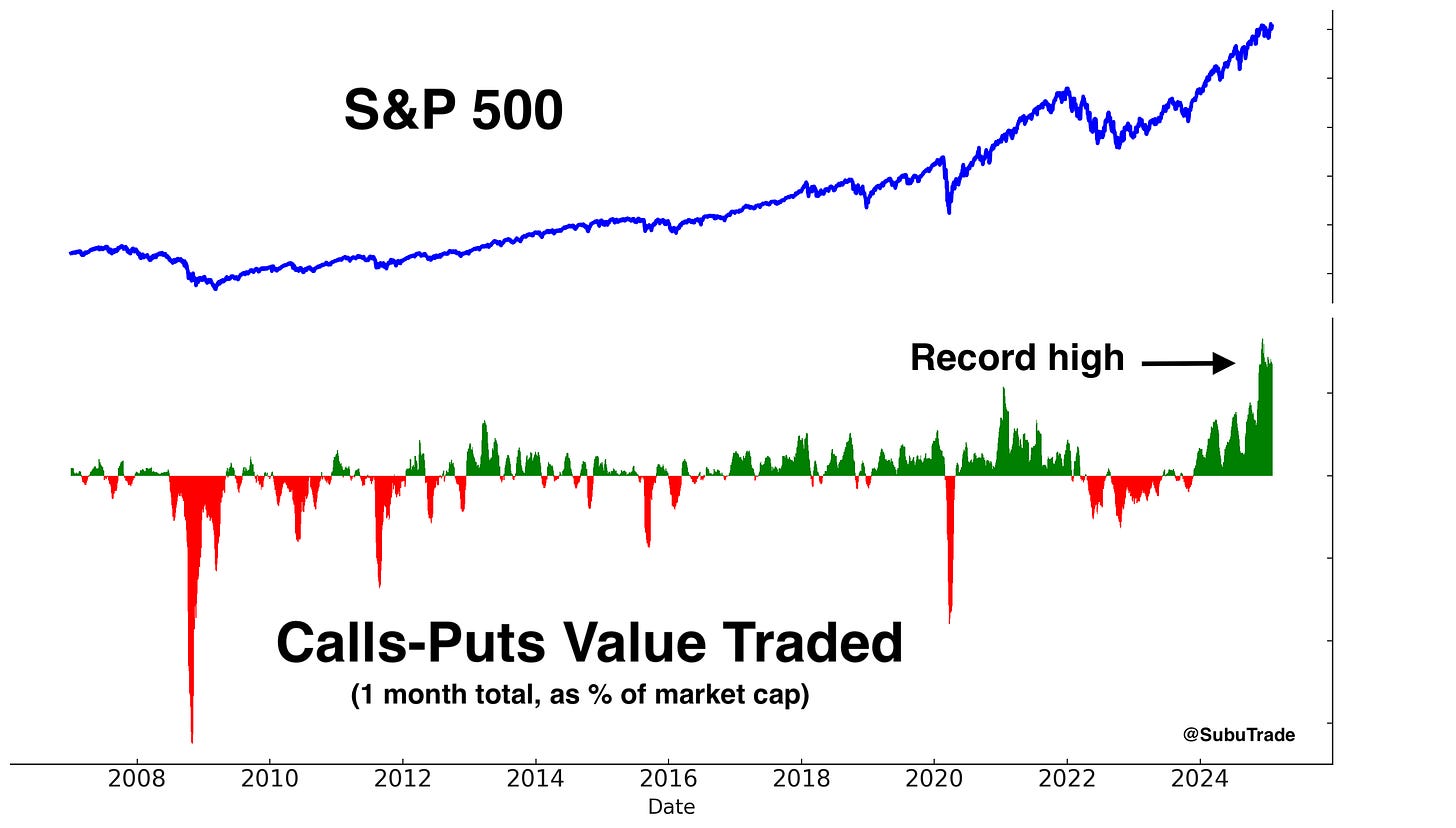

Similarly, the value of Calls-Puts traded for the S&P 500 remains near an all-time high. This warrants caution:

The SKEW Index, which essentially measures the probability of a stock market crash, is still extremely elevated:

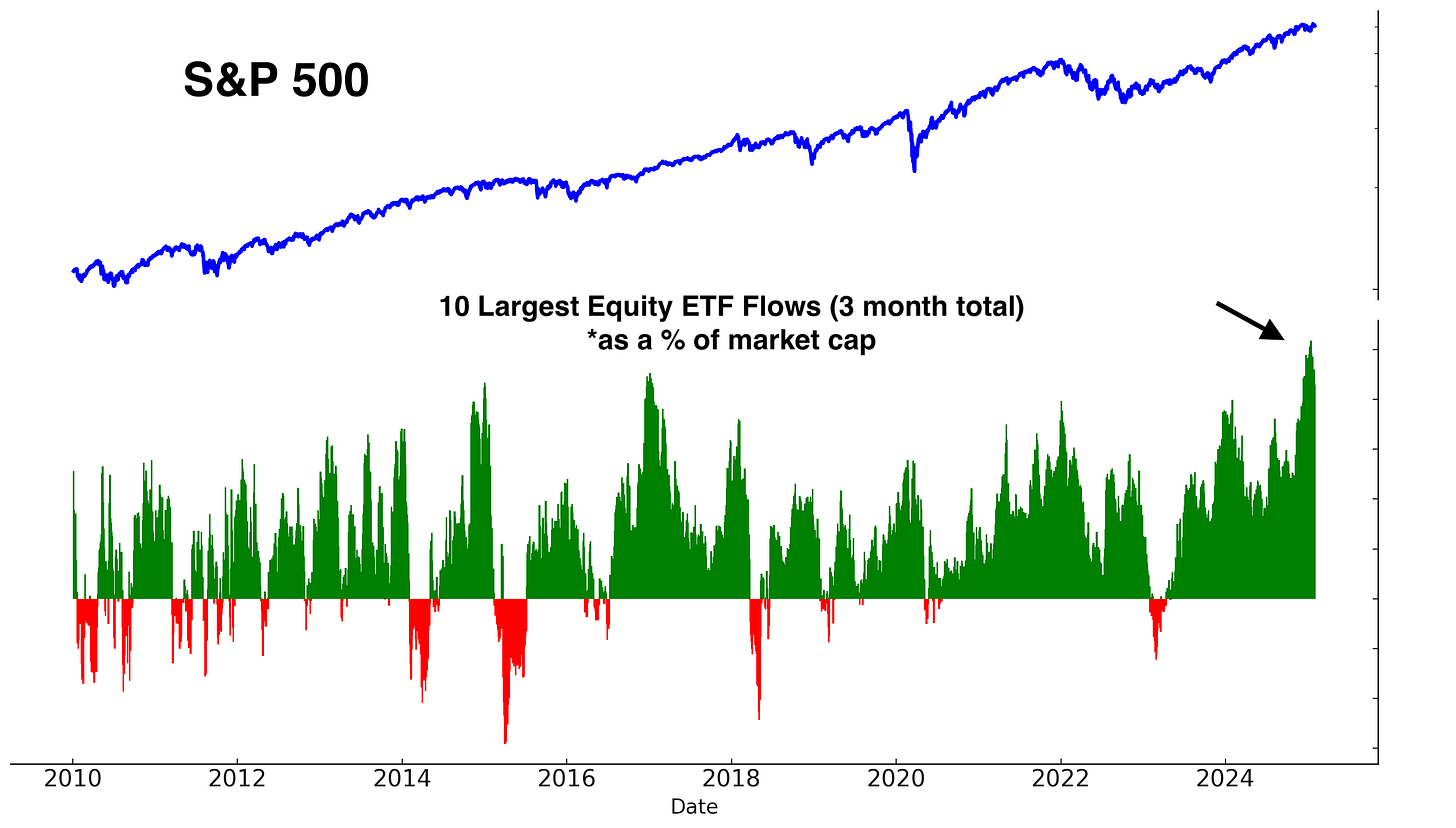

We’ve seen massive inflows into U.S. equity ETFs in the past 3 months:

Some sectors are particularly worrisome, namely financials and banks. Bank stocks surged this month as interest rates fell, with many bank stocks making new highs .

*Bank stocks are negatively correlated with interest rates: lower interest rates boost banks’ Net Interest Margin, which helps their bottom line.

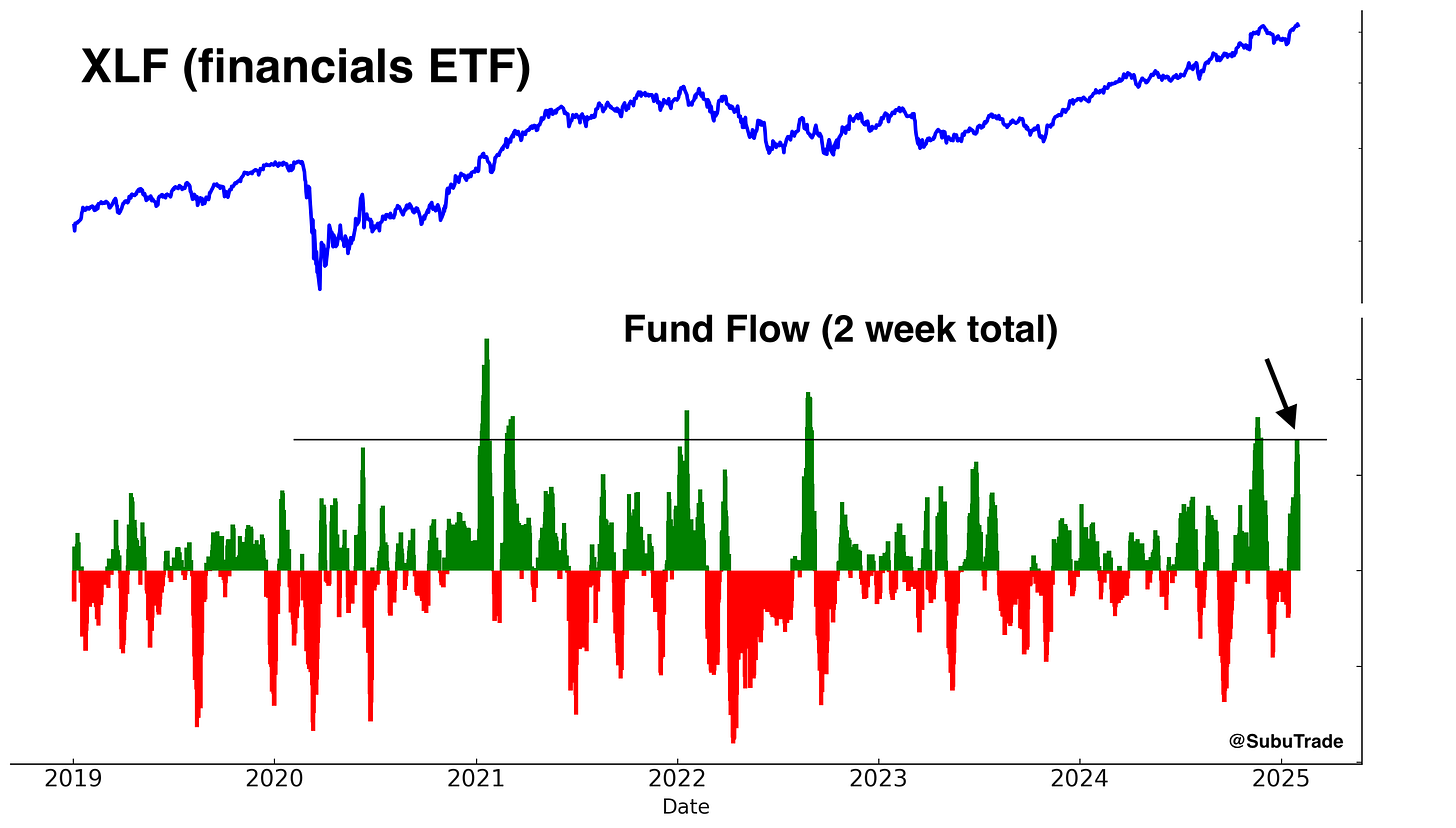

Traders are chasing the rally. We saw a huge spike in XLF call volume on Thursday. The last such spike was on election day in November, after which financials mostly traded sideways:

Meanwhile, XLF saw large inflows over the past 2 weeks:

Breadth and sector rotation: unstable market

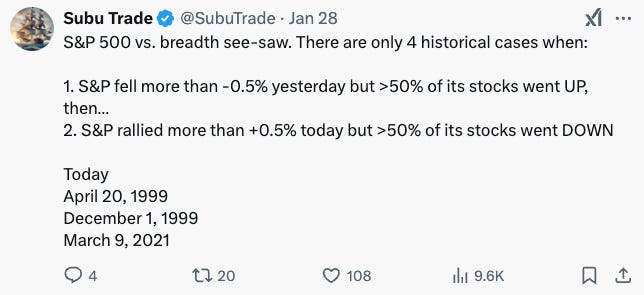

The market’s internals are very unstable. As I noted on Twitter/X:

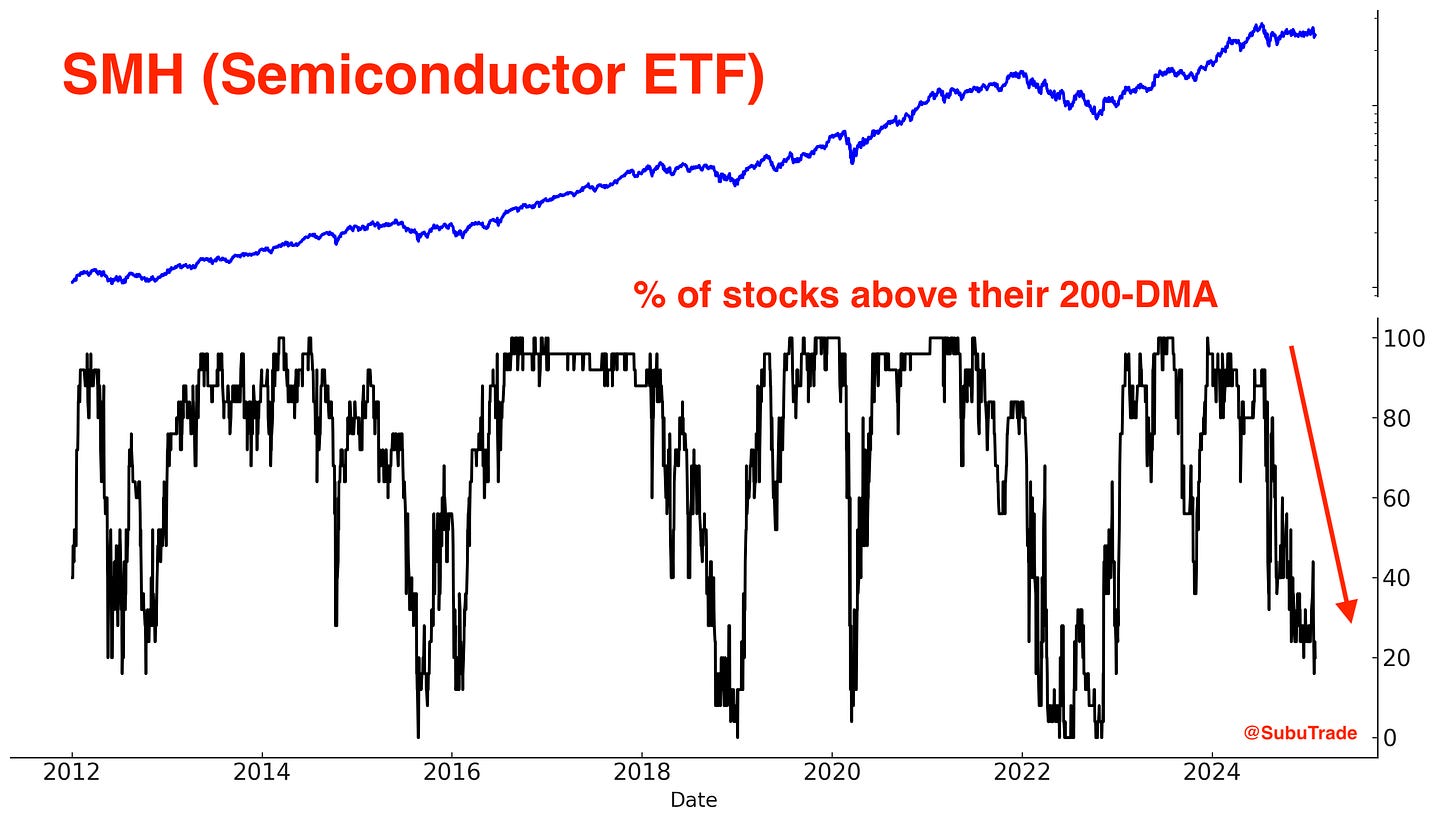

Meanwhile, the semiconductor sector’s breadth remains weak. Semiconductor and tech stocks (e.g. Nvidia) largely drove the U.S. stock market’s gains and earnings growth over the past 2 years:

Medium term: neutral

The medium-term outlook is neither bullish nor bearish, though much of the market's next move hinges on the trajectory of Trump’s trade wars—an unpredictable variable.

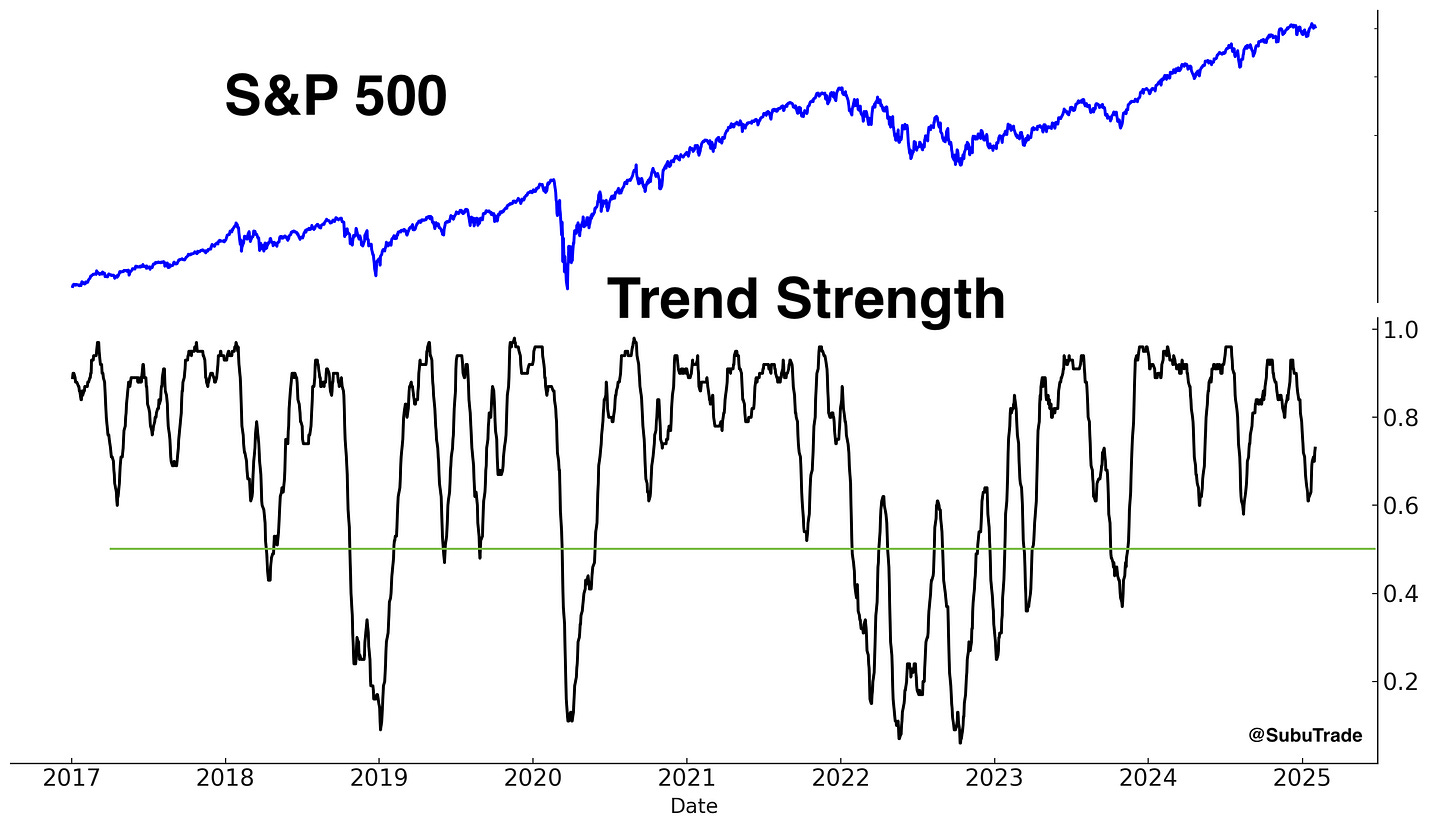

Trend

The U.S. stock market remains in an up-trend, for now.

Options Flows

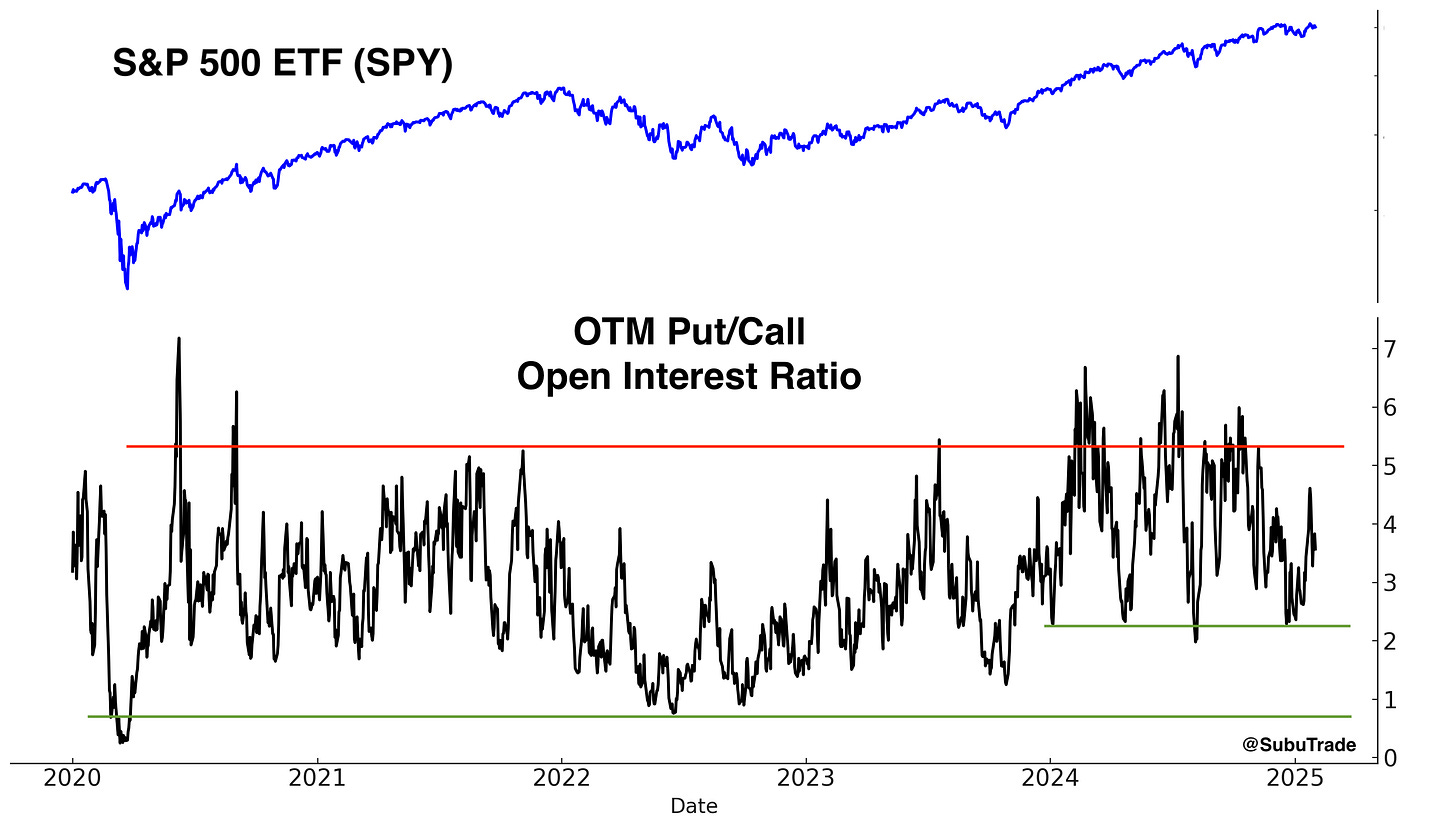

Here’s the SPY OTM Put/Call Open Interest ratio: stuck in neutral territory (neither bullish nor bearish).

*OTM (Out of the Money) Put/Call Open Interest Ratio tracks who is losing money right now: put buyers or call buyers. This Ratio goes up when the market goes up, and goes down when the market goes down.

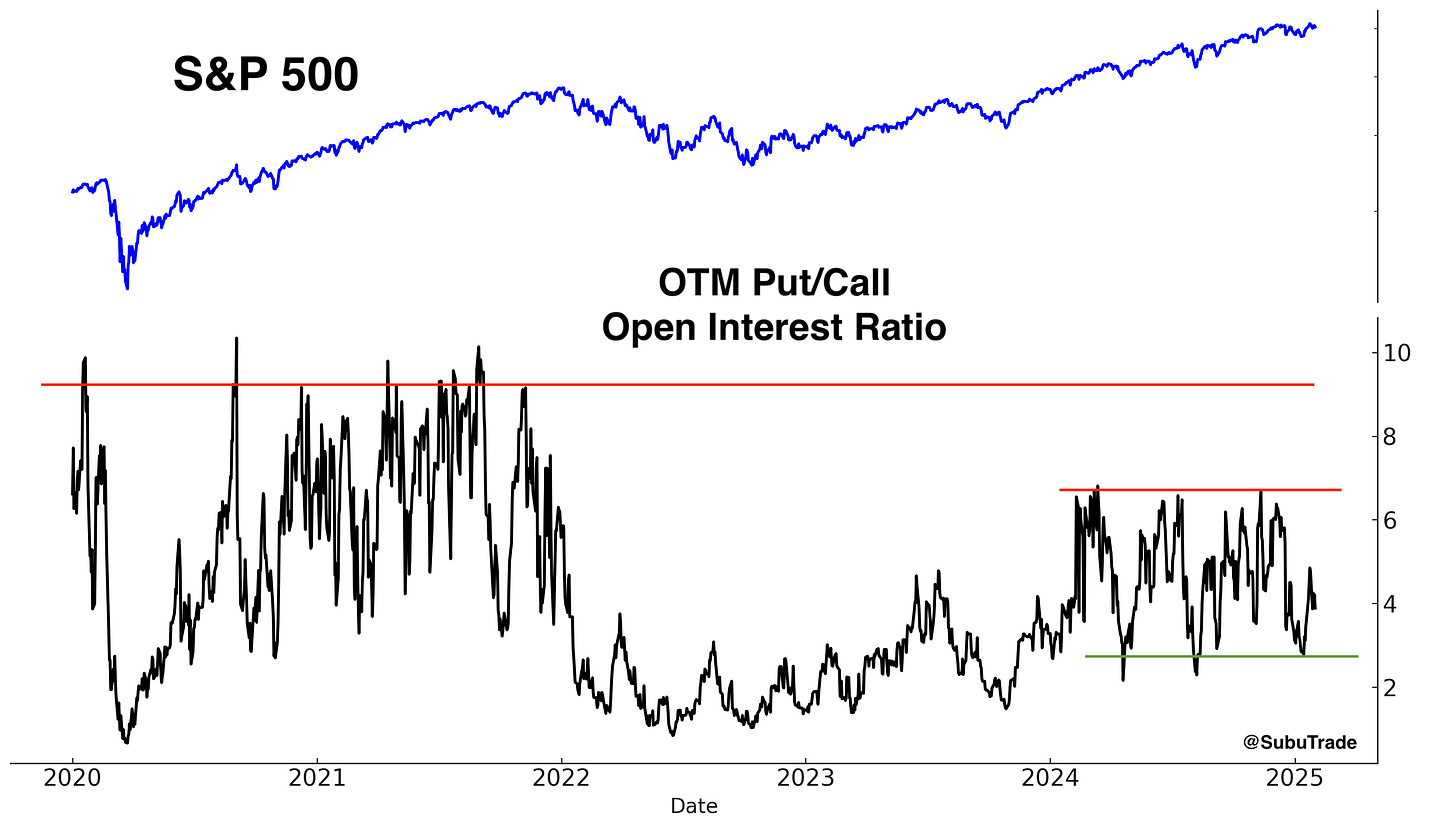

Here’s the S&P 500 OTM Put/Call Open Interest ratio: also stuck in neutral territory.

Sentiment: neutral

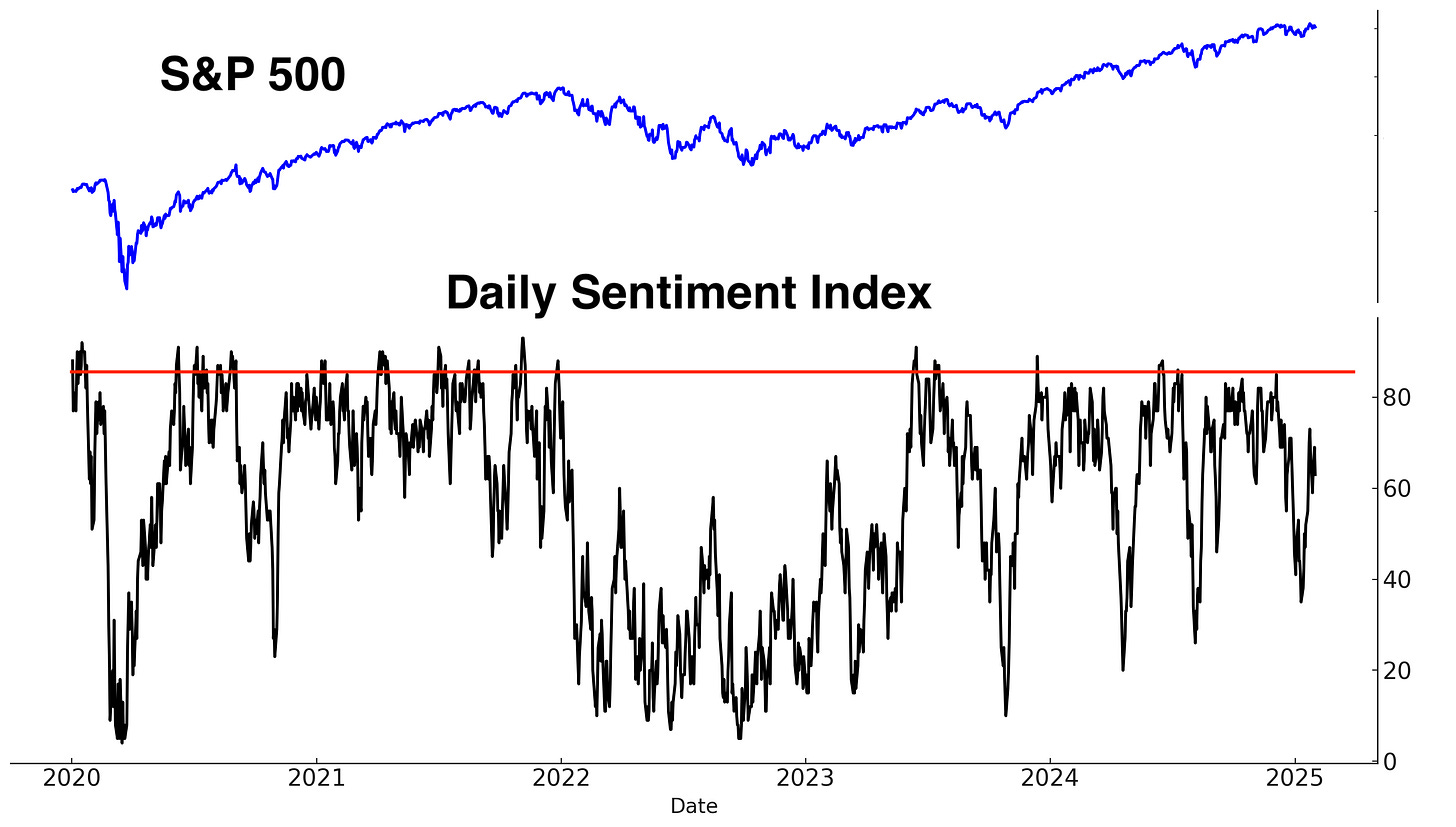

Sentiment remains neutral. Here’s the S&P 500’s Daily Sentiment Index:

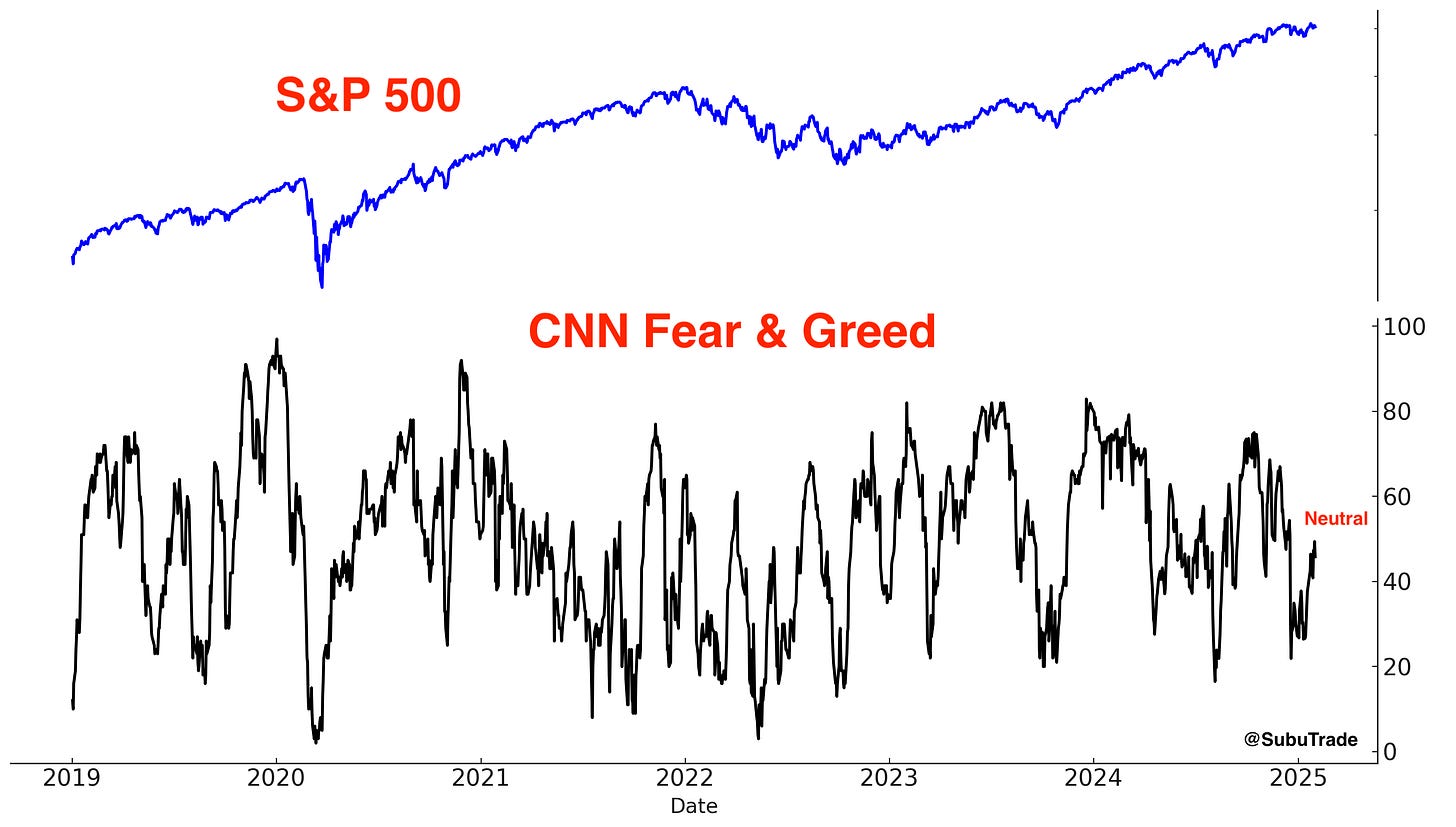

The CNN Fear & Greed Index is also neutral:

Overall, neither bulls nor bears hold a clear advantage in the current market environment, with short-term movements largely driven by news events (e.g. trade war). In times of uncertainty, it is essential to maintain a broader perspective. Markets face significant headwinds, and 2025 is unlikely to offer the same low-volatility environment seen in 2024.

Ex-U.S. Equities

China

I’ve outlined the bull case for China in previous Markets Reports. Repeating what I wrote:

I want to emphasize that I am not long term bullish on China. China will lose the U.S.+India vs. China economic war. But for the time being, sentiment towards Chinese equities is so depressed that there is room for a multi-month rally.

Chinese equities were rallying this week until Trump.

Trump’s latest tariffs underscore the fundamental challenge of any long-China trade: the U.S. remains committed to curbing China’s economic ascent. As the world’s largest economy, the U.S. is determined to prevent its closest competitor from overtaking it—and it has both the global economic and political leverage to pursue this objective.

The medium term impact of Trump’s tariffs on Chinese equities remains uncertain. This could mark the beginning of a broader effort to hammer China or serve as a strategic move ahead of future negotiations. Any long-China position should be small. There are too many unknown factors at play here.

India

India remains my top long-term investment theme, though successfully navigating its markets requires a degree of jugaad—a Hindi term referring to resourceful problem-solving with limited means.

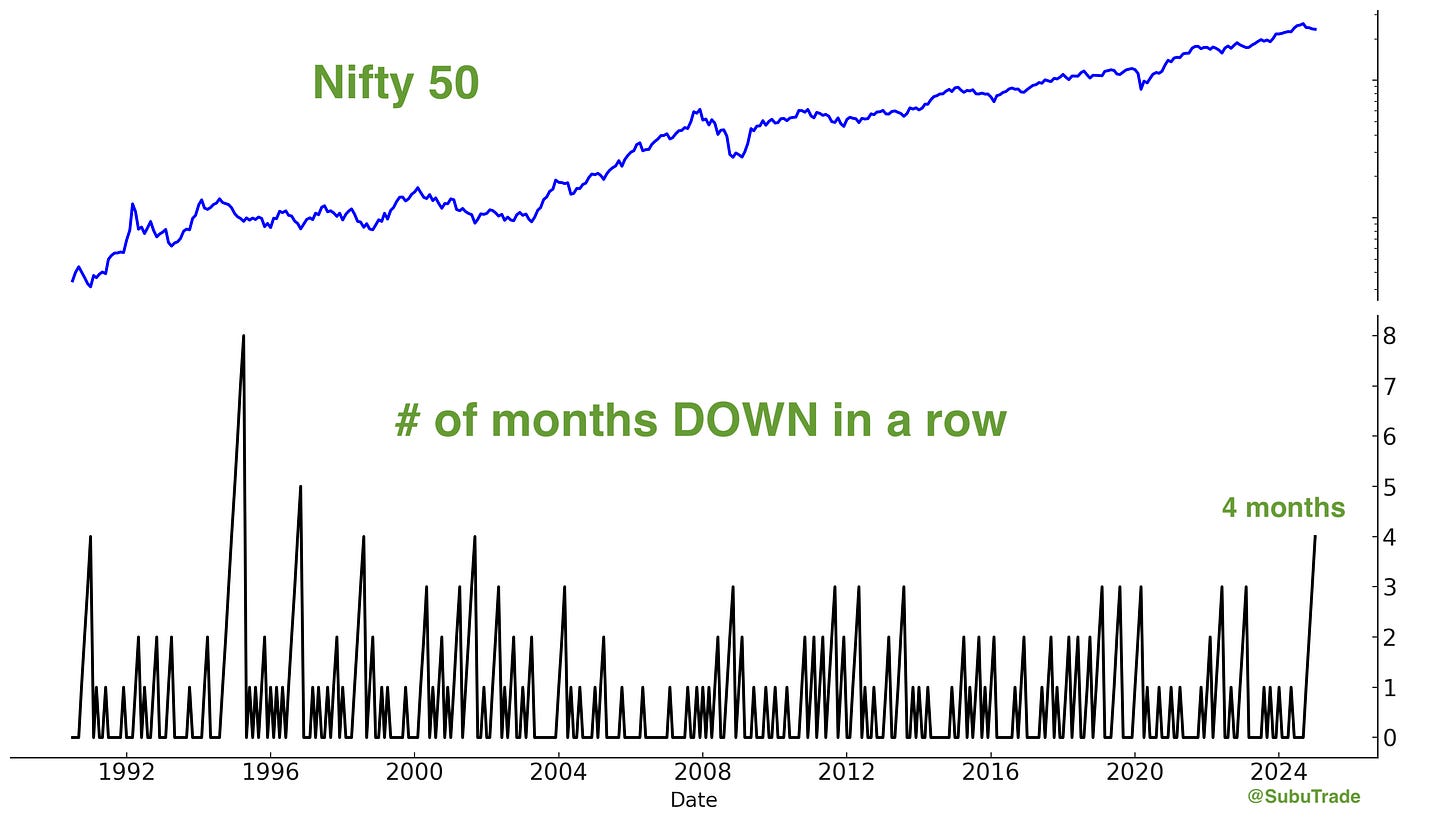

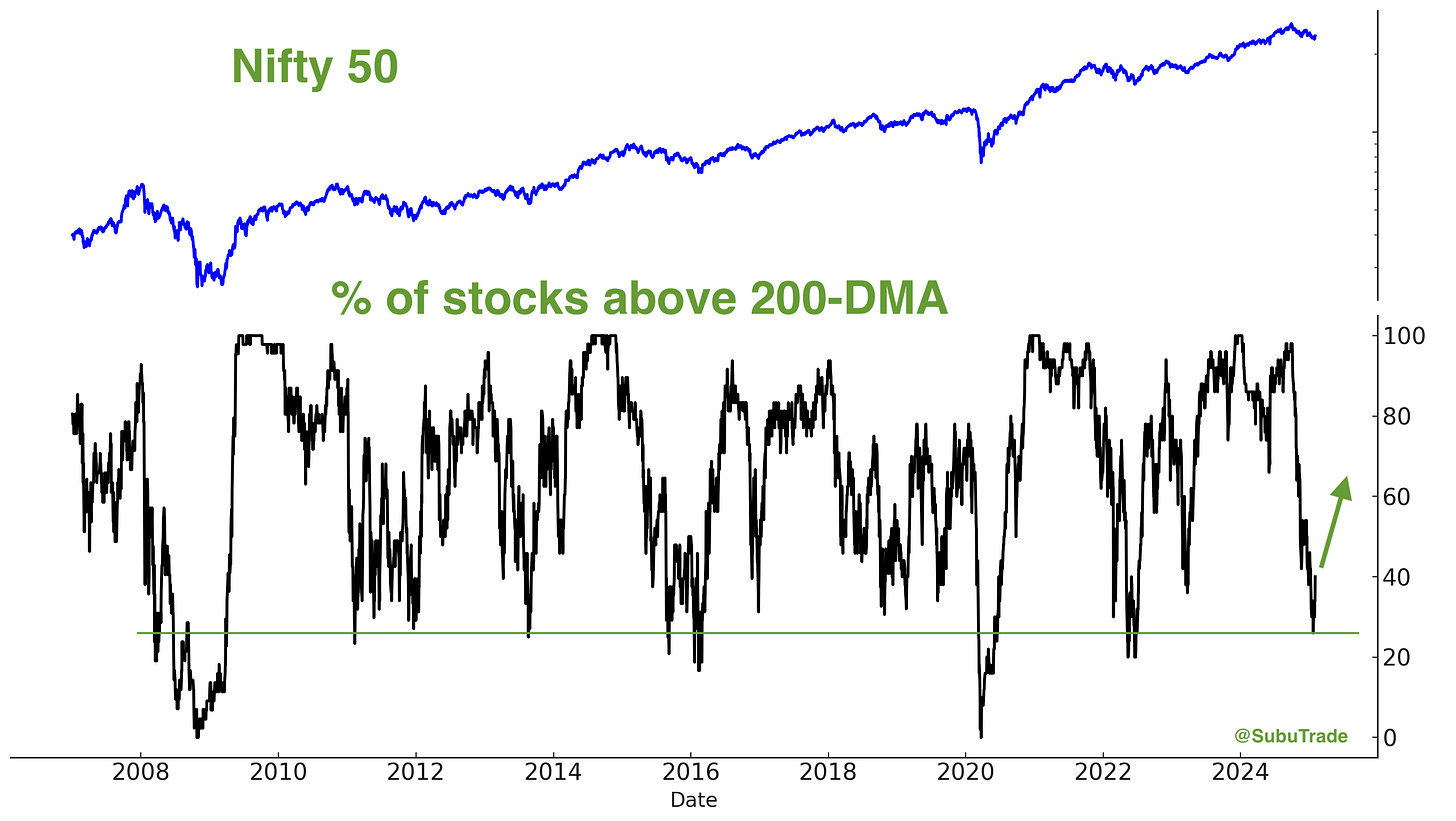

Despite its strong fundamentals, Indian equities have faced sustained selling pressure, with the Nifty 50 declining for 4 consecutive months.

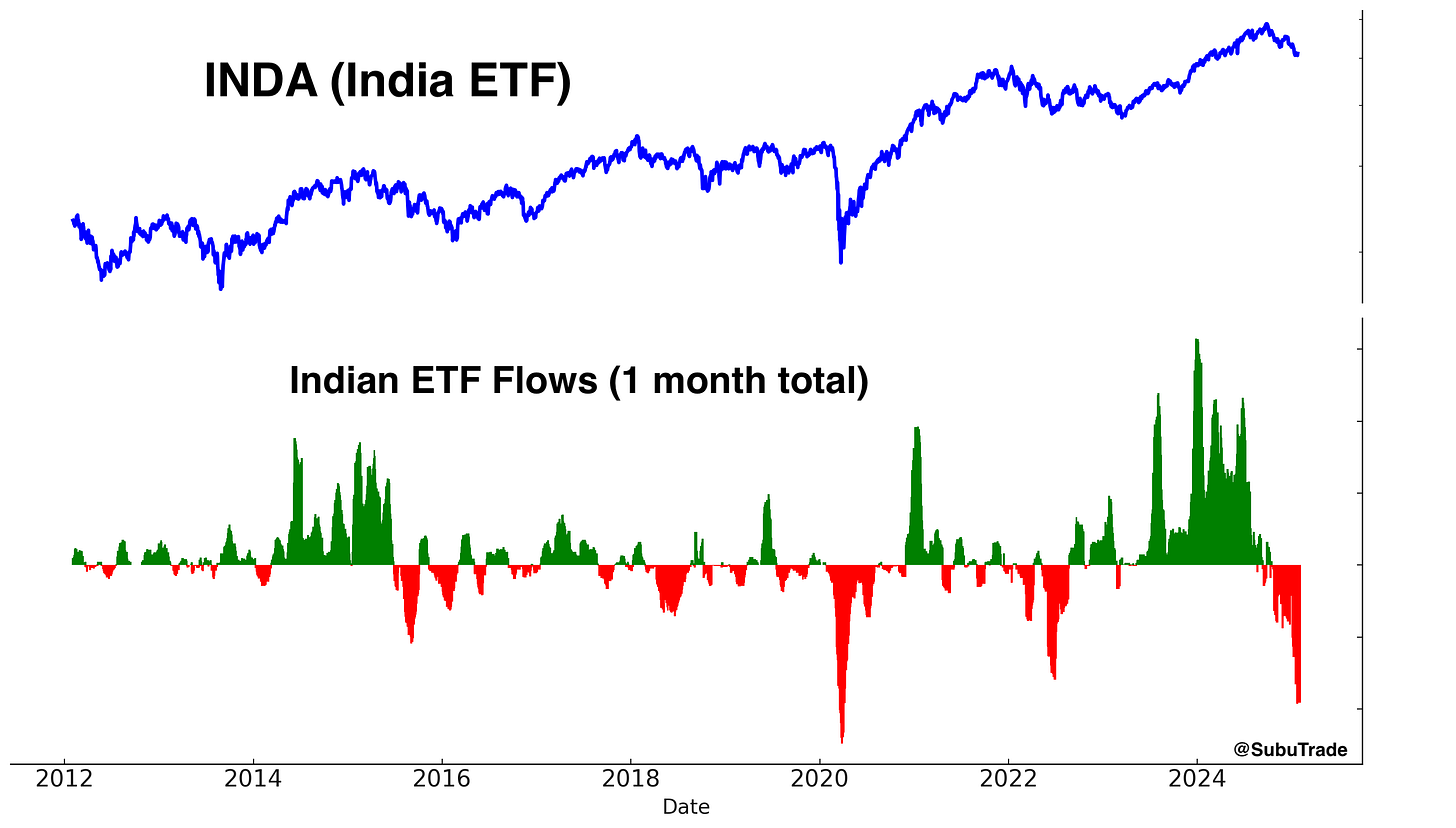

Investors are pulling back from Indian equities amid a modest slowdown in economic growth. However, they are overlooking a key factor: India stands to be the primary beneficiary of the U.S.-China economic conflict. Any escalation only fuels further economic growth for India, giving it every incentive to see conflict between the U.S. and China worsen.

Meanwhile, Indian breadth is so bad, that it’s bullish. Expect mean-reversion:

Indian Prime Minister Modi is set to visit Washington D.C. in February, further solidifying the U.S.-India alliance.

Too many people underestimate India’s power and that of its Indian diaspora. Yet this is how empires are built. We are witnessing a once-in-500-year event where, for the first time in centuries, the West is no longer dominant. While the world is fixated on China, the true long-term winner of this transition is Greater India — “Akhand Bharat”.

Commodities

Gold broke out to a new all-time high.

I remain bullish on gold, silver, and mining stocks. Gold, in particular, stands to benefit from the U.S.-China economic conflict.

Consider this: If you were the Chinese government, would you want to hold hundreds of billions in U.S. Treasury bonds—assets that the U.S. could freeze or confiscate at any moment? Or would you prefer reserves in an asset beyond U.S. control, such as gold? The strategic shift toward non-confiscatable reserves strengthens gold’s long-term investment case.

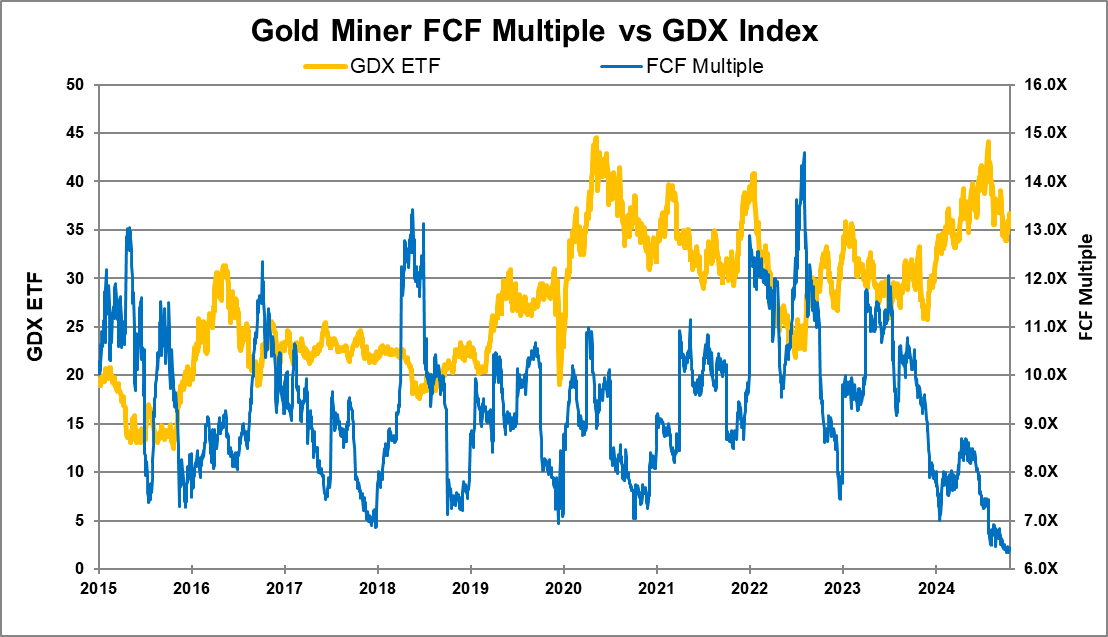

Meanwhile, gold miners are extremely cheap. Chart via @GarrettGoggin:

SLV short interest: still near an all-time high.

U.S. Treasury Bonds

I have been bullish towards Treasury bonds in recent weeks, but a trader must remain flexible—strong opinions, weakly held.

The price action in bonds has been underwhelming. Despite rallies in non-U.S. equities, U.S. banks, and precious metals this week, bonds showed only a muted response, signaling relative weakness. Bonds should have surged along with other assets.

This presents a key concern: many traders are anticipating a bond rally, yet the market’s weak price action is failing to confirm those expectations.

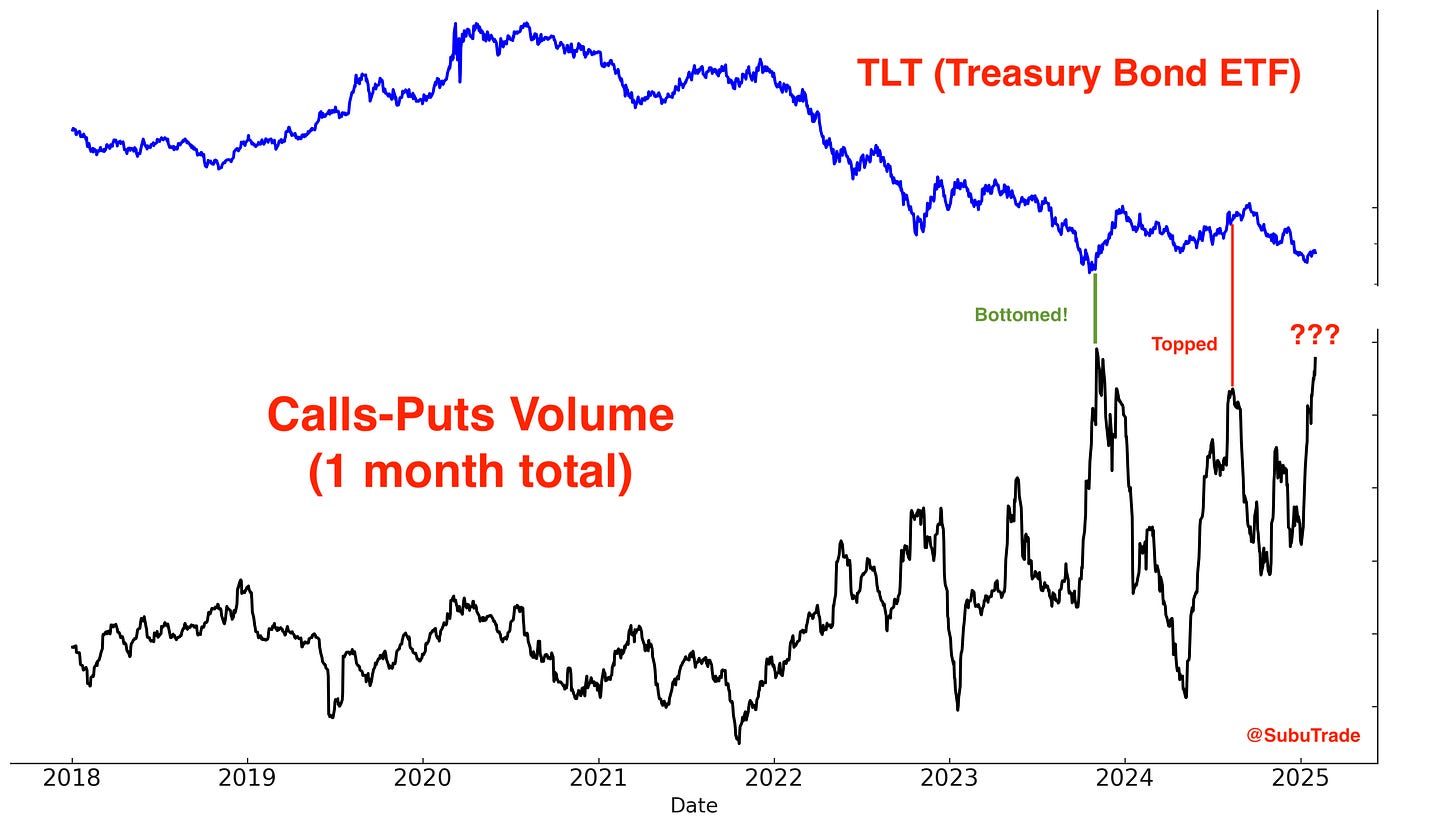

The following chart examines TLT calls-puts volume. As shown, a significant number of traders are positioning for a bond market rally—one that has yet to materialize.

I remain medium term bullish towards bonds, but less bullish than before. I was looking for a strong multi-week rally that has failed to materialize thusfar.

Overall, my longer term outlook towards bonds remains the same: I believe that the bond market will continue to swinging sideways as it has done over the past 2 years. I see no narrative/theme that can propel bonds massively higher or massively lower.

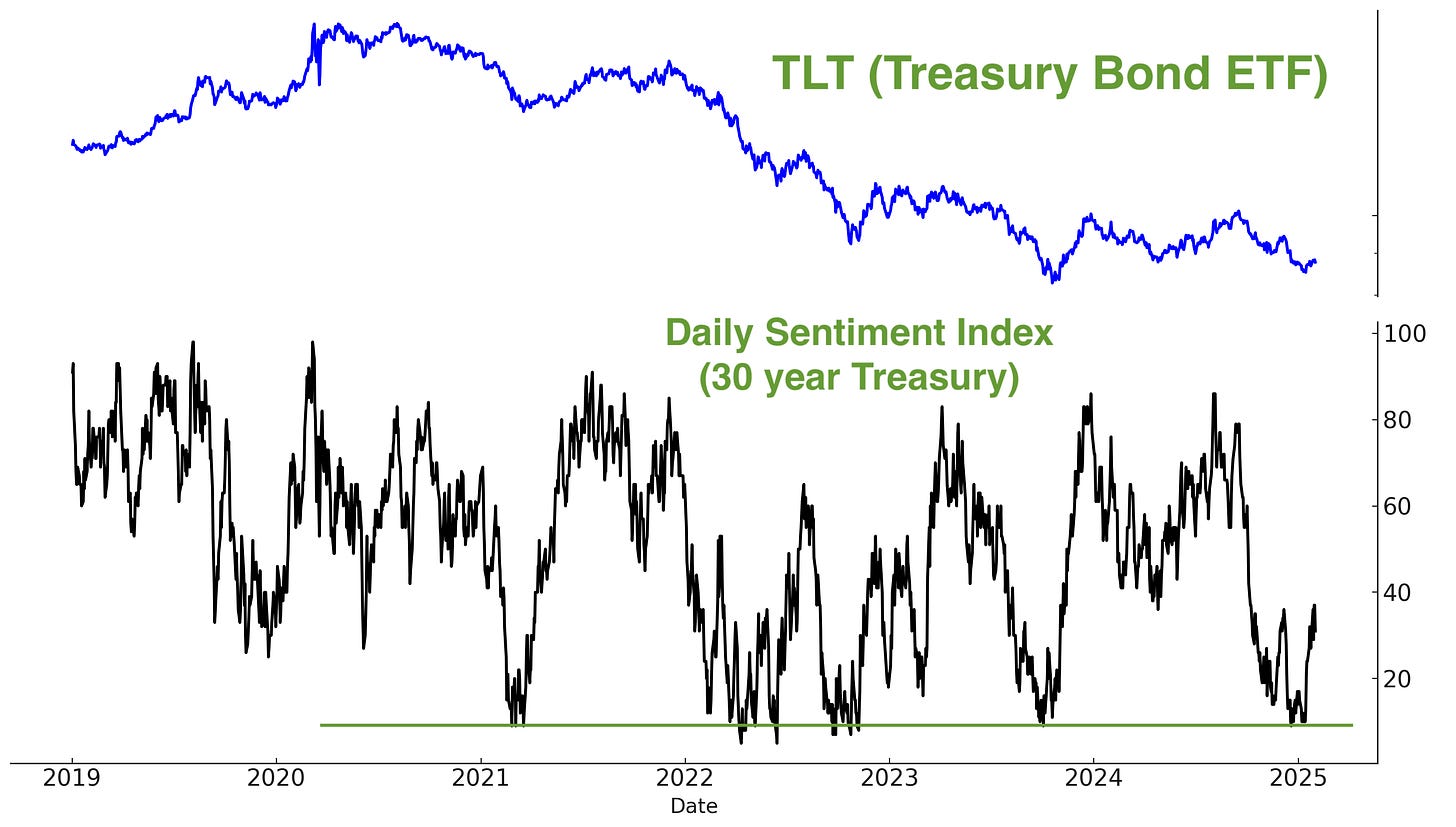

As a side note, the 30 year Treasury bond’s Daily Sentiment Index has bounced off of extremely pessimistic levels. Again this is a rally that should have materialized by now, but has not thusfar.

Summary

U.S. Equities: Long term concerns for 2025 are piling up. Short term signals are mixed, offering neither bulls nor bears a clear edge.

Chinese Equities: Chinese equities were gaining momentum until Trump’s latest trade salvo. Traders can be long, but position size should be small.

Indian Equities: Positioned as a key beneficiary of the U.S.-China economic conflict.

Gold, Silver, and Miners: Breaking out while benefiting from the U.S.-China economic war.

Treasury Bonds: Weak price action, not rallying as it should. Still bullish, but less bullish than before.